Short Term Health Insurance Plans Texas: Find the Best Coverage Today!

Short Term Health Insurance Plans Texas are available from top providers like Allstate and UnitedHealthcare. These plans offer temporary coverage for individuals and families, ideal for filling gaps in insurance or during life transitions.

In Texas, residents can easily access a variety of short-term health insurance options from reputable companies such as Allstate and UnitedHealthcare, providing essential coverage for unexpected health needs. These plans are designed to offer temporary solutions for individuals and families, ensuring peace of mind and financial protection during periods of transition or gaps in traditional healthcare coverage.

By opting for short-term health insurance, individuals in Texas can safeguard their well-being without committing to long-term contracts, making it a flexible and convenient choice for managing healthcare needs.

The Importance Of Short Term Health Insurance

Short-term health insurance in Texas provides crucial coverage for individuals in transitional periods or who need protection against unexpected medical expenses. These plans offer a flexible and budget-friendly solution to help bridge the gap in health coverage. In this article, we will delve into the significance of short-term health insurance and how it can benefit Texas residents.

Protecting Against Unexpected Medical Expenses

Short-term health insurance plans are designed to safeguard individuals from unforeseen medical costs. Emergencies can occur at any time, and having a short-term health insurance plan can provide financial security in situations where medical care is urgently required. With these plans, individuals can be prepared for unexpected illnesses or accidents, ensuring that they receive the necessary medical treatment without worrying about overwhelming expenses.

Coverage In Transitional Periods

During transitional periods such as unemployment, early retirement, or waiting for employer-sponsored health benefits, short-term health insurance can serve as a temporary solution for maintaining healthcare coverage. These plans offer the flexibility to bridge the gap between primary medical coverage or to provide healthcare protection while transitioning between different stages of life.

Understanding Short-Term Health Insurance Plans In Texas

Short-term health insurance plans in Texas provide temporary coverage for individuals in need of immediate healthcare services.

- Provides coverage for essential medical services

- Flexible options for varying durations

- Cost-effective premiums for short-term coverage

Eligibility for short-term health insurance plans in Texas is typically based on simple criteria, making them accessible to many individuals.

- Available for individuals without long-term health insurance

- Duration ranges from 30 days to 12 months

- Renewable for additional coverage if needed

Top Providers Of Short Term Health Insurance In Texas

If you’re in Texas and looking for short-term health insurance coverage, you’ll want to know the top providers in the state. Below, we’ve highlighted four reliable providers who offer short-term health insurance plans in Texas:

Allstate

Allstate, a national insurance company, offers short-term health insurance plans in Texas. With Allstate, you can find coverage that suits your needs and receive the benefits of a trusted insurance provider.

Unitedhealthcare®

UnitedHealthcare® offers temporary health plans in Texas under its subsidiary, Golden Rule Insurance Company. It provides a range of short-term medical, dental, and other health coverage options to individuals and families.

Bluecross Healthcare

Bluecross Healthcare ensures you don’t get caught without health insurance in Texas. They offer short-term health coverage that can be applied for online and is available as soon as the following day.

Moda Health

Moda Health provides short-term medical plans in Texas. Their plans are designed to offer Texas residents temporary health insurance coverage that meets their specific needs.

These top providers of short-term health insurance in Texas offer reliable coverage options to individuals and families who need temporary health insurance. Whether you’re transitioning between jobs, waiting for employer-sponsored coverage to begin, or in any other situation where you need short-term coverage, these providers can help. Explore their offerings, compare plans, and choose the right short-term health insurance plan for your needs in Texas.

Comparing Short-term Health Insurance Plans

Compare Short-term Health insurance plans available in Texas for flexible coverage options. Find temporary medical insurance with leading providers for individuals and families in Austin, Texas. Get quotes and explore Golden Rule Ins Co, Bluecross Healthcare, and Moda Health plans in Texas.

Plan Options

When comparing short-term health insurance plans in Texas, it is essential to consider the different plan options available. AllstateCompanion LifeEverest ReinsuranceModa HealthNorth Companies provide coverage specifically in Texas. These companies offer a variety of plans to choose from, ensuring that you can find one that suits your specific needs and budget.

Affordability And Coverage Limits

Affordability is a crucial factor to consider when comparing short-term health insurance plans. These plans are typically more affordable than traditional health insurance options, making them a popular choice for individuals and families who are looking for temporary coverage. However, it is essential to note that short-term health insurance plans often come with coverage limits. These limits may include maximum coverage amounts per condition and a limited coverage period. It’s important to carefully review the coverage limits of each plan to ensure it aligns with your specific healthcare needs. To give you a better understanding, here is a brief comparison of short-term health insurance plan options in Texas:

| Insurance Company | Plan Options | Affordability | Coverage Limits |

|---|---|---|---|

| Allstate (National Insurance) | Various plans available | Affordable rates | Coverage limits apply; review terms |

| Companion Life | Texas-specific plans | Competitive Pricing | Review coverage limits |

| Everest Reinsurance | Texas-specific plans | Affordable options | Coverage limits may apply |

| Moda Health | Texas-specific plans | Reasonably priced options | Check coverage limits |

| North Companies | Texas-specific plans | Competitive rates | Review coverage limits |

As you can see, each insurance company offers different plan options with varying affordability and coverage limits. Evaluating these factors will help you find the short-term health insurance plan in Texas that best fits your needs and budget. Remember to carefully review the terms and conditions of each plan to ensure it provides the coverage you require during your temporary coverage period.

Availability Of Short Term Health Insurance In Texas

Availability of Short-Term Health Insurance in Texas

Several insurance companies offer short-term health insurance in Texas. These companies provide temporary health plans that can be a viable option for individuals and families who need immediate healthcare coverage. Short-term health insurance plans are designed to bridge the gap between traditional health insurance plans, providing coverage for a specific period.

Insurance Companies Offering Coverage

In Texas, several insurance companies offer short-term health coverage. These include:

| Insurance Company | Coverage Options |

|---|---|

| Allstate | Temporary Health Plan |

| Companion Life | Short Term Health Insurance |

| Everest Reinsurance | Temporary Medical Coverage |

| Moda Health | Short-Term Medical Plans |

| North | Temporary Health Coverage |

Comparison With Other Health Plans

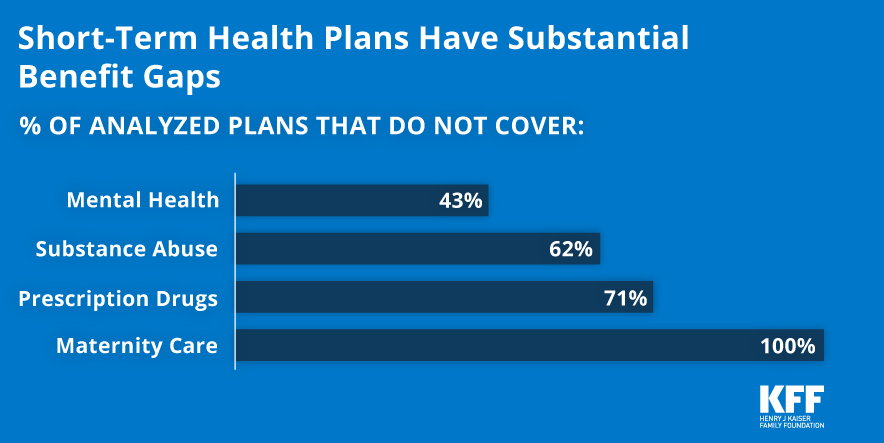

While short-term health insurance plans offer temporary coverage, it is essential to understand their differences from other health plans. Unlike traditional health insurance plans, short-term health insurance plans have certain limitations.

- Short-term health insurance plans do not cover pre-existing conditions.

- These plans typically have limited benefits and may not include coverage for essential health benefits.

- Short-term health insurance plans often come with lower monthly premiums but have higher deductibles and out-of-pocket costs.

- The coverage period for short-term health insurance plans is usually up to 364 days, but it can vary depending on state regulations.

Despite these limitations, short-term health insurance plans can be a suitable option for individuals who are between jobs, waiting for employer-sponsored coverage, or need temporary coverage due to life transitions.

Credit: covertexasnow.org

Finding The Best Coverage Today

Are you looking for the best short-term health insurance plans in Texas? Finding the right coverage can be daunting. However, with the right approach, you can secure a plan that perfectly fits your needs. This guide will walk you through the steps to find the best coverage available today.

Researching Plans

Start by researching the short-term health insurance plans available in Texas. Look for providers that offer comprehensive coverage and have a good reputation in the industry. Compare the benefits, coverage limits, and pricing of different plans to determine the best option for you.

Consulting With Insurance Agents

Seeking advice from experienced insurance agents can significantly simplify the process of finding the best short-term health insurance plan in Texas. These professionals can provide personalized recommendations based on your specific requirements and budget. Their expertise can help you navigate the complexities of insurance policies and find the most suitable coverage.

Understanding Texas-specific Regulations

When considering short-term health insurance plans in Texas, it’s essential to be well-versed in the state’s specific regulations. Texas has its laws and provisions governing short-term health insurance, ensuring consumer rights and protections are upheld.

State Laws On Short-Term Health Insurance

Texas-specific regulations outline the duration limit of short-term health insurance plans, which is currently set at 364 days, in alignment with federal regulations. It’s essential to understand that Texas law allows policyholders to renew short-term plans for up to 36 months, providing flexibility for individuals seeking temporary coverage.

Consumer Rights And Protections

In Texas, consumers are entitled to certain rights and protections when purchasing short-term health insurance. These include the right to a clearly defined policy contract and the right to cancel the policy within a specified period without penalty. Individuals should also be informed of their right to file complaints regarding their coverage with the Texas Department of Insurance.

Credit: www.kff.org

Making An Informed Decision

Making an informed decision is crucial when considering short-term health insurance plans in Texas. By understanding the pros and cons of these plans and evaluating individual healthcare needs, you can ensure you choose the most suitable coverage.

Weighing The Pros And Cons

Before opting for a short-term health insurance plan in Texas, it’s essential to weigh the pros and cons carefully.

- Pros:

- Immediate coverage for unexpected medical expenses

- Flexible duration options to match your needs

- Potentially lower premiums compared to long-term plans

- Cons:

- Limited coverage for pre-existing conditions

- No essential health benefits mandate

- Renewal limitations and potential coverage gaps

Considering Individual Healthcare Needs

When selecting a short-term health insurance plan in Texas, considering individual healthcare needs is paramount.

- Evaluate your current health status and medical requirements

- Assess the frequency of doctor visits and prescription medications

- Determine the level of coverage needed for anticipated medical services

Credit: www.uhc.com

Frequently Asked Questions

How Much Is Health Insurance In Texas Per Month For One Person?

Health insurance in Texas can average around $400 to $600 per month for one person.

What are The Cheapest Short Term Health Insurance Plans Texas?

The cheapest health insurance in Texas varies depending on individual circumstances. It is best to compare different plans and providers to find the most affordable option that meets your needs. Consider consulting with licensed insurance agents for personalized advice.

Can You Buy Health Insurance Anytime In Texas?

You can buy health insurance anytime in Texas. Understand your coverage options and choose a plan that suits your needs.

Can I Buy A Ppo Plan In Texas?

Yes, you can buy a PPO plan in Texas by becoming a member of an association that offers Texas PPO plans.

Conclusion

Short-term health insurance plans in Texas offer quick and flexible coverage solutions for your health needs. With various options available from reputable insurance providers, finding the right plan is simple. Protect yourself and your loved ones with the convenience and peace of mind these plans offer.