Short Term Health Insurance Nc: Your Affordable Solution

Short Term Health Insurance Nc provides basic coverage for unexpected medical expenses. Benefits vary, and coverage for essential services may be limited or excluded.

Short-term plans offer flexibility and peace of mind during transitional periods, making them a popular choice for many individuals in need of temporary health coverage. To purchase short-term health insurance in North Carolina, applicants must meet underwriting guidelines set by participating insurers.

With various options available, short-term health insurance can help bridge the gap in coverage and provide essential care when needed. Considering the lower cost and tailored coverage options, short-term health insurance is a viable solution for those seeking temporary medical coverage.

Credit: www.google.com

Benefits

Short-term health insurance in North Carolina offers a range of benefits that make it an attractive option for individuals and families. From affordability to flexibility of coverage, it provides a valuable solution for those seeking temporary insurance coverage.

Affordability

One key benefit of short-term health insurance in North Carolina is its affordability. Due to their temporary nature and more limited coverage, short-term plans often come at a lower monthly premium compared to traditional comprehensive health insurance. This makes them a cost-effective option for individuals who need coverage for a specific period, such as during a job transition or waiting for open enrollment.

Flexibility Of Coverage

Short-term health insurance also offers flexibility in coverage, allowing policyholders to customize their insurance plan based on their specific needs and budget. With the ability to choose the length of coverage and optional benefits, such as prescription drug coverage and preventive care, individuals have the freedom to tailor their insurance to suit their circumstances.

Credit: www.kff.org

Coverage

Short-term health insurance in NC offers coverage for basic medical expenses through limited-term, flexible plans. Understanding the coverage details is crucial for making informed decisions about your healthcare needs.

Basic Medical Expenses

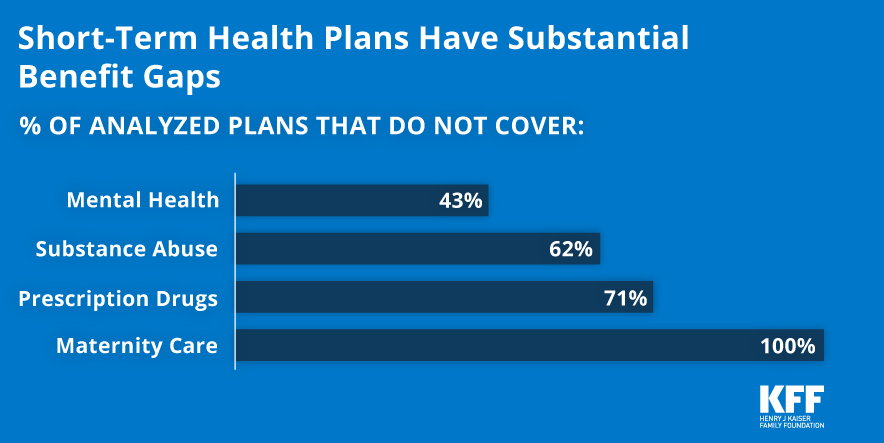

Short-term health insurance typically covers basic medical expenses, including emergency care and hospitalization. However, coverage for pre-existing conditions, prescription drugs, preventive care, and maternity care may be limited or excluded.

Exclusions And Limitations

- Short-term health insurance may have limitations on coverage for certain medical services or conditions.

- Exclusions may apply to pre-existing conditions, preventive care, and other essential benefits mandated by the ACA.

- It’s important to carefully review the policy’s exclusions and limitations to understand what is not covered.

Comparison

Are you looking to compare short-term health insurance options in North Carolina? Find out the benefits, coverage, and considerations of different plans to make an informed decision. Get a quote now from licensed insurance agents at Allstate Health Solutions or First Family Insurance.

Short-term Insurance Vs. Cobra

When it comes to choosing a health insurance plan in North Carolina, it’s essential to understand the differences between two popular options: short-term insurance and COBRA. Short-term insurance is a type of temporary coverage that provides vital protection for unexpected medical expenses, such as emergency care and hospitalization. It offers flexibility in terms of coverage and cost, making it an attractive choice for individuals who are between jobs or facing a gap in coverage. On the other hand, COBRA stands for the Consolidated Omnibus Budget Reconciliation Act, which allows individuals to continue their employer-sponsored health insurance coverage after leaving their jobs. COBRA coverage can be a good option for those who want to maintain the same level of benefits they had while working. Still, it often comes with higher costs since the individual is responsible for paying the entire premium.

Short-term Insurance Vs. Traditional Plans

Short-term insurance also differs from traditional health insurance plans in North Carolina. Traditional plans, such as those offered through the Affordable Care Act (ACA) marketplace, provide comprehensive coverage that includes various essential benefits like preventive care, prescription drugs, and maternity care. These plans are designed for long-term health coverage and are typically more expensive than short-term options. In contrast, short-term insurance offers limited coverage for pre-existing conditions, prescription drugs, and preventive care. It’s essential to carefully consider your health needs when deciding between a short-term plan and a traditional plan. If you’re generally in good health and primarily need coverage for unexpected medical expenses, short-term insurance may be a more cost-effective choice. However, if you have ongoing medical needs or require specific types of care, a traditional plan may provide more comprehensive coverage. Overall, the choice between short-term insurance, COBRA, and traditional plans depends on your circumstances and priorities. It’s essential to compare the benefits, coverage, and costs of each option before making a decision. Consider factors such as your health status, budget, and the duration of coverage you need. By understanding the differences between these options, you can make an informed choice that meets your specific needs.

Availability In North Carolina

Applicants who meet the underwriting guidelines created by participating insurers can purchase short-term health insurance in North Carolina. This mostly…

Meeting Underwriting Guidelines

Short-term health insurance in North Carolina is available to individuals who meet the underwriting guidelines established by the participating insurers. These guidelines determine eligibility…

Participating Insurers In North Carolina

In North Carolina, a variety of insurance companies participate in offering short-term health insurance plans. Some well-known insurers in the state include:

- ABC Insurance Company

- XYZ Health Insurance

- 123 HealthCare

| Insurance Company | Contact Information |

|---|---|

| ABC Insurance Company | Phone: 123-456-7890 |

| XYZ Health Insurance | Email: [email protected] |

| 123 HealthCare | Website: www.123healthcare.com |

Popular Providers

Several popular providers offer short-term health insurance in North Carolina. It’s essential to choose a reputable provider that offers the coverage you need at a price that fits your budget.

National General Accident & Health

National General Accident & Health is a well-known provider of short-term health insurance in North Carolina. They offer a range of flexible plans to meet different needs, including coverage for unexpected medical expenses such as emergency care and hospitalization.

Other Key Providers In North Carolina

Several other critical providers in North Carolina offer short-term health insurance plans to individuals and families. These providers include licensed insurance agents like First Family Insurance, with whom you can get a quote today to find the plan that suits your needs.

Credit: www.cleveland19.com

Considerations

When considering short-term health insurance in North Carolina, it’s essential to weigh the benefits and limitations of the coverage. While short-term plans can provide primary coverage for unexpected medical expenses, they may not cover pre-existing conditions, prescription drugs, preventive care, or maternity care.

It’s crucial to carefully consider your health goals, needs, and finances before enrolling in a short-term plan.

Considerations Short-term health insurance in North Carolina can offer a flexible and affordable option for individuals seeking temporary coverage. It’s essential to understand some crucial considerations when evaluating this type of insurance, including the duration and renewal of Renewabilityell as implications for pre-existing conditions. Duration and RenewaRenewabilityconsidering short-term health insurance in NC, it’s important to note the duration of coverage. These plans typically provide coverage for a limited period, such as three months to a year, making them suitable for individuals facing a temporary coverage gap. Additionally, renewaRenewabilityort term health insurance plans may vary. Some plans may offer the option to renew for additional coverage periods, while others may have limitations or restrictions on renewal. Implications for Pre-Existing Conditions Short-term health insurance in NC may have an impact on individuals with pre-existing conditions. It’s crucial to understand that these plans may not provide coverage for pre-existing conditions or may have limitations on related expenses. Individuals with existing health conditions should carefully evaluate the implications of short-term health insurance on their specific healthcare needs. In conclusion, Choosing short-term health insurance in NC requires a thorough consideration of the duration and renewal implications for pre-existing conditions. By understanding these fundamental considerations, individuals can make informed decisions when selecting temporary health coverage that aligns with their unique needs.

Frequently Asked Questions

How Much Is Health Insurance A Month In NC?

In North Carolina, health insurance costs vary but can range from $200 to $600 per month.

What type of insurance is Short Term Health Insurance Nc?

Short-term insurance provides basic coverage for unexpected medical expenses, such as emergency care and hospitalization. However, coverage for pre-existing conditions, prescription drugs, and other essential benefits may be limited.

Why Is Short-term Insurance So Cheap?

Short-term insurance is cheaper due to fewer features and limited coverage. It doesn’t build cash value and may have lower coverage amounts.

Is Cobra Or Short-term Health Insurance Better?

Short-term health insurance is better than COBRA for those facing a gap in coverage. It provides flexible options for your health needs and finances, giving you peace of mind during transitions. COBRA has limited options and is typically more expensive.

Conclusion

Short-term Health Insurance in North Carolina offers quick, affordable coverage for those in need. With its primary benefits, it provides peace of mind during transitional periods. Its availability and flexibility make it a popular alternative to COBRA. Consider short-term plans for your health needs.