Surest Health Insurance Reviews: Top Recommendations

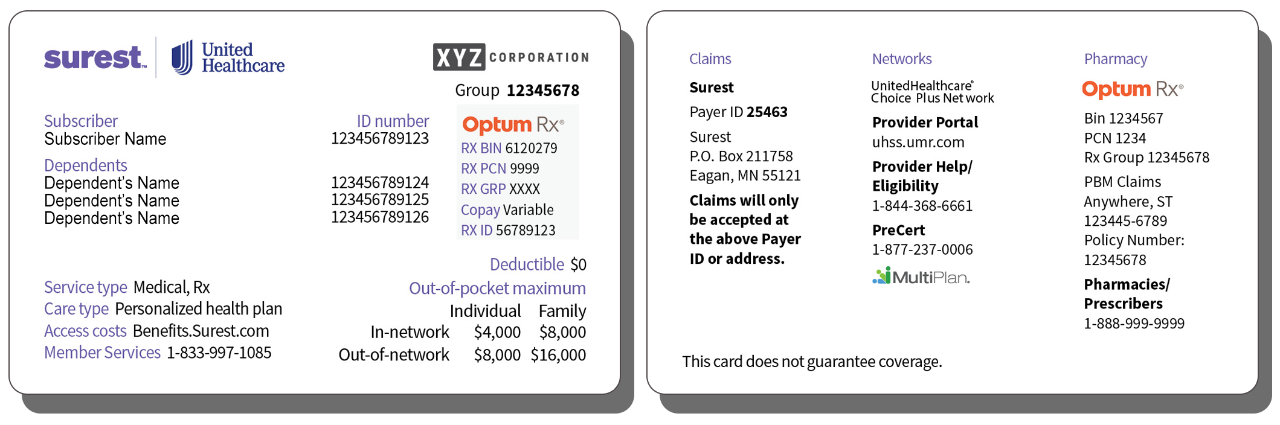

Surest Health Insurance Reviews: Surest is a UnitedHealthcare company that offers a health plan without a deductible or coinsurance. Members can access the nationwide UnitedHealthcare and Optum Behavioral Health networks and review costs and care options in advance.

Surest Health Insurance has gained attention for its unique approach to pricing transparency and eliminating traditional deductibles and coinsurance. Its user-friendly app allows Members to search, compare, and choose care. However, some individuals have experienced coverage and claims processing issues, raising concerns about Surest’s reliability.

Considering the pros and cons before enrolling in Surest Health Insurance is essential.

Credit: nwi. life

Choosing The Right Health Insurance

When choosing the right health insurance, various factors can significantly impact your overall well-being and financial security. Understanding the coverage options and cost considerations is crucial in making an informed decision that meets your healthcare needs. Surest Health Insurance Reviews offers valuable insights into finding the most suitable health insurance plan for you and your family.

Coverage Options

One of the first things to consider when evaluating health insurance options is its coverage. Surest Health Insurance offers comprehensive coverage options, including access to the nationwide UnitedHealthcare and Optum® Behavioral Health networks. This ensures members can choose from a vast network of healthcare providers, allowing them to seek medical care where and when needed.

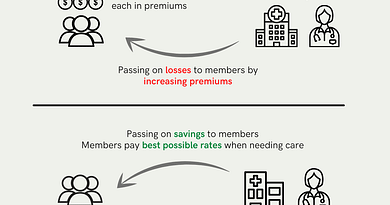

Cost Considerations

Aside from coverage, the cost of health insurance is another critical factor to consider. Surest Health Insurance allows members to check costs and care options in advance. The plan boasts a unique feature of eliminating deductibles and coinsurance, providing a transparent and predictable pricing structure. This allows individuals to review and consider their options before deciding on care, leading to better financial planning and peace of mind.

Top Criteria For Evaluating Health Insurance

When evaluating health insurance plans, several critical criteria must be considered to ensure you get the best coverage for your needs. From the network of providers to coverage limits and customer service, these factors play a significant role in determining the effectiveness of a health insurance policy.

Network Of Providers

One of the top criteria for evaluating health insurance is the network of providers included in the plan. Ensuring that the insurance plan provides access to a wide range of doctors, specialists, and hospitals is essential. A comprehensive network lets you choose healthcare providers that meet your needs and preferences.

Coverage Limits And Exclusions

Understanding the coverage limits and exclusions of a health insurance plan is critical. Carefully review the policy to determine the extent of coverage for various medical services, prescription drugs, and treatments. Additionally, be mindful of any exclusions or limitations that may impact your ability to access certain types of care.

Customer Service

Assessing the customer service provided by a health insurance company is vital. Prompt and effective customer support can make a significant difference when navigating health insurance matters. Evaluate the company’s responsiveness to inquiries, the availability of online resources, and overall customer satisfaction with the service provided.

Claims Process

Another essential factor for evaluating health insurance is the claims process. A straightforward and efficient claims process contributes to a positive experience with the insurer. Understanding the steps involved in filing a claim, the timeline for claim resolution, and the transparency of the process is crucial for evaluating the overall effectiveness of the insurance plan.

Benefits Of Reading Health Insurance Reviews

Health insurance is essential to your well-being, providing medical coverage and peace of mind. However, choosing the right health insurance plan can be overwhelming with many options. That’s where health insurance reviews come in. Reading reviews from real customers can provide valuable insights into the experiences of others, helping you make informed decisions about your healthcare coverage. This article will explore the benefits of reading health insurance reviews, including gaining insight into customer experiences, comparing plans, and identifying red flags.

Insight Into Customer Experiences

One key benefit of reading health insurance reviews is gaining insight into other customers’ experiences. By hearing firsthand accounts of real people, you can get a sense of how the insurance company performs in terms of customer service, claims processing, and overall satisfaction. These reviews can help you gauge the insurance provider’s reliability and trustworthiness before committing. Additionally, customer experiences can shed light on any potential issues or challenges you may encounter while using the health insurance plan.

Comparing Different Plans

Another advantage of reading health insurance reviews is comparing different plans. Reviews often highlight the specific features, benefits, and drawbacks of various insurance policies, allowing you to make informed comparisons. By understanding the strengths and weaknesses of different plans, you can choose a health insurance policy that aligns with your specific needs and budget. Reading reviews can save you time and effort by narrowing down your options and helping you make a more confident decision.

Identifying Red Flags

Health insurance reviews can also help you identify any red flags indicating potential issues with the insurance provider. Negative reviews that consistently mention problems such as denied claims, poor customer service, or confusing policies should serve as cautionary signs. Spotting these red flags early on can help you avoid signing up for a plan that may not meet your expectations or provide the level of coverage you need. Taking the time to read reviews can potentially save you from frustrating and costly experiences with subpar health insurance providers.

Common Pitfalls To Avoid

When selecting a health insurance plan, you must know common pitfalls that can impact your coverage and financial well-being. By understanding these pitfalls, you can make informed decisions that align with your healthcare needs. Here are some key pitfalls to avoid:

Overlooking Fine Print

One common mistake is overlooking the fine print of your health insurance policy. Carefully review the terms and conditions, including coverage limitations, exclusions, and copayment details.

Ignoring In-network Providers

Ignoring the importance of in-network providers can lead to unexpected costs. Ensure your preferred healthcare providers are within the network to maximize your benefits and minimize out-of-pocket expenses.

Not Considering Long-term Needs

Not considering your long-term healthcare needs can result in inadequate coverage. To select a comprehensive and sustainable coverage plan, evaluate your anticipated medical needs, such as chronic conditions or future treatments.

Making Informed Decisions

Making informed decisions is crucial when choosing the right health insurance plan. Explore Surest Health Insurance Reviews for comprehensive insights. Ensure your coverage meets your needs with nationwide networks and transparent cost options offered by Surest.

Researching Online Reviews

When looking for a health insurance plan, making informed decisions is crucial. Researching online reviews can provide valuable insights into the experiences and satisfaction of current policyholders. Examining diverse sources and platforms such as Trustpilot, Reddit, and healthcare industry publications can comprehensively understand the Surest Health Insurance plan’s features, network, and customer service. Seeking Professional Advice

Seeking Professional Advice

In addition to conducting online research, seeking professional advice from insurance brokers, financial advisors, or healthcare professionals can provide personalized guidance. These experts can offer tailored recommendations based on individual needs and preferences. Consulting with professionals can help navigate the complexities of health insurance and ensure that the chosen plan aligns with specific healthcare requirements and financial constraints. By examining online reviews and leveraging professional advice, individuals can make well-informed decisions when selecting a health insurance plan. Combining thorough research and expert consultation empowers individuals to secure a plan that meets their healthcare needs and financial goals.

Credit: public.providerexpress.com

Reviewing Customer Satisfaction

Diving into the world of health insurance can feel overwhelming, especially when deciding which provider offers the best coverage and customer satisfaction. At Surest Health Insurance, we understand the value of prioritizing customer happiness. Let’s take a closer look at how we ensure top-notch customer satisfaction through surveys and testimonials.

Surveying Consumer Ratings

At Surest Health Insurance, we regularly survey our customers to gauge their satisfaction. By gathering data on factors such as customer service responsiveness, claim processing efficiency, and overall coverage experience, we can continually improve our services to meet the needs of our members. These surveys not only help us identify areas for enhancement but also allow us to celebrate the aspects of our insurance that our customers appreciate the most. We can provide the best possible experience for all Surest Health Insurance members by staying attuned to our customers’ feedback.

Analyzing Testimonials

One of the most effective ways to evaluate customer satisfaction is by delving into the testimonials of our policyholders. Real-life stories and experiences can provide invaluable insights into our insurance offerings’ strengths and areas of improvement. Analyzing these testimonials enables us to understand our customer’s unique needs and concerns and work towards addressing them. Whether it’s a positive experience that reaffirms our dedication to excellent service or constructive criticism that prompts us to make meaningful changes, the testimonials of our members are an essential tool in our pursuit of customer satisfaction.

Credit: www.surest.com

Frequently Asked Questions On Surest Health Insurance Reviews

Is Surest The Same As UnitedHealthcare?

Surest is part of UnitedHealthcare, offering a health plan with no deductible or coinsurance. Members access UnitedHealthcare and Optum® Behavioral Health networks, with cost and care options upfront.

What Is A Surest Insurance Plan?

UnitedHealthcare administers the surest insurance plan. It offers a health plan without a deductible or coinsurance. Members can access nationwide networks and check costs and care options in advance. It is different from traditional health insurance.

Who Is The Parent Company Of Surest Insurance?

UnitedHealthcare, a leading health insurance company in the industry, owns Surest Insurance.

Which Is The No. 1 Health Insurance Company in the USA?

UnitedHealthcare is the top health insurance company in the USA.

Conclusion

Surest Health Insurance has proven to be a top choice for individuals seeking reliable coverage. With affordable plans and access to the nationwide UnitedHealthcare and Optum® Behavioral Health networks, Surest offers comprehensive care options. The elimination of deductibles and coinsurance sets Surest apart from traditional health insurance, providing peace of mind for members.

Surest ensures a seamless experience with just a few clicks, whether searching, comparing, or choosing care. Don’t hesitate to explore the benefits of Surest Health Insurance and make an informed decision for your healthcare needs.