Who is the Subscriber for Health Insurance? Unveiling the Key Roleplayer!

Who is the subscriber for health insurance? The subscriber is the individual who agrees with the insurance company. Also known as the policyholder, they are responsible for the insurance plan.

Health insurance subscribers are crucial individuals who initiate agreements with insurance companies to secure coverage. As the policyholder, they play a vital role in maintaining the insurance plan and can add dependents as needed. Understanding the subscriber’s role is essential for navigating the complexities of health insurance coverage and ensuring proper adherence to policy terms.

Let’s delve deeper into the subscriber’s significance in the realm of health insurance and the implications of their responsibilities.

The Role Of The Subscriber

The subscriber is the policyholder or member who agrees with the health insurance company. They are responsible for purchasing the policy and carrying the insurance plan for themselves or their dependents.

Definition Of Subscriber

The subscriber, also known as the policyholder, is the individual who agrees with the insurance company. They are the primary member of the insurance plan and are responsible for its management and payments.

Importance Of The Subscriber

Subscribers play a crucial role in health insurance as they are the insurance company’s primary point of contact. They are responsible for enrolling and managing the coverage for themselves and any dependents, ensuring that all necessary information and documentation is provided to the insurer.

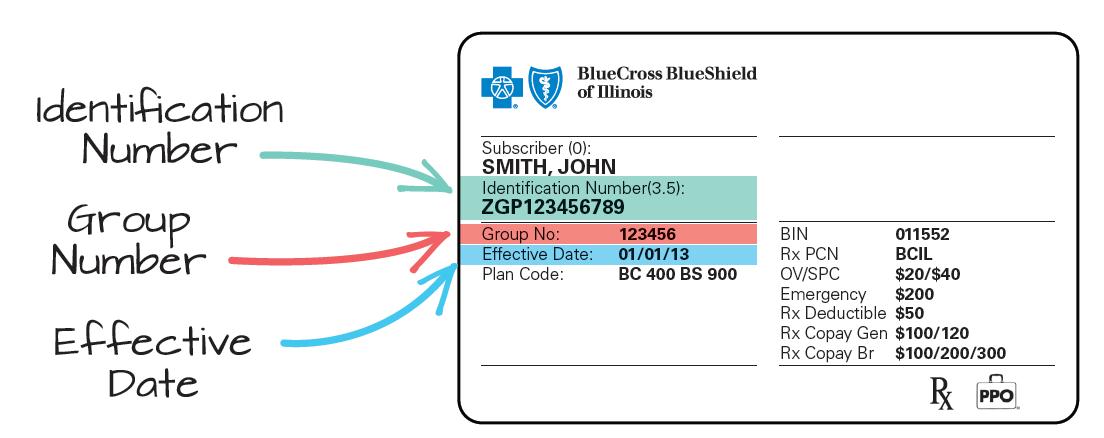

Credit: connect.bcbsil.com

Understanding Policyholder Vs. Subscriber

The individual who enters the insurance agreement is known as the subscriber or policyholder. If you directly purchase a policy, you are considered a health insurance subscriber.

Defining The Policyholder

The policyholder is the individual who owns the insurance policy and provides protection and coverage under the policy’s terms.

Distinguishing Policyholder And Subscriber

Policyholder: Owns the insurance policy.

Subscriber: The person subscribing to or carrying the insurance plan for the patient’s case.

Subscriber’s Responsibilities

The subscriber for health insurance is the individual who agrees with the insurance company, also known as the policyholder. This person is responsible for purchasing the policy directly from an insurance company and maintaining the insurance plan.

Paying Premiums

pay your premiums consistently and on time. The premium is the amount of money you need to pay to the insurance company in exchange for the coverage they provide. Failing to pay your premiums can result in the termination of your health insurance policy, leaving you without the necessary financial protection during times of illness or injury.

Maintaining Eligibility

maintain your eligibility as a subscriber. This means fulfilling the requirements set by your insurance provider to remain qualified for coverage. These requirements may include factors such as age, employment status, residency, or other qualifying criteria. Failure to meet these eligibility criteria may result in the denial of certain benefits or even the cancellation of your health insurance policy.

Understanding Your Responsibilities

As a health insurance subscriber, it is crucial to understand and fulfill your responsibilities to ensure the smooth operation of your policy. These responsibilities include paying premiums regularly, maintaining eligibility, and adhering to the terms and conditions set by your insurance provider. By fulfilling these obligations, you can ensure that you can avail yourself of the maximum benefits offered by your health insurance policy and have the necessary financial support in times of medical emergencies.

Credit: selecthealth.org

Relationship To Dependents

The relationship with dependents in health insurance is crucial for understanding the coverage and responsibilities towards family members. As the policyholder, also known as the subscriber, it is essential to understand how to add dependents to your health insurance plan and what responsibilities come with it.

Adding Dependents

Adding dependents to your health insurance plan allows your family members to be covered under the same policy. This process typically involves providing the necessary information and documentation to your insurance provider for the enrollment of your dependents.

Responsibilities Towards Dependents

As the policyholder, you are responsible for ensuring that your dependents receive the necessary healthcare coverage and benefits as outlined in your insurance plan. This includes tracking their medical needs, appointments, and claims to guarantee their well-being.

The Subscriber In Healthcare

The subscriber, also known as the policyholder, plays a crucial role in health insurance. They are the people who enter into an agreement with the insurance company and carry the insurance plan for the patient’s case. If you buy a policy directly from an insurance company, you would be considered a subscriber. Understanding the subscriber’s role and the importance of their subscriber ID is critical to navigating the healthcare system.

Subscriber’s Role In Filing Claims

As a subscriber, it is your responsibility to play an active role in filing claims with your insurance company. Filing claims is the process of submitting a request for reimbursement of medical expenses incurred by the insured individual. By filing claims correctly and in a timely manner, the subscriber ensures that the insurance company receives the necessary information to process and approve the claim.

Here are some essential points to remember about the subscriber’s role in filing claims:

- Provide accurate and complete information: The subscriber must accurately and fully complete claim forms, ensuring that all required fields are filled in.

- Attach supporting documents: Depending on the nature of the claim, the subscriber may need to provide supporting documents such as medical bills, receipts, and medical records. These documents help to validate the expenses claimed and facilitate the reimbursement process.

- Follow submission guidelines: Each insurance company may have specific guidelines and deadlines for claim submission. Subscribers need to familiarize themselves with these guidelines and adhere to them to avoid claim denials or delays.

- Keep records: The subscriber should keep a copy of all submitted claim forms, supporting documents, and any correspondence with the insurance company. These records serve as proof of submission and can be helpful in case of any disputes or inquiries.

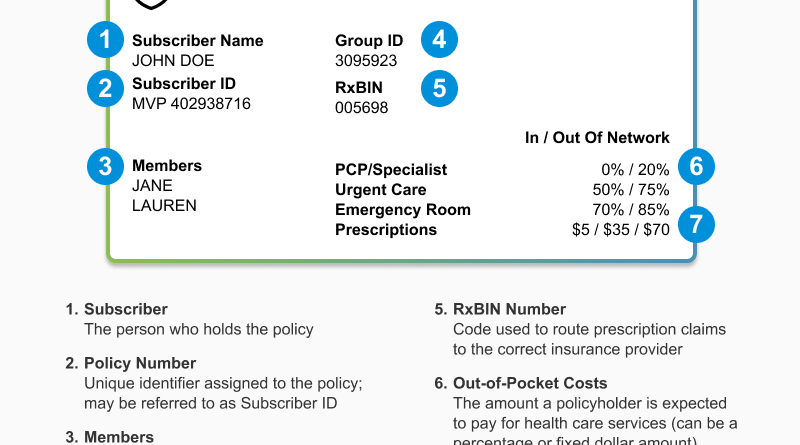

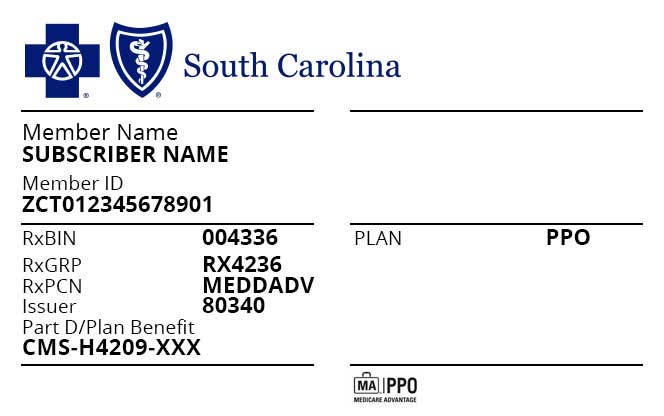

Understanding Subscriber Id

The subscriber ID, also known as the policy number, is a unique code associated with your insurance plan. This ID serves as a reference for the insurance company to track and process insurance claims and costs. The subscriber needs to understand their subscriber ID and its significance in healthcare transactions.

Here are some key points to understand about the subscriber ID:

- Uniqueness: Each subscriber is assigned a unique subscriber ID by the insurance company. This number distinguishes them from other policyholders and ensures accurate identification and tracking of their insurance plan.

- Identification: The subscriber ID helps healthcare providers, pharmacies, and other entities involved in healthcare transactions to identify the subscriber’s insurance coverage and facilitate billing and reimbursement processes.

- Access to benefits: The subscriber ID is often required when seeking medical services or purchasing prescription medications. It allows healthcare providers to verify the subscriber’s insurance coverage and determine the extent of benefits available to them.

- Sharing with dependents: In some cases, the subscriber may have dependents covered under their insurance plan. These dependents may have their unique ID numbers, but they are typically linked to the subscriber’s ID. This linkage ensures that the dependents’ healthcare transactions are associated with the subscriber’s coverage.

By understanding the subscriber’s role in healthcare and the importance of the subscriber ID, individuals can navigate the health insurance system more effectively and ensure the smooth processing of claims and benefits.

Credit: www.southcarolinablues.com

Significance In Health Insurance

The subscriber for health insurance is the individual who agrees with the insurance company, also known as the policyholder. They are responsible for paying premiums and maintaining eligibility for the insurance plan. If you purchase a policy directly from an insurance company, you are considered a subscriber.

Health insurance subscribers play a crucial role in the functioning of the health insurance system. Understanding their significance is essential for individuals and families seeking comprehensive coverage. Let’s delve into the key aspects that underline the importance of health insurance subscribers in different areas.

Financial Implications

When it comes to health insurance, the subscriber directly influences the financial implications of the policy. Subscribers are responsible for paying premiums, which in turn enables them to access the policy’s benefits. The subscriber’s economic stability and responsibility contribute significantly to the sustainability of the health insurance plan. Moreover, in the event of a claim, the subscriber bears the financial responsibility of deductibles, co-payments, and other out-of-pocket expenses.

Access To Healthcare Services

Health insurance subscribers hold the key to accessing healthcare services for themselves and their covered dependents. Through the subscriber’s contributions, family members can benefit from medical treatments, doctor’s visits, preventative care, and other essential healthcare services. The subscriber’s role in facilitating access to healthcare services is vital in ensuring the well-being and security of insured individuals. By understanding the importance of the subscriber’s role in health insurance, individuals can make informed decisions and effectively leverage their coverage for optimal health outcomes.

Challenges Faced By Subscribers

The subscriber for health insurance refers to the individual who agrees with the insurance company, also known as the policyholder. They are responsible for buying the policy and are the primary holders of the insurance plan.

Navigating Complex Policies

Managing Changes In Coverage

Challenges Faced by Subscribers Health insurance is vital for ensuring access to quality healthcare, but the journey of a subscriber is not without its challenges. From navigating complex policies to managing changes in coverage, subscribers often encounter hurdles that require careful navigation.

Navigating Complex Policies

When it comes to health insurance, the policies and coverage options can be complex and overwhelming. Subscribers are tasked with decoding intricate terms, understanding various coverage levels, and grasping the nuances of deductibles, co-pays, and networks. This can be a daunting task, especially for those with limited experience in the insurance landscape. Navigating through the complexities of policies demands time and effort, as subscribers must ensure they comprehend the extent of their coverage and the associated costs. Managing Changes in Coverage As life evolves, so do the healthcare needs of individuals. Subscribers may encounter changes in their coverage due to life events such as marriage, childbirth, job transitions, or relocations. Adapting to these changes and understanding how they impact coverage can be a challenging endeavor.

Additionally, alterations in the policy terms and conditions, modifications in the healthcare provider network, or shifts in medication coverage can further complicate the subscriber’s journey. Managing changes in coverage requires proactivity, clear communication with the insurance provider, and a thorough understanding of the implications of any adjustments. In conclusion, health insurance subscribers face various challenges, from deciphering complex policies to managing shifts in coverage. These obstacles require patience, diligence, and a keen eye for detail to ensure that individuals can effectively utilize their health insurance when needed.

Frequently Asked Questions

Who is the subscriber for health insurance?

The subscriber’s name on your insurance is the individual who agrees with the insurance company, also known as the policyholder.

Are Subscriber And Member IDs the Same?

The subscriber and member ID are the same; both refer to the primary insured person.

What Is The Difference Between A Subscriber And A Dependent On Health Insurance?

A subscriber is the policyholder who enters into the insurance agreement. A dependent is someone covered by the subscriber’s policy.

Who is the subscriber to the health insurance policy?

The person who owns the insurance policy is known as the policyholder or subscriber.

Conclusion

Understanding who the subscriber is in health insurance is crucial. The subscriber, also known as the policyholder, is the individual who enters into the insurance agreement. Whether you purchase the policy or someone else does, knowing this role is essential for managing your coverage effectively.