Can You Add a Girlfriend to Health Insurance? Find Out Now!

Can You Add a Girlfriend to Health Insurance? Yes, you can add a girlfriend to your health insurance as a domestic partner. This requires providing proof of domestic partnership to your employer-sponsored insurance.

Adding a significant other to your health insurance as a domestic partner is possible if your employer recognizes the relationship. Adding a girlfriend to your health insurance is an option if you are in a domestic partnership. Typically, employer-sponsored insurance allows adding domestic partners, but proof of the partnership is required.

This can be in the form of an affidavit of domestic partnership or any relevant document recognized by the employer. It’s essential to check with your employer regarding the specific requirements and eligibility criteria for adding a girlfriend to your health insurance. Understanding the process and documentation needed can help ensure a smooth enrollment process.

Credit: healthnews.com

Understanding Domestic Partnerships

Establishing a domestic partnership allows you to add your Girlfriend to your health insurance easily. This legal relationship will enable you to share benefits and coverage, ensuring your partner’s healthcare needs are met. Ensure you meet your state’s requirements for domestic partnerships.

Defining Domestic Partnerships

Domestic partnerships refer to a legal relationship where two individuals live together and share a domestic life without being married or blood relatives.

Legal Recognition Of Domestic Partnerships

Domestic partnerships may not be federally recognized, so the ability to add a partner to health insurance depends on state laws.

Medical plans typically only allow spouse or dependent family additions, but domestic partnership coverage can be an exception.

Adding A Girlfriend To Health Insurance

Specific guidelines and requirements must be met when adding a girlfriend to your health insurance. Whether you have private health insurance or are covered under an employer-sponsored plan, it’s essential to understand the process and any potential limitations.

General Guidelines For Adding Non-spouse Partners

Adding a non-spouse partner to your health insurance typically requires a formal recognition of the relationship, such as a domestic partnership or civil union. Before attempting to add your Girlfriend to your policy, it’s essential to review your insurance provider’s specific guidelines and documentation requirements.

Employer-sponsored Insurance Requirements

For those covered under employer-sponsored insurance, additional requirements may need to be met to add a girlfriend to the policy. This could include providing documentation of the domestic partnership, such as an affidavit or other legal recognition of the relationship.

Criteria For Inclusion

While it depends on your specific health insurance provider, you can sometimes add a girlfriend or boyfriend to your policy if you meet the requirements for a domestic partnership. It’s essential to check with your insurance company and provide any necessary documentation to ensure eligibility.

Qualifying Factors For Domestic Partnership

Adding a girlfriend to your health insurance can be possible if your relationship qualifies as a domestic partnership. However, it is essential to understand the qualifying factors for domestic partnerships before considering this option. While the criteria for domestic partnership may vary by state, there are some general factors to consider:

- Shared Residency: To qualify, you and your Girlfriend must live together in a committed relationship in the same residence or have a permanent, ongoing living arrangement.

- Shared Finances: Demonstrating shared financial responsibilities, such as joint bank accounts or shared bills, can be essential criteria for domestic partnership validity.

- Commitment: A domestic partnership typically requires both partners to commit to an exclusive relationship.

- Intent to Stay Together: Both partners must intend to maintain a long-term relationship without intending to dissolve the partnership in the near future.

- Non-Marital Status: It is important to note that a domestic partnership is distinct from a marriage or civil union, so both partners must not be legally married or enrolled in a civil union.

State-specific Regulations

While the criteria mentioned above generally apply, it is crucial to consider the state-specific regulations regarding domestic partnerships. State laws govern the recognition and benefits provided for domestic partnerships, and they can vary significantly. Some states have specific registration requirements, while others may automatically recognize a domestic partnership by meeting specific criteria.

Here is an overview of some state-specific regulations:

| State | Recognition | Requirements |

|---|---|---|

| California | Full recognition | Registration with the Secretary of State or meet the state’s criteria |

| New Jersey | Full recognition | Registration with the Bureau of Vital Statistics or meet the state’s criteria |

| Colorado | Partial recognition | Meet the state’s criteria and be registered with the designated county clerk. |

| Texas | No recognition | Not applicable |

Note that this is just a brief overview. To ensure compliance with state-specific regulations, it is crucial to consult the specific state laws or seek legal advice.

Remember, every relationship and state has unique requirements and regulations for domestic partnership recognition. Understanding the criteria and rules for your specific situation will be essential before considering adding your Girlfriend to your health insurance policy.

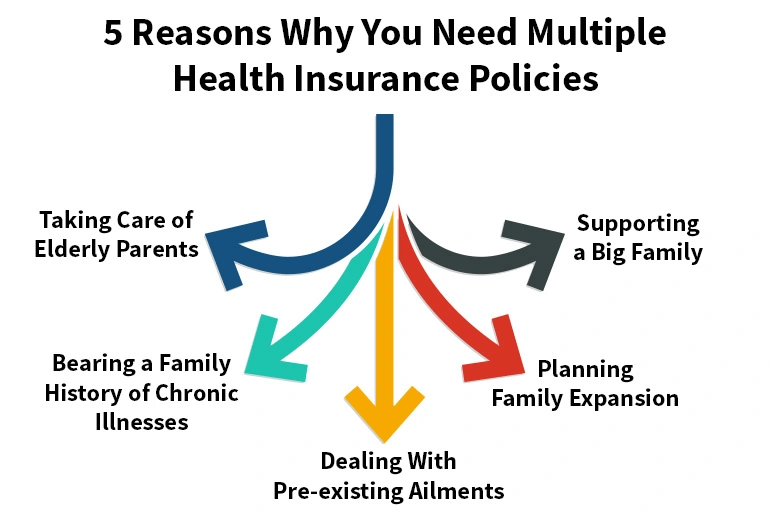

Benefits And Challenges

Adding your Girlfriend to your health insurance can provide numerous benefits, but it may also pose some challenges. Understanding the advantages and potential hurdles can help you make an informed decision regarding this option. Below, we’ll explore the benefits of including a girlfriend on health insurance and possible hurdles to overcome.

Advantages Of Including A Girlfriend On Health Insurance

There are several advantages to adding your Girlfriend to your health insurance policy:

- Expanded Coverage: Including your Girlfriend on your health insurance can expand the coverage to provide medical care for both of you.

- Cost Savings: Some employers may offer cost-effective options for adding domestic partners to their employees’ health insurance plans, which could lead to potential cost savings for both individuals.

- Peace of Mind: Knowing that your Girlfriend has access to comprehensive healthcare coverage can provide peace of mind for both of you.

Potential Hurdles To Overcome

While adding a girlfriend to your health insurance can be beneficial, there are potential hurdles to consider:

- Eligibility Requirements: Not all health insurance plans recognize unmarried partners, so it’s essential to check the eligibility criteria and ensure that your relationship meets the specified requirements for inclusion.

- Legal Documentation: In some cases, you may need to provide legal documentation, such as a domestic partnership affidavit, to prove the validity of your relationship for insurance purposes.

- State Regulations: The ability to add a girlfriend to health insurance can be subject to state-specific regulations regarding domestic partnerships and eligibility, so it’s crucial to understand the rules in your particular state.

Insurance Providers Perspective

Certainly! Adding a non-family member, like a girlfriend, to health insurance often depends on the provider. When the relationship qualifies as a domestic partnership, some insurers allow it. Check the specific criteria and documentation needed for your insurance policy to add a girlfriend as a dependant.

Insurance Companies’ Policies On Adding Non-family Members

Insurance companies may allow adding non-family members such as girlfriends to health insurance under certain conditions.

- Documentation of a domestic partnership is usually required to add a girlfriend to the insurance policy.

- Employer-sponsored insurance plans may have specific guidelines for adding non-family members.

- Some insurance providers offer domestic partnership coverage for individuals who are not legally married.

Common Restrictions And Exceptions

There are common restrictions and exceptions when it comes to adding non-family members to health insurance:

- Most plans restrict adding only dependent family members like spouses and children.

- Exceptions include domestic partnership coverage for unmarried couples living together.

- State laws play a significant role in determining eligibility for adding non-family members to insurance.

Credit: www.insure.com

Process Of Adding A Girlfriend

You have the option to add a girlfriend to your health insurance as a domestic partner. This may require documentation from your employer recognizing the partnership, such as an affidavit or domestic partnership agreement. Some insurers allow adding significant others to car insurance policies if you live together.

Documentation Required For Adding A Domestic Partner

When adding your Girlfriend to your health insurance, you may be required to provide specific documentation. Common documents include:

- Proof of Domestic Partnership: Affidavit of Domestic Partnership

- Other Supporting Documents: Any additional paperwork recognizing your domestic partnership

Steps To Follow For Inclusion

Follow these steps to include your Girlfriend in your health insurance:

- Consult with Your Insurance Provider: Inquire about the process and required documents.

- Gather Necessary Documentation: Ensure you have all the paperwork to validate your partnership.

- Submit the Documents: Provide the documentation to your employer or insurance company for processing.

- Review the Terms: Understand the coverage and benefits extended to your Girlfriend.

- Confirm Inclusion: Verify that your Girlfriend has been successfully added to the policy.

Credit: stock.adobe.com

Frequently Asked Questions

Can You Add a Girlfriend to Health Insurance?

You can add a domestic partner, such as a boyfriend or Girlfriend, to your health insurance with specific requirements and documentation.

Is My Girlfriend A Domestic Partner?

To determine if your Girlfriend is a domestic partner, check if you both meet legal criteria.

Can You Add Someone Who Is Not Your Spouse To Your Health Insurance?

Yes, you can add a domestic partner, such as a boyfriend or Girlfriend, to your health insurance. You will typically need to provide documentation of your domestic partnership to your employer.

Can I be added to my Girlfriend’s insurance?

Yes, you can add your Girlfriend to your insurance if you qualify as a domestic partner. Provide your employer with the necessary documentation to recognize your domestic partnership.

Conclusion

Adding a girlfriend to your health insurance can be possible through a domestic partner arrangement. The process may involve providing documentation to your employer. However, the specific requirements can vary based on state regulations and insurance provider policies. It’s important to carefully review the eligibility criteria and follow the necessary procedures when considering this option.