Health Insurance Companies North Carolina: Find the Best Providers for Your Coverage

Health Insurance Companies North Carolina consider Blue Cross Blue Shield and UnitedHealth Group for comprehensive coverage and affordable plans. These companies offer a wide range of options to suit individual and family needs.

Navigating the health insurance landscape in North Carolina can often feel overwhelming. With numerous providers and plans available, it’s essential to understand your options and make an informed decision. Blue Cross Blue Shield of North Carolina and UnitedHealth Group are two of the largest health insurance companies in the state, providing a variety of coverage options to meet diverse needs.

Whether you’re seeking individual, family, or group coverage, these companies offer competitive rates and comprehensive plans to ensure you have access to quality healthcare without breaking the bank. It’s essential to explore and compare the offerings of these reputable insurers to find the best fit for your specific requirements.

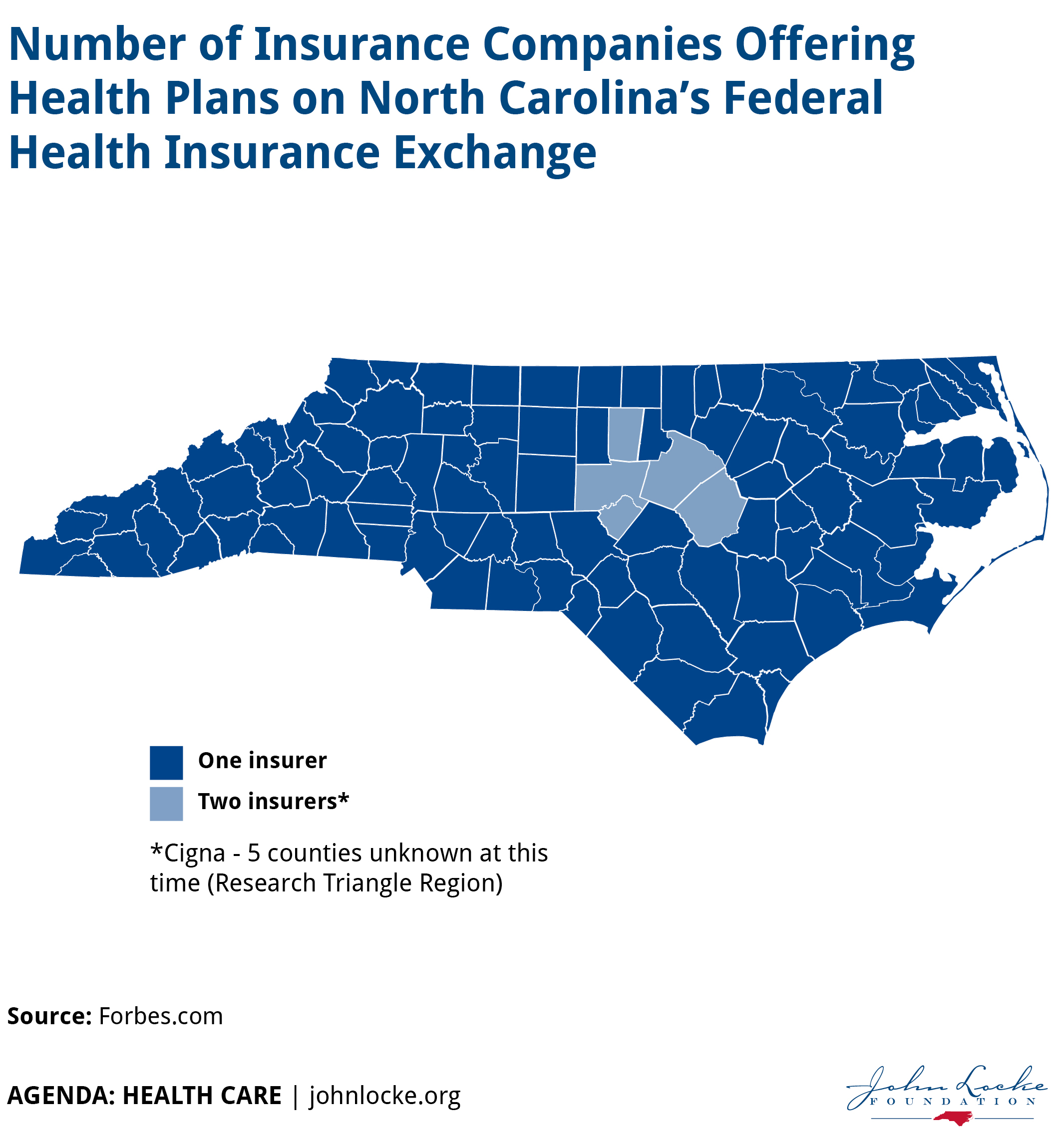

Credit: www.johnlocke.org

Health Insurance Landscape In North Carolina

North Carolina boasts a diverse health insurance landscape, with several significant providers offering a range of coverage options to residents. Understanding the key players in the state’s health insurance market can help individuals make informed decisions about their healthcare needs.

Major Health Insurance Companies In North Carolina

When it comes to health insurance in North Carolina, several prominent companies stand out for their comprehensive coverage and diverse plan options. These significant providers play a crucial role in ensuring residents have access to quality healthcare services.

Comparison Of Top Providers

| Insurance Company | Rating | Contact |

|---|---|---|

| Health Plans of NC | 🌟🌟🌟🌟🌟 | (800) 797-0327 |

| Carolina Health Group | 🌟🌟🌟🌟 | (336) 200-8341 |

| HealthMarkets Insurance – Tyler Wood | 🌟🌟🌟🌟 | (919) 912-4069 |

- Health Plans of NC: Known for its exceptional customer service and range of affordable plans

- Carolina Health Group: Offers comprehensive coverage options tailored to individual needs.

- HealthMarkets Insurance – Tyler Wood: Trusted provider with a focus on personalized insurance solutions

Comparing these top providers can help individuals in North Carolina make an informed decision about their health insurance needs, ensuring they choose a plan that suits their lifestyle and budget.

Credit: eastcaryfamilyphysicians.com

Choosing The Best Health Insurance Provider

Securing the best health insurance provider is a crucial decision that directly impacts your well-being. In North Carolina, numerous health insurance companies are vying for your attention, offering an array of coverage plans and benefits. Navigating through these options requires careful consideration of various factors and informed decision-making. Let’s delve into the key aspects to ponder on when choosing the best health insurance provider in North Carolina.

Factors To Consider

Several factors should influence your decision when selecting a health insurance provider in North Carolina. These factors include:

- Network Coverage and Providers

- Monthly Premiums and Deductibles

- Coverage and Benefits Offered

- Customer Service and Support

- Medication Coverage

- Out-of-Pocket Costs

Tips For Selecting The Right Coverage

Here are some essential tips to help you choose the right coverage:

- Assess Your Healthcare Needs: Understand your specific healthcare needs and those of your family.

- Compare Plans: Research and compare the coverage, benefits, and costs offered by different providers in North Carolina.

- Consider Network Providers: Ensure that your preferred healthcare providers are within the network coverage of the insurance plan.

- Review Customer Feedback: Investigate customer reviews and satisfaction ratings to gauge the quality of customer service and support provided.

- Check Prescription Medication Coverage: If you have regular medications, ensure that the insurance plan covers them.

- Understand Costs: Understand the monthly premiums, deductibles, and out-of-pocket costs associated with the coverage.

Understanding Health Insurance Plans

When it comes to navigating the world of health insurance, it’s essential to have a clear understanding of the different types of plans available and the coverage options in your specific state. In North Carolina, there are a variety of health insurance companies that offer plans to meet the diverse needs of individuals and families. Let’s take a closer look at the types of health insurance plans available and the coverage options in North Carolina.

Types Of Health Insurance Plans Available

Before choosing a health insurance plan, it’s crucial to understand the available different types. In North Carolina, you will find the following types of health insurance plans:

- Health Savings Account (HSA) Plans: These plans allow you to set aside pre-tax money for medical expenses and offer high-deductible health plans.

- Preferred Provider Organization (PPO) Plans: PPO plans allow you to receive care from both in-network and out-of-network providers. However, you’ll typically pay less if you stay within the network.

- Health Maintenance Organization (HMO) Plans: HMO plans require you to receive all your care from a network of providers and typically necessitate a referral to see a specialist.

- Exclusive Provider Organization (EPO) Plans: EPO plans are similar to PPO plans but do not provide coverage for out-of-network care.

- Point of Service (POS) Plans: POS plans combine elements of both HMO and PPO plans, allowing you to see both in-network and out-of-network providers, although out-of-network care will likely cost more.

Coverage Options In North Carolina

In North Carolina, health insurance companies offer a range of coverage options to cater to different needs and budgets. Here are the coverage options you can find in the state:

| Company | Coverage Options |

|---|---|

| Aetna CVS Health | Various plans tailored to individual and family needs |

| Ambetter of North Carolina | Affordable plans with comprehensive coverage |

| AmeriHealth Caritas Next | Plans focused on delivering high-quality care |

| Blue Cross and Blue Shield of NC | Wide range of plans for individuals, families, and businesses |

| Caresource | Plans with a focus on preventive care and wellness programs |

| Cigna Healthcare | Flexible plans with an extensive network of providers |

| Oscar Health Plan of North Carolina, Inc. | Technology-driven plans with personalized care options |

| UnitedHealthcare | A diverse range of plans and coverage options |

These are just a few examples of the health insurance companies and coverage options available in North Carolina. It’s essential to thoroughly research and compare plans to find the one that best meets your specific healthcare needs and budget.

Credit: help.ihealthagents.com

Key Considerations Before Purchasing

When considering health insurance companies in North Carolina, there are several key factors to evaluate before making a decision. Understanding these considerations can help you select the best insurance provider for your needs.

Financial Factors To Evaluate

- Premium Costs: Compare monthly premiums to ensure affordability.

- Deductibles: Understand the amount you’ll have to pay out of pocket before insurance kicks in.

- Co-Payments: Check co-payment amounts for doctor visits or prescriptions.

Network Coverage And Provider Options

It’s crucial to assess the network coverage and provider options offered by health insurance companies in North Carolina before purchasing a plan. Make sure your preferred doctors and hospitals are in-network to avoid extra costs.

Popular Health Insurance Providers In North Carolina

Discover the top health insurance providers in North Carolina, including Blue Cross Blue Shield of North Carolina, UnitedHealthcare, and Cigna Healthcare. Compare plans and find affordable coverage for you and your family.

Blue Cross Blue Shield Of North Carolina

Blue Cross Blue Shield of North Carolina is one of the leading health insurance providers in the state. It offers a range of comprehensive health insurance plans tailored to individuals, families, and businesses. With a strong network of healthcare providers, Blue Cross Blue Shield ensures its members have access to quality medical services. The company is committed to promoting health and wellness, providing coverage for preventive care, and supporting its members in managing chronic health conditions.

UnitedHealthcare

UnitedHealthcare is another prominent player in the North Carolina health insurance market. They prioritize affordability and accessibility, offering diverse health insurance options that cater to different budgetary and healthcare needs. The company leverages innovative technology and data-driven insights to enhance its members’ overall healthcare experience. With a focus on preventive care and personalized support, UnitedHealthcare aims to empower individuals and families to manage their health proactively.

Aetna And Other Leading Companies

In addition to the providers as mentioned above, Aetna and several other leading health insurance companies operate in North Carolina, contributing to the competitive landscape. These companies offer a wide array of plans, including HMOs, PPOs, and high-deductible options, ensuring that consumers have the flexibility to choose coverage that aligns with their unique healthcare requirements.

Navigating The Health Insurance Market

When it comes to choosing health insurance companies in North Carolina, the process can be overwhelming. Understanding the options and finding the right coverage for your needs is crucial. Navigating the health insurance market requires careful consideration and research to ensure you make an informed decision.

Using Online Resources For Comparisons

One of the most convenient ways to navigate the health insurance market is by utilizing online resources for comparisons. Online platforms allow you to compare different plans, coverage options, and prices easily. You can use websites that offer side-by-side comparisons or visit individual insurer websites to gather more information.

Seeking Assistance From Health Insurance Agents

Another valuable approach is seeking assistance from health insurance agents. Agents are knowledgeable professionals who can guide you through the process of selecting the best coverage for your specific needs. They can provide personalized recommendations and help you understand complex insurance terms.

Frequently Asked Questions

What are the Best Health Insurance Companies North Carolina?

Blue Cross Blue Shield of North Carolina offers the best health insurance for North Carolina. They offer a wide range of plans at affordable rates.

What Is The Largest Health Insurance Companies North Carolina?

The largest health insurance company in North Carolina is Blue Cross Blue Shield. They provide comprehensive coverage options.

Who Are The Top 5 Health Insurance Companies North Carolina?

UnitedHealth Group, Anthem, Kaiser Permanente, Ambetter, and Humana are the top 5 health insurance companies.

How Much Is Health Insurance Per Month In North Carolina?

Health insurance in North Carolina can cost about $200 to $600 per month.

Conclusion

In North Carolina, health insurance is critical to managing one’s healthcare needs. Whether you are an individual or a family, finding the right coverage can be daunting. However, you can now make informed decisions by comparing plans from leading insurers.

Remember to prioritize your specific healthcare requirements while choosing a plan.