Health Insurance Explained for Dummies: Your Complete Guide to Understanding Coverage

Health Insurance Explained for Dummies provides financial protection for medical care in case of accident or sickness, covering doctors’ services, medications, hospital care, and special equipment in exchange for a monthly premium. Understanding health insurance is crucial as it offers essential financial protection when illness or injury occurs.

Health insurance operates by pooling clients’ risks, making payments more affordable for the insured through a policy provided by an insurance company. In simple terms, it spreads the risk over a group of people, allowing them to pay a fixed amount every month to cover potential medical expenses.

When selecting health insurance, personal needs, monthly premiums, provider networks, drug formularies, and expected out-of-pocket costs should be considered to find the most suitable plan.

Credit: fyi.extension.wisc.edu

Health Insurance Basics

Health insurance is a contract that provides financial protection for medical expenses. It covers services like doctor visits, hospital bills, and prescription drugs in exchange for a monthly premium. Understanding health insurance basics is essential for anyone looking to choose the right plan.

Definition Of Health Insurance

Health insurance provides financial protection for medical expenses in case of illness or injury. It covers services like doctor visits, medications, hospital stays, and more in exchange for a premium.

Critical Components Of Health Insurance

- Premium: Monthly payment for health coverage.

- Deductible: Amount you pay before insurance kicksCopaymentyment: Fixed amount paid for each service.

- Network: Group of doctors and hospitals covered by the plan.

- Out-of-pocket maximum: Limit on what you pay each year.

Types Of Health Insurance Plans

When it comes to health insurance, it’s essential to understand the different types of plans available. Each type caters to specific needs and preferences, so it’s crucial to choose the one that best suits your circumstances. Let’s dive into the various types of health insurance plans to help you make an informed decision.

Individual Health Insurance

Individual health insurance is a plan that you purchase independently, typically if you’re self-employed or if your employer doesn’t provide coverage. It allows you to personalize your coverage based on your specific needs and preferences, ensuring you have control over the benefits and costs.

Government-sponsored Plans

Government-sponsored health insurance plans are programs established and funded by the government to provide coverage for specific groups of people, such as Medicaid for low-income individuals and families and Medicare for seniors and specific disabled individuals. These plans offer comprehensive coverage at a lower cost, making healthcare accessible to those who may not afford private insurance.

Choosing The Right Plan

When selecting a health insurance plan, consider various factors to ensure it aligns with your needs and budget. Evaluate the monthly premiums, the provider network, drug formulary, and expected out-of-pocket costs to determine which plan suits you best.

How Health Insurance Works

Health insurance is a crucial safety net, providing financial protection in the face of accidents or illnesses. But how does it actually work? Let’s break it down into three key aspects: premiums and deductibles, coverage for medical services, and prescription drug coverage.

Premiums And Deductibles

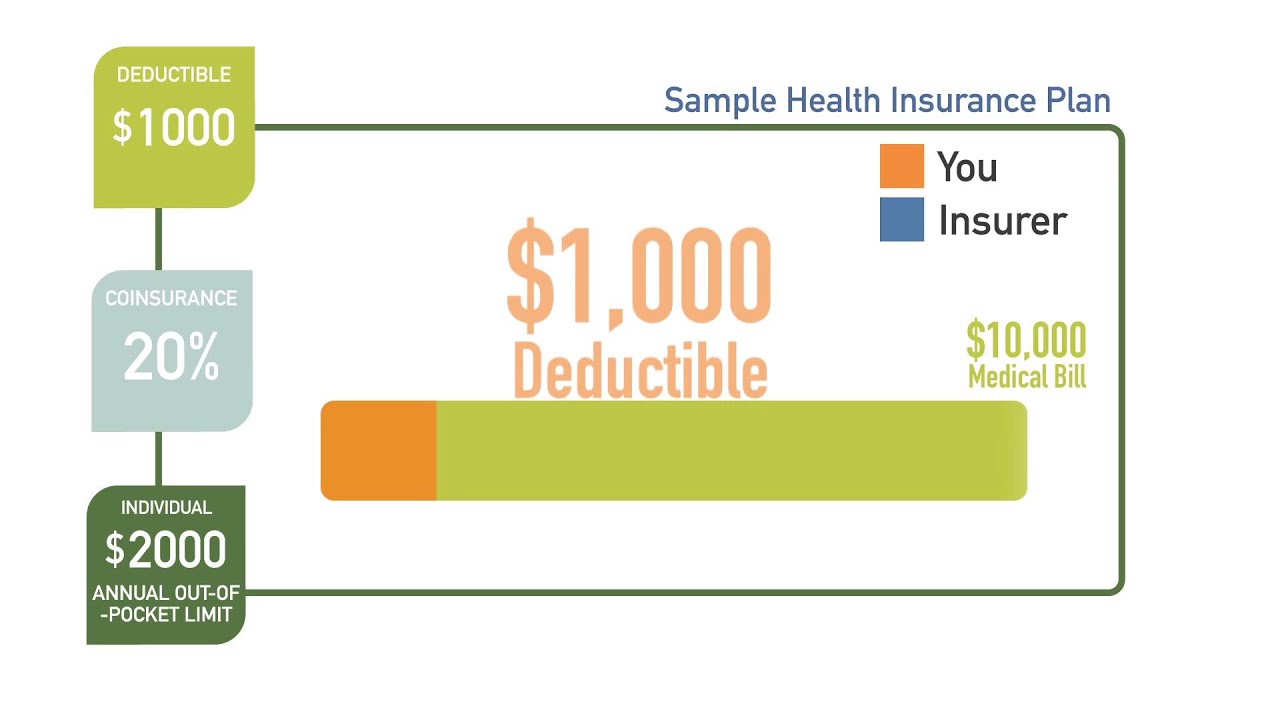

When it comes to health insurance, premiums are like a monthly subscription fee. You pay this amount to your insurance company regardless of whether you receive medical care or not. Think of it as a way to secure your coverage.

On the other hand, deductibles are the amount of money you must pay out of pocket before your insurance starts to kick in. They are like thresholds that you need to cross before your insurance benefits take effect. The higher your deductible, the lower your monthly premiums may be.

For example:

| Plan | Premium | Deductible |

|---|---|---|

| Plan A | $200/month | $2,500 |

| Plan B | $150/month | $5,000 |

In this scenario, Plan A has a higher monthly premium but a lower deductible than Plan B. When choosing the right plan, it’s essential to consider your financial situation and healthcare needs.

Coverage For Medical Services

One of the key benefits of health insurance is the coverage it provides for medical services. This includes doctor visits, hospital stays, surgeries, and preventive care.

It’s essential to understand what services are covered under your insurance plan. Each plan has its list of covered medical services, and it’s crucial to check if specific treatments, procedures, or specialists are included.

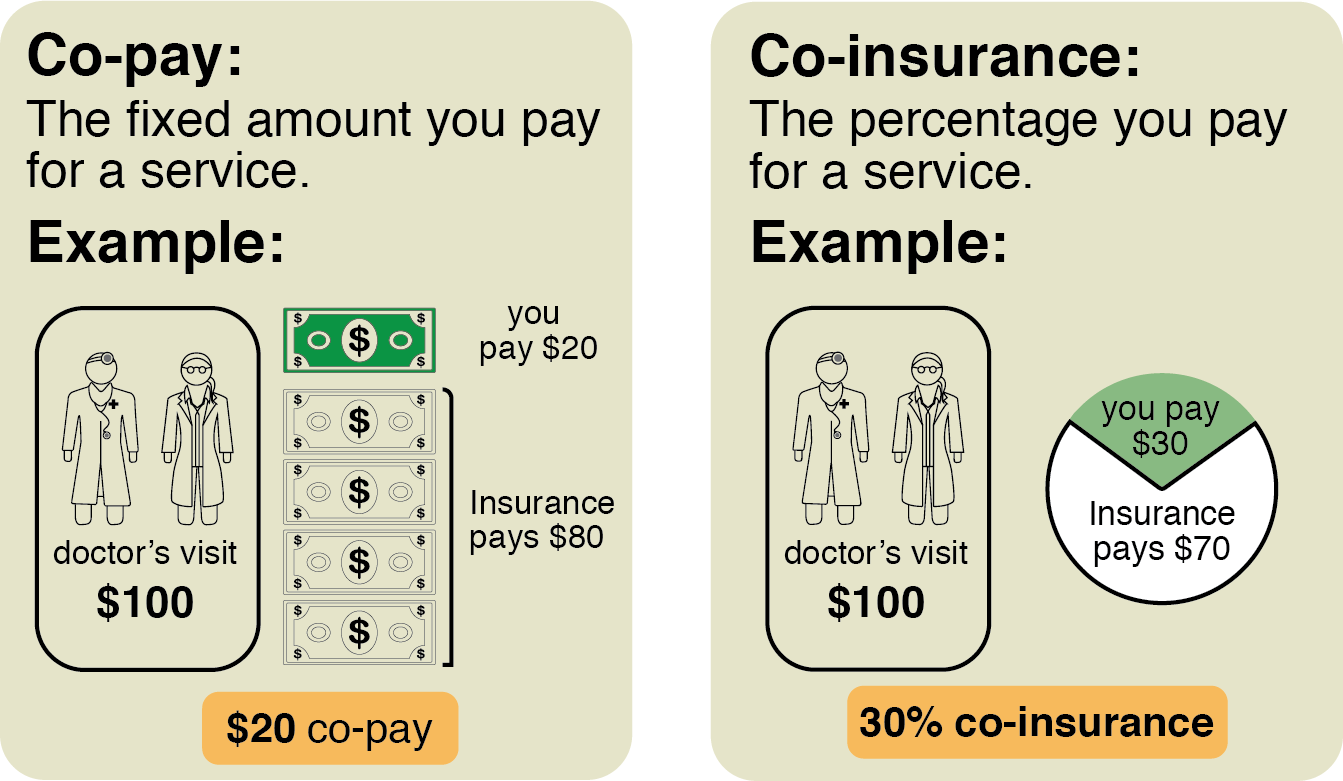

Your insurance plan may have different levels of coverage for various types of medical services. Some procedures may be fully covered, while others may require you to pay a portion of the cost, such as knowcopayments or coinsurance.

Prescription Drug Coverage

Prescription drugs can be a significant expense, and that’s where your health insurance can come to the rescue. Prescription drug coverage is an essential aspect of health insurance, ensuring that you have access to the medications you need.

Similar to medical services, prescription drug coverage can vary between insurance plans. Some plans may have a list of covered drugs, known as a formulary, which categorizes medications into different tiers with varying costs. It’s essential to review the formulary to see if your medications are covered and at what price.

Additionally, some plans may require you to pay a portion of the drug cost, succopaymentsments or coinsurance, while others may offer more comprehensive coverage.

In conclusion, understanding how health insurance works is crucial for making informed decisions about your healthcare coverage. By understanding premiums, deductibles, coverage for medical services, and prescription drug coverage, you can choose the right plan that suits your needs, protects your finances, and ensures access to necessary medical care.

Credit: www.youtube.com

Factors To Consider

Monthly Premiums

Monthly premiums are the amount you pay each month for your health insurance coverage. When assessing the monthly premiums of different plans, be sure to consider your budget.

Provider Networks

Provider networks consist of doctors, hospitals, and other healthcare providers that are contracted with your insurance company. Check if your preferred healthcare providers are in-network to ensure coverage.

Out-of-pocket Costs

Out-of-pocket costs include deductibles and coinsurance that you are responsible for paying. Understanding these costs can help you estimate your total expenses for healthcare services.

When selecting a health insurance plan, evaluate the monthly premiums, provider networks, and out-of-pocket costs to find the best fit for your medical needs and financial situation.

Health Insurance For Different Needs

When it comes to health insurance, it’s essential to understand that different individuals and families have unique needs. Health insurance plans vary based on these unique needs and the level of coverage required. Understanding the options available for other needs is crucial to making an informed decision when choosing a health insurance plan.

Family Coverage

Family coverage

Family health insurance typically provides comprehensive coverage for the entire family. This type of plan usually includes spouses and children and offers a wide range of benefits, including preventive care, maternity care, pediatric services, and more. It’s a cost-effective way to ensure that the entire family has access to necessary medical care.

Individual Coverage

Individual coverage

Individual health insurance plans cater to the needs of a single person. These plans offer personalized coverage and are ideal for individuals who are self-employed, unemployed, or those who do not have access to employer-sponsored health insurance. Individual coverage provides the flexibility to choose a plan that best suits an individual’s specific health needs and budget.

Specialized Plans

Specialized plans

Specialized health insurance plans cater to specific needs, such as dental, vision, mental health, and critical illness coverage. These plans provide focused coverage for particular healthcare needs beyond the scope of standard medical insurance. They can be added as supplemental coverage to enhance overall health insurance benefits.

Credit: www.simplyinsured.com

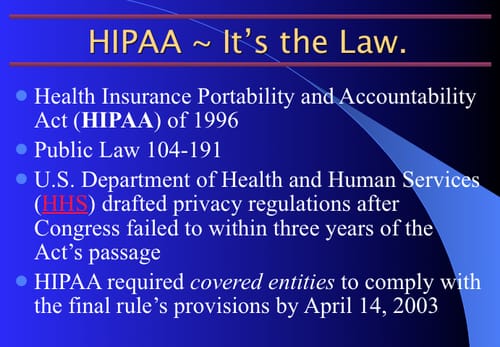

Understanding Policy Terms

Health insurance policies can sometimes be confusing due to the use of specific terms. It’s essential to understand key policy terms to make the most out of your coverage. Let’s break down some crucial terms:

Policy Limits

Policy limits refer to the maximum amount your insurance provider is willing to pay for covered services. Understanding your policy limits is crucial to avoid unexpected out-of-pocket expenses.

Exclusions

Exclusions are services or conditions that are not covered by your health insurance policy. It’s essential to be aware of these exclusions to prevent any surprises when seeking medical treatment.

Claim Process

Knowing the claim process is essential for receiving reimbursement for medical expenses covered by your insurance. Familiarize yourself with the steps involved in submitting a claim to ensure a smooth process.

Frequently Asked Questions

How Does Health Insurance Work In Simple Terms?

Health insurance provides financial protection in case of accidents or illnesses. It helps pay for doctors’ services, medications, hospital care, and special equipment in exchange for a monthly premium. It is a contract between the insured and the insurance company, which pools the risks of many clients to make payments more affordable.

How Do You Health Insurance Explained for Dummies?

Insurance for dummies is a financial protection contract against losses offered by an insurance company. It helps pay for medical services and treatment, reducing the insured’s costs. Depending on individual needs, different plans provide coverage for various expenses like doctor’s fees, hospital bills, and medicine.

How Do You Explain Health Insurance To A Child?

Health insurance helps with medical costs by spreading risk among a group. It covers doctor visits, medicines, and more in exchange for a monthly payment.

What Are 3 Things You Need To Consider When Choosing Your Health Insurance?

When choosing health insurance, consider monthly premiums, provider network, and out-of-pocket costs. Choose a plan that fits your needs and budget.

Conclusion

Understanding the basics of health insurance is crucial for everyone’s well-being. With the right plan, you can protect yourself from unexpected medical expenses and ensure access to necessary healthcare services. As you navigate through the complexities of health insurance, remember to consider your individual needs and budget to make an informed decision.