Health Insurance Metal Levels: Choosing the Right Coverage

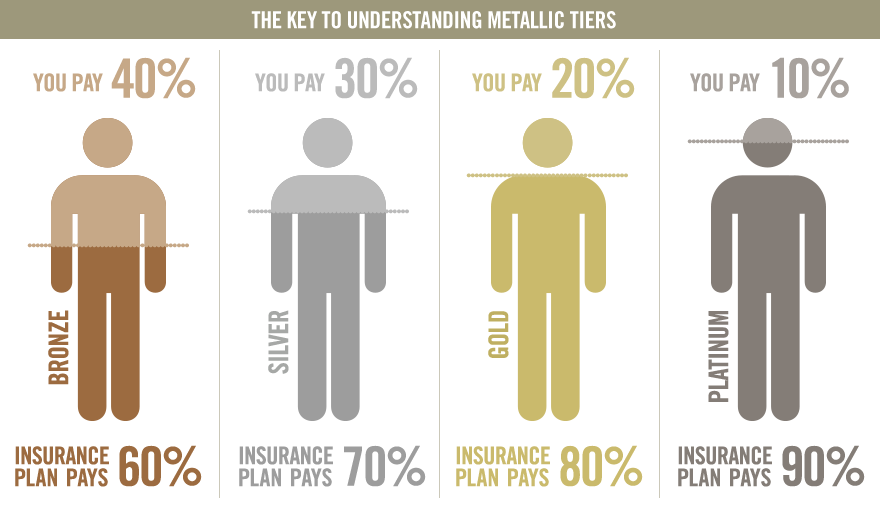

Health insurance metal levels indicate the generosity of plan coverage; higher metal levels pay more. Plans in higher metal categories have higher premiums but lower out-of-pocket care costs, while bronze plans have the lowest monthly premiums but higher care costs.

The metals signal how much the plan covers, affecting monthly premiums and cost-sharing. For example, platPlatinumers have the most coverage, but bronze plans generally have the lowest premiums and highest care costs. When it comes to choosing the right metal level for your health insurance, understanding the relationship between metal tiers and out-of-pocket expenses can help you make an informed decision.

When selecting the appropriate metal level for your health insurance plan, you must carefully consider your healthcare needs and budget.

Understanding Health Insurance Metal Levels

Health Insurance Metal Levels, indicated by bronze, silver, gold, and platPlatinumtermine the plan’s coverage generosity. Higher metal levels come with higher monthly premiums but lower out-of-pocket costs when you need medical care. Understanding these metal levels helps you choose the right level of coverage for your health insurance needs.

What Do Health Insurance Metal Levels Signify?

Health insurance metal levels indicate the coverage generosity of a plan. Higher metal levels offer more coverage.

Role Of Metal Tiers In Health Insurance

Metal tiers affect your monthly premiums and out-of-pocket costs. Higher metal tiers mean lower costs when you need care.

Health Plan Categories Based On Metal Levels

Health plans are categorized into Bronze, Silver, Gold, and Platinum based on metal levels. Each tier offers varying levels of coverage and costs.

Choosing The Right Coverage

Understanding the metal levels is crucial when selecting the appropriate health insurance coverage. Health insurance metal levels, represented by Bronze, Silver, Gold, and Platinum, determine the cost-sharing and coverage provided by the plan. Choosing the right metal level is essential for balancing monthly premiums and out-of-pocket expenses. It directly impacts the financial aspect of healthcare and influences the overall quality of care. Here are critical factors to consider when choosing metal levels and the relationship between metal tiers and premiums.

Factors To Consider When Choosing Metal Levels

1. Financial Situation: Assess your monthly budget and potential out-of-pocket expenses to determine the affordability of different metal levels.

2. Healthcare Needs: Consider your current health condition, expected medical expenses, and the frequency of doctor visits or prescriptions.

3. Risk Tolerance: Based on your medical history and likelihood of requiring medical care, evaluate your willingness to pay higher monthly premiums for lower out-of-pocket expenses or vice versa.

4. Quality of Care: Research and compare the coverage benefits offered by each metal level, including access to preferred providers and essential healthcare services.

5. Lifestyle Factors: Factor in any lifestyle habits or activities that may increase the probability of requiring specialized medical treatment or emergency care.

Relationship Between Metal Tiers And Premiums

The mental tier of the chosen plan directly influences health insurance premiums. As the metal category ascends from Bronze to Platinum, monthly premiums typically increase. Conversely, lower metal tiers entail lower monthly premiums but higher out-of-pocket expenses when medical care is needed.

The structure of metal tiers offers individuals the flexibility to choose a plan that aligns with their financial capabilities and healthcare needs. Selecting the appropriate metal level involves striking a balance between monthly premiums and potential out-of-pocket costs to ensure comprehensive coverage without incurring excessive financial strain.

Comparison Of Metal Levels

When it comes to health insurance, understanding the mental levels is crucial for choosing the right plan. Health insurance metal levels, which include bronze, silver, gold, and platPlatinumtermine the coverage and out-of-pocket costs of the plan. Let’s take a closer look at each metal level and compare their coverage levels and out-of-pocket costs.

Coverage Levels: Bronze, Silver, Gold, Platinum

Each metal level represents a different level of coverage. Here is a breakdown of what each level entails:

| Metal Level | Coverage |

|---|---|

| Bronze | The lowest level of coverage |

| Silver | Moderate coverage |

| Gold | High coverage |

| Platinum | The highest level of coverage |

As you can see, bronze plans offer the least coverage, while platinum plans offer the most comprehensive coverage.

Out-of-pocket Costs Across Metal Tiers

In addition to coverage levels, metal tiers also have an impact on your out-of-pocket costs. Here’s a comparison of the out-of-pocket expenses you can expect across different metal tiers:

- Bronze: Bronze plans typically have the lowest monthly premiums but the highest out-of-pocket costs. This means that while you’ll pay less upfront, you may have to cover higher expenses when you require medical care.

- Silver: Silver plans strike a balance between monthly premiums and out-of-pocket costs. They offer moderate coverage and moderate expenses when you need care.

- Gold: Gold plans have higher monthly premiums but lower out-of-pocket costs. So, you’ll pay more upfront, but your cost-sharing will be reduced.

- Platinum: Platinum plans come with the highest monthly premiums but the lowest out-of-pocket costs. This means that while you’ll pay more each month, your expenses when using medical services will be significantly lower.

When choosing a metal level, consider your healthcare needs and budget. If you anticipate needing frequent medical care, a platinum or gold plan may be worth the higher upfront cost. On the other hand, if you’re generally healthy, a bronze or silver plan with lower premiums could be a more affordable option.

Now that you have a better understanding of the mental levels and how they impact coverage and costs, you can make a more informed decision when selecting a health insurance plan.

Credit: www.google.com

Understanding Bronze Level Plans

Bronze-level plans are one of the options available in health insurance metal tiers. These plans offer the lowest level of coverage, making them an affordable choice for those who are generally healthy and don’t anticipate needing extensive medical care. In this section, we will explore the characteristics of bronze plans as well as their drawbacks and benefits.

Characteristics Of Bronze Plans

Bronze plans are known for their lower monthly premium costs compared to higher metal-tier plans. This makes them an attractive option for individuals and families looking to save on their health insurance expenses. However, it’s important to note that these plans also come with higher out-of-pocket costs when you need medical care.

Here are some critical characteristics of bronze plans:

- Lowest monthly premium costs among all metal levels.

- Higher deductibles compared to plans in higher metal tiers.

- Higher cost-sharing means you will likely have to pay more for services such as copayments, coinsurance, and deductibles.

- Typically, bronze plans have a higher maximum out-of-pocket limit, which is the maximum amount you will need to pay for covered medical expenses in a year.

- Offer a vast network of doctors and hospitals, ensuring you have access to a range of healthcare providers.

Despite their higher out-of-pocket costs, bronze plans can still provide essential coverage for preventive care services, such as vaccinations and screenings. These plans may also cover some primary care visits and generic prescription drugs.

Drawbacks And Benefits Of Bronze Plans

While bronze plans have their advantages in terms of lower monthly premiums, it’s essential to consider the drawbacks and benefits before making a decision.

Drawbacks:

- Higher out-of-pocket costs: Bronze plans typically require you to pay more when you need medical care, including higher deductibles and copayments.

- Limited coverage for non-preventive care: These plans may have limited coverage for services such as specialist visits, brand-name prescription drugs, and hospital stays.

- Higher maximum out-of-pocket limit: Bronze plans often have a higher maximum limit on how much you may have to pay for covered services in a year.

Benefits:

- Affordability: Bronze plans have lower monthly premiums compared to higher metal tier plans, making them an economical choice for individuals and families.

- Access to a network of providers: These plans often offer a vast network of doctors and hospitals, ensuring you have options for your healthcare needs.

- Essential preventive care coverage: Bronze plans typically cover preventive care services, such as vaccinations, screenings, and certain primary care visits.

It’s essential to evaluate your healthcare needs and budget before choosing a bronze plan. If you are generally healthy and do not anticipate needing extensive medical care, a bronze plan may be a suitable option. However, if you have ongoing medical conditions or require frequent healthcare services, it may be worth considering plans in higher metal tiers that offer more comprehensive coverage.

Silver Vs. Gold Plans

When it comes to health insurance metal levels, two popular options are silver and gold plans. These metal levels determine the coverage and costs of your health insurance plan. Understanding the differences between silver and gold plans can help you make the right decision for your healthcare needs.

Comparison Of Coverage And Costs

Let’s take a closer look at how coverage and costs differ between silver and gold plans:

| Coverage | Costs | |

|---|---|---|

| Silver Plans | Offers moderate coverage | Higher out-of-pocket costs |

| Gold Plans | Offers high coverage | Lower out-of-pocket costs |

As you can see, silver plans provide moderate coverage, making them suitable for individuals who require regular medical care. While they come with higher out-of-pocket costs, they balance it out with lower monthly premiums. On the other hand, gold plans offer high coverage, making them ideal for individuals who anticipate needing more extensive medical care. With gold plans, you’ll have lower out-of-pocket costs but higher monthly premiums.

When To Opt For Silver Over Gold Plans

Choosing between a silver and gold plan depends on your unique healthcare needs and financial situation. Here are a few scenarios when opting for a silver plan may be a better choice:

- You visit your doctor regularly and require routine check-ups and preventive care.

- You have ongoing medical conditions that require regular medication or treatment.

- You want to keep your monthly premium costs lower.

- You are comfortable with higher out-of-pocket costs when you need medical care.

By opting for a silver plan, you can strike a balance between coverage and costs, ensuring that you have access to essential healthcare services without breaking the bank.

Platinum Level In Detail

The Platinum level of health insurance plans is known for its comprehensive coverage and excellent benefits. Let’s delve into the details of Platinum plans to understand their features, advantages, and considerations for choosing them.

Features And Advantages Of Platinum Plans

- Extensive Coverage: Platinum plans offer the highest level of coverage among all metal tiers, providing robust protection for your healthcare needs.

- Low Out-of-Pocket Costs: Platinum plans offer lower out-of-pocket expenses when accessing medical services, making them ideal for individuals who require frequent healthcare services.

- Rich Benefits: These plans often come with comprehensive benefits, including coverage for services like preventive care, prescription drugs, and specialist visits.

Considerations For Choosing Platinum Coverage

- Healthcare Needs: If you anticipate needing regular medical care or have pre-existing conditions, a Platinum plan can provide the extensive coverage you require.

- Financial Situation: While PlatPlatinumns offers comprehensive coverage, they also come with higher monthly premiums. Consider your budget and ability to pay these premiums regularly.

- Value vs. Cost: Evaluate the value you place on lower out-of-pocket costs and comprehensive coverage against the higher premium costs associated with Platinum plans.

Impact Of Metal Tiers On Healthcare Costs

Health insurance metal levels, categorized into Bronze, Silver, Gold, and Platinum, directly influence healthcare costs. The mental tier of a health insurance plan determines the balance between monthly premiums and out-of-pocket expenses when receiving medical care.

Cost-sharing Structure In Different Metal Tiers

The cost-sharing structure varies across different metal tiers:

| Metal Tier | Cost-Sharing |

|---|---|

| Bronze | Lowest monthly premium but higher out-of-pocket costs |

| Silver | Moderate monthly premium and moderate out-of-pocket costs |

| Gold | Higher monthly premium but lower out-of-pocket costs |

| Platinum | Highest monthly premium with lowest out-of-pocket costs |

Premium Tax Credits And Cost-reduction Schemes

- Premium Tax Credits: Financial assistance is available for individuals with lower incomes to reduce monthly premium payments.

- Cost-Reduction Schemes: Additional support that lowers out-of-pocket expenses like deductibles and copayments for eligible individuals.

Credit: google.com

Aca Metal Levels And Regulations

Understanding the Affordable Care Act (ACA) metal levels is crucial when it comes to health insurance. These mental tiers determine the coverage and cost-sharing levels of health plans. Compliance with ACA guidelines ensures that health insurance plans adhere to specific standards set by the ACA. In this post, we will provide an overview of ACA metal tiers and discuss compliance with ACA guidelines.

Overview Of Aca Metal Tiers (bronze, Silver, Gold, Platinum)

Health insurance plans are categorized into four metal levels: Bronze, Silver, Gold, and Platinum. Each metal level represents a different level of coverage and cost-sharing. These metal tiers help consumers compare plans and choose the one that best suits their healthcare needs.

Compliance With Affordable Care Act Guidelines

The Affordable Care Act stipulates guidelines that health insurance plans must adhere to, ensuring that they provide comprehensive coverage to consumers. Compliance with these guidelines is essential for insurance plans to be eligible for inclusion in the health insurance marketplace.

Credit: mnjinsurance.com

Frequently Asked Questions

What Does Metal Level Mean In Health Insurance?

Metal level in health insurance indicates the plan’s generosity. Higher metal levels provide better coverage but higher premiums.

What Is The Relationship Between Metal Tiers And Health Insurance Premiums?

Higher metal tiers increase health insurance premiums, offering lower medical care costs. Lower tiers entail lower premiums but higher medical costs.

What Role Do Metals Play In Health Insurance?

Metals play a role in health insurance by indicating the level of coverage and cost-sharing. Bronze plans have the lowest premiums but higher costs when you need care, while platinum plans have the highest coverage. Premiums generally increase with higher metal levels.

What Plan Metal Has The Highest Out-of-pocket Costs?

The Platinum metal plan has the highest out-of-pocket costs, with the most expensive coverage.

Conclusion

Understanding the metal levels in health insurance is crucial for making informed decisions. The metal category determines the coverage level and impacts the monthly premiums and out-of-pocket costs. When choosing a plan, individuals should evaluate their healthcare needs and financial capabilities to select the most suitable mental level for their circumstances.