Ohio Small Business Health Insurance: The Ultimate Guide to Affordable Coverage

Ohio small business health insurance is primarily obtained through employers who may offer voluntary coverage for employees. Employers in Ohio are not legally required to provide health insurance for their employees.

However, many businesses offer coverage as a benefit to attract and retain top talent. Understanding the options and requirements for small business health insurance in Ohio is crucial for employers and employees to ensure access to affordable and comprehensive healthcare coverage.

Various insurance carriers and programs in Ohio cater to the needs of small businesses, offering options like group health insurance plans and SHOP coverage through Healthcare. gov marketplace. By exploring these options, business owners can find the best health insurance solution that meets the needs of their workforce while staying compliant with state regulations.

Credit: www.nuviasmiles.com

Challenges Of Securing Health Insurance

Securing adequate health insurance for small businesses in Ohio is fraught with challenges, leaving entrepreneurs and business owners navigating a complex landscape marked by steep costs and limited options. Ohio’s small business community faces considerable challenges in providing affordable and comprehensive health insurance coverage for their employees, often grappling with the high costs of coverage and a scarcity of viable options.

High Costs Of Coverage

The soaring expenses associated with obtaining health insurance for small businesses in Ohio are a prominent obstacle. The substantial financial burden of providing comprehensive coverage for employees constrains many small business owners, posing a barrier to offering competitive benefits packages. The exorbitant costs associated with health insurance perpetuate the struggle of Ohio small businesses to remain sustainable while ensuring the well-being of their workforce.

Limited Options For Small Businesses

Small businesses in Ohio encounter a shortage of options for securing health insurance for their employees. The limited availability of plans tailored to the unique needs of small enterprises contributes to the complexity of navigating the state’s healthcare landscape. This scarcity hampers businesses in their quest to identify suitable coverage that aligns with their financial capabilities while meeting the diverse healthcare needs of their employees.

Available Health Insurance Plans

When considering health insurance options for your small business in Ohio, it’s essential to be aware of the available plans that cater to the needs of both individuals and small business owners. Ohio offers a range of health insurance plans designed to provide coverage and support to different categories of individuals and businesses. Below are some of the primary health insurance plans available in Ohio:

Individual Health Plans

Individual health plans in Ohio cater to the needs of self-employed individuals or those who do not have access to employer-sponsored health insurance. These plans cover individuals and families, offering various options for different needs and budgets.

Small Business Health Options Program (shop)

The Small Business Health Options Program (SHOP) in Ohio is designed to help small businesses provide health insurance to their employees. This program allows employers to compare and select from a range of healthcare coverage options, making it easier to find cost-effective plans that meet the business’s and its employees’ needs.

Benefits Of Providing Health Insurance

Attracting Top Talent

Offering health insurance can attract skilled professionals.

Improving Employee Retention

Health coverage enhances staff loyalty and satisfaction.

Legal Requirements And Regulations

Ohio small business health insurance allows employers to offer coverage to their employees and their dependents, but it is not a legal requirement. Anthem and eHealth are resources that can help small businesses find cost-saving coverage options.

Understanding the available options and considering your employees’ needs to keep them healthy and happy is essential.

Affordable Care Act Compliance

Small businesses in Ohio must ensure that they meet specific requirements to comply with the Affordable Care Act (ACA) provisions. The ACA, also known as Obamacare, includes provisions to provide affordable health insurance options to individuals and businesses. As per the ACA, small businesses with 50 or more full-time equivalent employees must offer their employees health insurance coverage.

Additionally, small businesses with fewer than 50 full-time employees are not required by law to offer health insurance to their employees. However, they may still choose to do so to attract and retain top talent and provide valuable benefits. It’s essential for small businesses to carefully consider the impact of not offering health insurance, as it can affect employee satisfaction, recruitment efforts, and overall productivity.

State-specific Regulations

In addition to federal regulations, Ohio has its rules that businesses must comply with when offering health insurance to their employees. These regulations may vary depending on the business size and the coverage type chosen. Small businesses must be aware of these state-specific regulations to ensure that they remain in compliance.

One vital regulation to note is that Ohio has no specific laws requiring employers to offer health insurance to their employees. This means that it is solely at the employer’s discretion whether or not to provide coverage. However, suppose an employer does offer health insurance. In that case, there are specific regulations they must adhere to, such as providing equal access to coverage for all eligible employees and complying with non-discrimination laws.

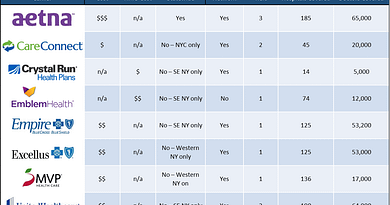

Additionally, Ohio provides specific options for small businesses to obtain health insurance coverage. For instance, small businesses can explore options through private insurers, such as Anthem, Aetna, and Ambetter. Resources such as the Ohio Chamber of Commerce Health Benefits Program, which offers self-funded Multiple Employer Welfare Arrangement (MEWA) plans, are also available.

In conclusion, small businesses in Ohio must navigate both federal and state regulations to offer health insurance to their employees. Understanding the requirements of the Affordable Care Act and the state-specific regulations is crucial to ensuring compliance and providing valuable benefits to employees.

Factors To Consider When Choosing A Plan

Factors to Consider When Choosing a Plan:

Cost Vs. Coverage

When selecting a small business health insurance plan in Ohio, it’s crucial to balance the plan’s cost with the coverage it provides. Evaluate the premiums, deductibles, and out-of-pocket expenses against the benefits and services offered.

Network Providers

Another critical factor to consider is the network providers included in the plan. Ensure that the plan offers access to a vast network of doctors, specialists, and hospitals in Ohio to provide comprehensive healthcare options for your employees.

Credit: store.nolo.com

How To Save Costs On Health Insurance

When running a small business in Ohio, finding affordable health insurance options for your employees is crucial. Fortunately, there are ways to save costs on health insurance while still providing quality coverage. This article will explore two effective strategies: implementing wellness programs and comparing multiple quotes.

Wellness Programs

Implementing wellness programs in your small business can significantly reduce healthcare costs. These programs promote healthy habits, preventive care, and overall well-being among your employees. By encouraging regular exercise, healthy eating, and stress management, you can help prevent chronic health conditions and reduce the need for expensive medical treatments.

Here are some key features of wellness programs that can contribute to cost savings:

- Health screenings and assessments: Regular health check-ups can help identify potential health issues early on, allowing for prompt intervention and preventing expensive treatments.

- Smoking cessation programs: Offering support and resources for employees who want to quit smoking can lead to significant healthcare cost savings, as smoking-related diseases are known to be expensive to treat.

- Health education and awareness campaigns: By promoting health literacy and providing information on preventive measures, employees can make informed decisions about their health, reducing the need for medical interventions.

Comparing Multiple Quotes

Another effective way to save health insurance costs is by comparing quotes from different insurance providers. Doing so lets you find the best coverage and affordability for your small business. Here’s how you can go about it:

- Assess your needs: Start by determining the specific healthcare needs of your employees. Consider age, existing health conditions, and desired coverage options.

- Research insurance providers: Look for reputable health insurance providers in Ohio that offer coverage for small businesses. Please pay attention to their network of healthcare providers, coverage options, and pricing.

- Request quotes: Contact each insurance provider and request quotes based on your business’s needs. Provide accurate and detailed information to get accurate quotes.

- Compare the quotes: Once you receive the quotes, compare them side by side to identify the most cost-effective option that meets your employees’ healthcare needs.

- Negotiate and customize: Don’t hesitate to negotiate with insurance providers to customize your coverage further. This may include adjusting deductibles, co-pays, and coverage limits to save costs without compromising on benefits.

By implementing wellness programs and comparing multiple quotes, you can save costs on health insurance for your small business in Ohio while ensuring your employees have access to quality healthcare. Remember, taking proactive steps to promote employee well-being and making informed decisions about insurance providers can lead to significant cost savings and a healthier workforce.

Navigating Enrollment Periods

Understanding the enrollment periods for small business health insurance in Ohio is crucial for employers and employees alike. Awareness of the specific details of open and special enrollment periods ensures you can make informed decisions about your coverage.

Open Enrollment Period

The open enrollment period is the designated timeframe for small businesses to enroll in or change their health insurance plans without needing a qualifying event. In Ohio, this period typically runs from November 1st to December 15th each year. This is a suitable time for small business owners to compare available plans, assess their needs, and select the most appropriate coverage for their employees.

Special Enrollment Period

The particular enrollment period allows for the enrollment or modification of health insurance plans outside the annual open enrollment window. Small business owners and employees may qualify for a specific period of enrollment if they experience certain life events, such as marriage, the birth of a child, or loss of other health coverage. It’s important to note that eligibility for special enrollment periods is contingent upon meeting specific criteria.

Credit: hsaforamerica.com

Seeking Professional Guidance

Consulting Insurance Brokers

When navigating the complex world of small business health insurance in Ohio, consulting insurance brokers can be an invaluable asset. Brokers’ expertise and experience can help small business owners find the most suitable health insurance plans for their employees. Brokers can provide personalized guidance and recommendations, considering each business’s specific needs and budget constraints.

Utilizing Small Business Health Options

Utilizing the Small Business Health Options (SHOP) marketplace allows Ohio small business owners to explore a range of health insurance plans tailored to their employees’ needs. SHOP provides a convenient platform for comparing different insurance options and making informed decisions. Small business owners can leverage the resources available through SHOP to find affordable and comprehensive health insurance coverage for their workforce.

Frequently Asked Questions Of Ohio Small Business Health Insurance

How Much Is Health Insurance Per Month In Ohio?

In Ohio, health insurance costs vary, but on average, they can range from $300 to $600 monthly.

Do Employers Have To Pay Health Insurance In Ohio?

Employers in Ohio are not legally required to provide health insurance to their employees. However, many employers do offer health insurance coverage voluntarily. It’s essential to check with your employer about the coverage options that are available.

Does Ohio Have A Tax Penalty For No Health Insurance?

Yes, Ohio has a tax penalty for not having health insurance.

How To Get Free Health Insurance In Ohio?

To get free health insurance in Ohio, you may qualify for Medicaid coverage if you are a U.S. citizen or meet Medicaid non-citizen requirements, have low income, are pregnant, a child, an older adult, or have a disability. Employers in Ohio are not required by law to offer health insurance.

Conclusion

In Ohio, small businesses have various health insurance options to provide employee coverage. Anthem and eHealth offer cost-effective solutions to keep employees healthy. Understanding employer insurance’s voluntary aspects is vital, as Ohioans typically get coverage through their employers. Explore different carriers for the best Ohio small business health insurance.