Third Party Administrator Health Insurance: Maximizing Benefits and Efficiency

Third Party Administrator Health Insurance is an organization that handles administrative and operational tasks for an insurance plan, including claims processing, customer enrollment, premium collection, and compliance with federal regulations. In the complex landscape of health insurance, third-party administrators (TPAs) serve a crucial role in managing the administrative and operational aspects of insurance plans.

These organizations handle tasks such as processing claims, enrolling customers, collecting premiums, and ensuring compliance with regulatory requirements. TPAs are often outsourced by insurance companies and self-insured companies, providing essential services in claims processing and employee benefits management. As the healthcare industry continues to evolve, understanding the role of TPAs is necessary for both insurance providers and policyholders to navigate the complexities of health insurance effectively.

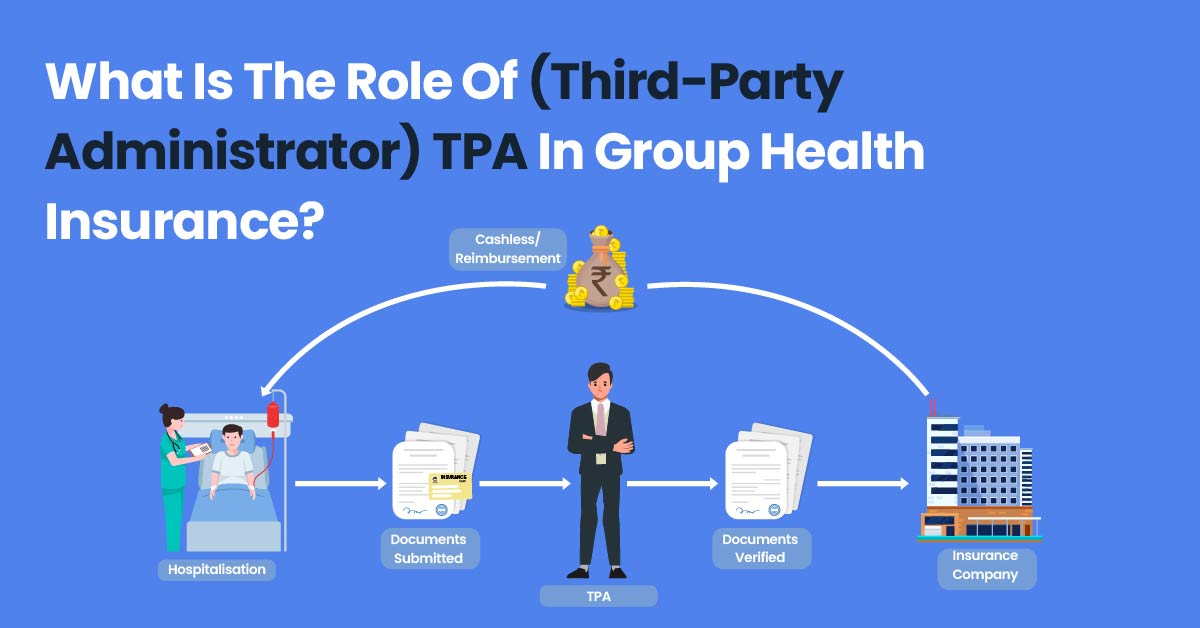

Credit: www.plancover.com

Role Of Third-party Administrators

Third-party administrators play a crucial role in managing various aspects of health insurance plans. From claims processing to employee benefits management, TPAs handle essential functions that help ensure the smooth operation of health insurance policies.

Claims Processing

Claims processing is a vital task undertaken by third-party administrators. They review and evaluate insurance claims submitted by policyholders, verifying the information and ensuring that the claims meet the policy guidelines.

Employee Benefits Management

Employee benefits management is another critical responsibility of TPAs. They oversee the administration of employee benefits such as health insurance coverage, retirement plans, and other perks provided by the employer.

Credit: collectivehealth.com

Importance Of Third-party Administrators

A third-party administrator (TPA) plays a crucial role in managing the administrative and operational aspects of health insurance plans. TPAs handle diverse tasks, such as claims processing, enrollment, premium collection, and ensuring compliance with regulations, thus providing essential support to insurance companies and self-insured businesses.

Efficiency In Claim Processing

Streamlined processes and specialized expertise enable TPAs to efficiently process and settle claims, ensuring a smooth and timely experience for policyholders. With their in-depth knowledge of insurance regulations and procedures, TPAs facilitate prompt and accurate claim adjudication, promoting customer satisfaction and trust in the insurance plan.

Cost Savings For Companies

Outsourcing administrative functions to a TPA can significantly reduce operational costs for insurance companies and businesses. By leveraging the TPA’s expertise and resources, organizations can avoid the need for extensive in-house administrative infrastructure and personnel, leading to cost savings and increased operational efficiency.

Benefits Of Third-party Administrators in Health Insurance

Third-party administrators (TPAs) in health insurance offer various benefits, such as efficient claim processing, customer enrollment, premium collection, and compliance with regulations. TPAs handle administrative and operational tasks, allowing insurance companies and self-insured companies to outsource their claims processing and employee benefits management with a streamlined and cost-effective approach.

Enhanced Customer Experience

A third-party administrator (TPA) plays a crucial role in providing an enhanced customer experience in the field of health insurance. By taking over administrative and operational work, TPAs simplify the insurance process for customers, ensuring they receive the support they need throughout their healthcare journey.

With TPA handling tasks such as claims processing, enrolment, premium collection, and compliance with regulations, customers can focus on their well-being instead of dealing with paperwork and administrative hassles. TPAs streamline the entire insurance process, making it more efficient and convenient for customers.

Digital Transformation Of Operations

One significant benefit of engaging a third-party administrator for health insurance is their expertise in the digital transformation of operations. TPAs leverage technology to optimize and automate processes, resulting in faster response times, improved accuracy, and reduced operational costs.

Through digital platforms and tools, TPAs enable seamless communication between insurance providers, healthcare providers, and customers. This digital integration ensures a smoother flow of information, enhances efficiency and reduces the chances of errors.

With a focus on leveraging artificial intelligence and other advanced technologies, TPAs can provide innovative solutions to make the insurance process more transparent and customer-friendly. Digital transformation allows for real-time updates, personalized communication, and easy access to information, ultimately enhancing the overall customer experience.

Types Of Services Offered By Third-party Administrators

In the realm of health insurance, third-party administrators (TPAs) play a crucial role in streamlining various administrative processes for insurance plans. Let’s delve into the specific services they offer:

Claims Settlement

One of the primary functions of TPAs is the efficient settlement of claims. This involves verifying and processing documents submitted by policyholders, ensuring the smooth flow of reimbursements or cashless transactions. TPAs play a pivotal role in facilitating timely claim settlement and maintaining transparency throughout the process.

Premium Collection

TPAs are also responsible for collecting premiums from policyholders. They ensure that premiums are collected promptly and accurately, thereby contributing to the financial stability of the insurance plans. This streamlined premium collection process helps sustain the overall health insurance system.

Selection Criteria For Third-party Administrators

Third-party administrators for health insurance are selected based on their ability to process claims efficiently, enrol customers, collect premiums, and comply with federal regulations. These organizations play a crucial role in managing the operational work for insurance plans, ensuring smooth and efficient processes for both insurers and policyholders.

Industry Experience

When selecting a third-party administrator for your health insurance plan, one of the most crucial criteria to consider is their industry experience. The third-party administrator should have a proven track record and extensive experience in managing health insurance plans. They should be well-versed in the complexities of the healthcare industry, including regulations, compliance, and the latest trends.

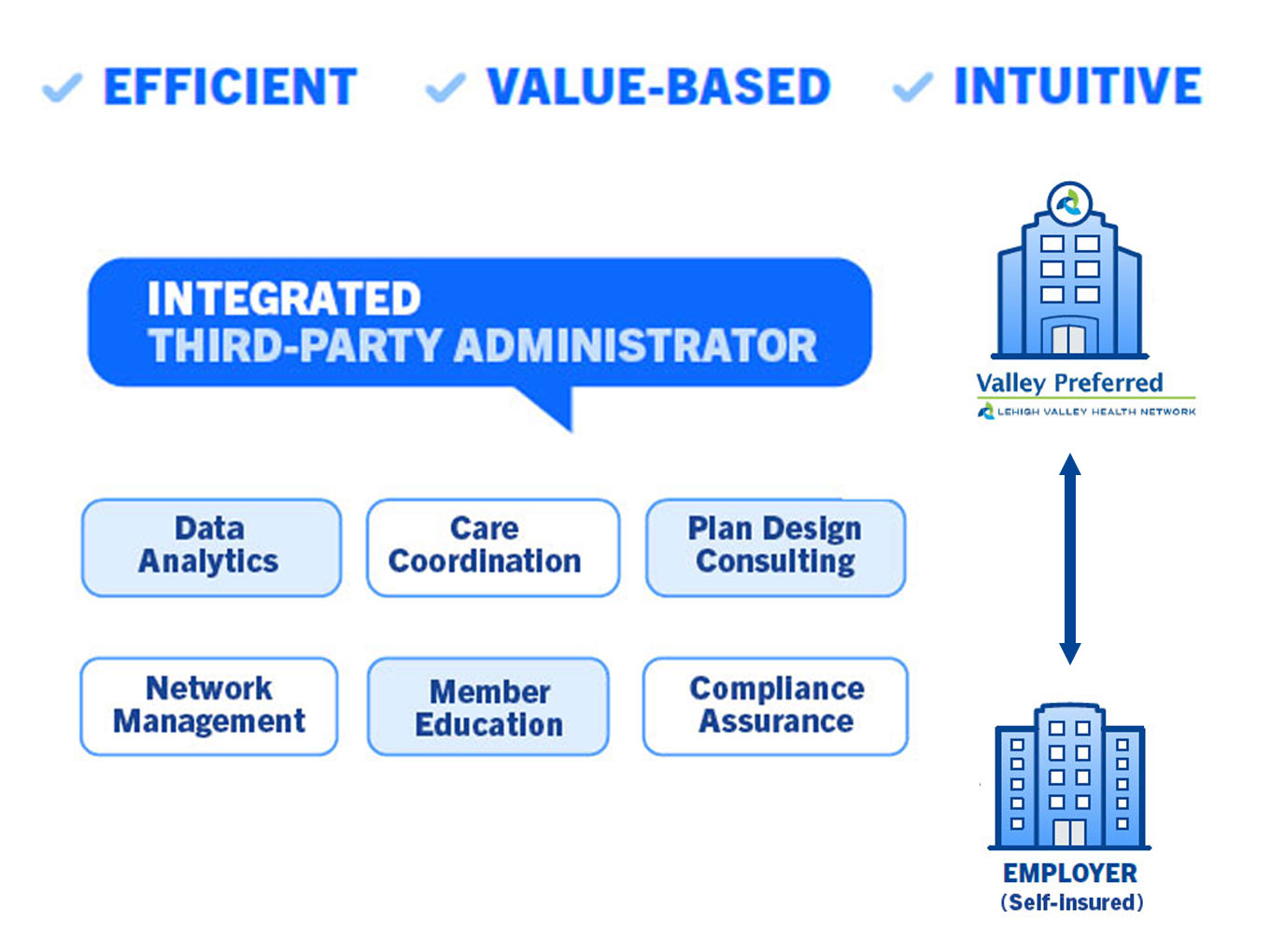

Technology Integration

Another essential aspect to evaluate when choosing a third-party administrator is their level of technology integration. In today’s digital age, the administrator must have robust technological capabilities to streamline processes, enhance efficiency, and provide a seamless experience for both insurers and insured individuals. They should have a user-friendly online platform that allows for easy online enrollment, claim submission, and real-time access to relevant information.

Moreover, the third-party administrator should employ advanced data analytics tools to monitor claims, identify cost-saving opportunities, and deliver actionable insights. By leveraging technology, they can streamline administrative tasks, reduce errors, and expedite claim processing, ultimately improving overall operational efficiency.

Conclusion

When selecting a third-party administrator for your health insurance plan, it is crucial to consider their industry experience and level of technology integration. An experienced administrator with a deep understanding of the healthcare industry can help navigate the complexities of the system, ensuring compliance and delivering optimal results. Additionally, a technologically advanced administrator can streamline processes, enhance efficiency, and provide a seamless experience for both insurers and insured individuals.

Case Studies

Case studies showcase how Third Party Administrators manage health insurance operations efficiently, including claims processing and benefits management. These real-life examples highlight the crucial role TPAs play in ensuring seamless and compliant insurance administration for businesses.

Optimizing Claim Settlement Processes

Improving Operational Efficiency

Discover how third-party administrator health insurance benefits companies.

Future Trends In Third-party Administration

As the landscape of healthcare administration continues to evolve, various trends are shaping the future of third-party administrators. From the integration of Artificial Intelligence to the expansion into new insurance sectors, these trends are poised to revolutionize how TPAs operate and deliver their services effectively.

Integration Of Artificial Intelligence

The integration of Artificial Intelligence technology within third-party administration systems is set to streamline and enhance various processes. AI algorithms can analyze data patterns to improve decision-making and enhance efficiency in claim processing and customer service.

Expansion Into New Insurance Sectors

TPAs are reaching new horizons by expanding their services into new insurance sectors. This expansion allows TPAs to cater to a broader range of clients and offer specialized solutions tailored to specific industry needs, thereby increasing their market presence and competitiveness.

Credit: www.populytics.com

Frequently Asked Questions

What Is Third Party Administrator Health Insurance?

A third-party administrator in health insurance manages administrative tasks like claims processing and enrollment for insurance plans.

What is the role of a Third Party Administrator Health Insurance?

A third-party administrator manages administrative tasks like claims processing and benefits management for other companies.

What Is Third-Party Administrator Health Insurance?

Third-party insurance in healthcare occurs when an organization pays or insures medical expenses for enrollees. It covers processing claims, enrolling customers, and ensuring compliance with regulations. Third-party administrators provide operational services like claims processing and benefits management for insurance companies and self-insured companies.

What Is The Role Of TPA in Insurance?

A third-party administrator (TPA) in insurance is an organization that handles administrative tasks for an insurance plan. This includes processing claims, enrolling customers, collecting premiums, and complying with regulations. TPAs ensure a smooth claims settlement by verifying documents and may request additional information.

They can also handle cashless or reimbursement claims and collect necessary documents directly from hospitals.

Conclusion

Third-party administrators play a crucial role in managing the administrative and operational aspects of health insurance plans. Their services include claims processing, enrollment, premium collection, and ensuring compliance with regulations. By outsourcing these functions, insurance companies and self-insured companies can streamline their operations and enhance the overall efficiency of their healthcare services.