Health Insurance is a Scam: Unveiling the Truth

Health Insurance is a Scam like a scam due to cost and complexity, but it is crucial for financial protection. Despite concerns about affordability, health insurance acts as a safety net in case of medical emergencies or serious illnesses.

Protecting oneself with a comprehensive health insurance plan can prevent the risk of overwhelming medical bills and ensure access to necessary healthcare services. Health insurance remains vital in safeguarding one’s well-being and financial stability as health costs continue rising.

It is essential to understand health insurance’s value in managing and mitigating healthcare expenses. It is a necessary safeguard against potential financial hardship in the face of unexpected medical needs.

The Cost Of Health Insurance

Health insurance continues to be a pressing issue in today’s society. A crucial safety net for many individuals, the cost of health insurance is becoming increasingly burdensome for the average American. This is mainly due to rising premiums and high deductibles, causing significant financial strain for families nationwide.

Rising Premiums

The steady increase in health insurance premiums has placed a heavy financial burden on individuals and families. Premiums have been soaring, outpacing the rate of inflation and wage growth. The relentless upward trend in premiums has made it challenging for many to afford basic healthcare coverage, leading to a growing number of uninsured or underinsured individuals.

High Deductibles

In addition to escalating premiums, high deductibles have become a common barrier to accessing healthcare services. Many insurances plans feature deductibles that are so high that individuals are forced to pay substantial out-of-pocket costs before their coverage kicks in. This has resulted in people forgoing necessary medical care due to the exorbitant expenses they would incur.

Credit: consumer.ftc.gov

Coverage Limitations

When it comes to health insurance, it’s essential to understand the limitations of coverage. While it is marketed to provide peace of mind and financial protection, coverage often comes with significant limitations that can leave policyholders feeling deceived and financially burdened.

Exclusions

Health insurance policies often include a long list of exclusions, which dictate the services, treatments, or conditions not covered by the policy. These exclusions vary widely between insurance providers, including elective procedures, cosmetic surgeries, alternative therapies, and pre-existing conditions. Some policies might exclude coverage for specific medications or experimental or investigational treatments.

Prior Authorizations

Prior authorizations are another aspect of health insurance that can lead to frustration and limited coverage. Many insurance plans require prior authorizations for certain medical services, procedures, or medications. This means that policyholders must obtain approval from the insurance company before proceeding with a recommended treatment or procedure. The process for obtaining prior authorizations can be time-consuming and, in some cases, result in denial, leaving individuals responsible for the total cost of the care.

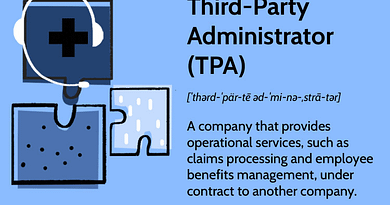

Complexity Of The System

Health insurance can be complex, making it difficult for individuals to navigate the system efficiently. The convoluted nature of health insurance often leaves policyholders feeling overwhelmed and frustrated when trying to understand coverage details and benefits.

Navigating Networks

Health insurance policies often come with a network of healthcare providers that policyholders must adhere to, leading to restrictions on where they can receive care. Understanding these network requirements is essential to avoid unexpected out-of-network costs.

Claim Denials

One common issue within the health insurance system is claim denials, where insurance companies refuse to pay for certain medical services or treatments. This can result in financial burdens for policyholders who believed they were adequately covered.

Credit: www.gebhardtinsurancegroup.com

Lack Of Transparency

Health insurance is a crucial safeguard against potential financial disaster in a medical emergency. However, the industry is riddled with inconsistencies, making it difficult for individuals to make informed decisions about their coverage. From hidden fees to confusing terms, the lack of transparency in health insurance can leave policyholders feeling deceived and uncertain about the value they are receiving.

Hidden Fees

One of the significant issues with health insurance is the prevalence of hidden fees. When individuals sign up for a policy, they are often presented with a seemingly affordable premium. However, little do they know that hidden fees are usually beneath the surface. These include administrative charges, processing fees, and certain medical services or procedures penalties. These hidden fees can quickly add up, making the overall cost of health insurance much higher than initially anticipated.

Confusing Terms

In addition to hidden fees, another aspect of the lack of transparency in health insurance is the use of confusing terms. Policy documents often contain jargon and technical language that confuse even the most educated individuals. This intentional complexity is a barrier to understanding the true nature of coverage, deductibles, and copayments. As a result, individuals may unknowingly sign up for policies that do not provide the coverage they need or struggle to navigate their plan’s intricacies when submitting a claim.

Alternative Options

Alternative health insurance options avoid the pitfalls of traditional health insurance and offer a fresh perspective on protecting your well-being without falling prey to scams. Take control of your healthcare with alternative options, prioritizing your health and financial security.

Self-insuring

Self-insuring involves setting aside funds to cover potential medical expenses. This option allows individuals to take control of their healthcare costs without being tied to traditional insurance plans. It is essential to establish a dedicated savings account for medical needs and to research different healthcare providers that offer transparent pricing.

Healthcare Sharing Ministries

Healthcare Sharing Ministries provide an alternative to traditional health insurance. Members contribute a monthly amount that is distributed to assist with medical expenses. These ministries often promote community and shared responsibility in covering healthcare costs. It’s essential to Note that these ministries have specific eligibility requirements and may not cover all medical services.

Impact On Healthcare Access

Health insurance scams can have a detrimental impact on the accessibility of healthcare services for individuals and communities.

Barriers To Care

High insurance premiums and deductibles present significant barriers to accessing essential healthcare services.

Health Disparities

Health insurance scams widen health disparities among populations, limiting access to quality healthcare.

Potential Solutions: Addressing potential solutions to the flaws and scams surrounding health insurance is crucial. The existing health insurance system in the US is rife with issues, from expensive premiums to insufficient coverage, leaving many individuals and families vulnerable to financial devastation. This section explores potential solutions to combat these challenges and provide a more transparent and accessible healthcare system.

Government Intervention

The government must play a pivotal role in reforming the healthcare system to ensure it is fair and affordable for all citizens. Key measures that could be implemented include:

- We regulate the pricing of healthcare services and prescription drugs to prevent inflated costs.

- We are expanding public healthcare programs to provide coverage for essential medical services.

- We are implementing subsidies and tax incentives to make health insurance more affordable for low-income individuals and families.

Insurance Reforms

Reforming the structure and operations of health insurance companies is crucial to addressing the existing scams and inefficiencies within the industry. Some vital reforms that can be undertaken include:

- They enforce strict regulations to prevent insurance companies from denying coverage based on pre-existing conditions or charging exorbitant premiums.

- We are standardizing insurance policies and simplifying the language used in policy documents to enhance consumer transparency.

- They are introducing accountability measures to ensure insurance companies fulfill their obligations and provide adequate coverage to policyholders.

Credit: chqgov.com

Frequently Asked Questions

Is Health Insurance Even Worth It Anymore?

Yes, health insurance is worth it. It protects you from financial disaster if you require medical care.

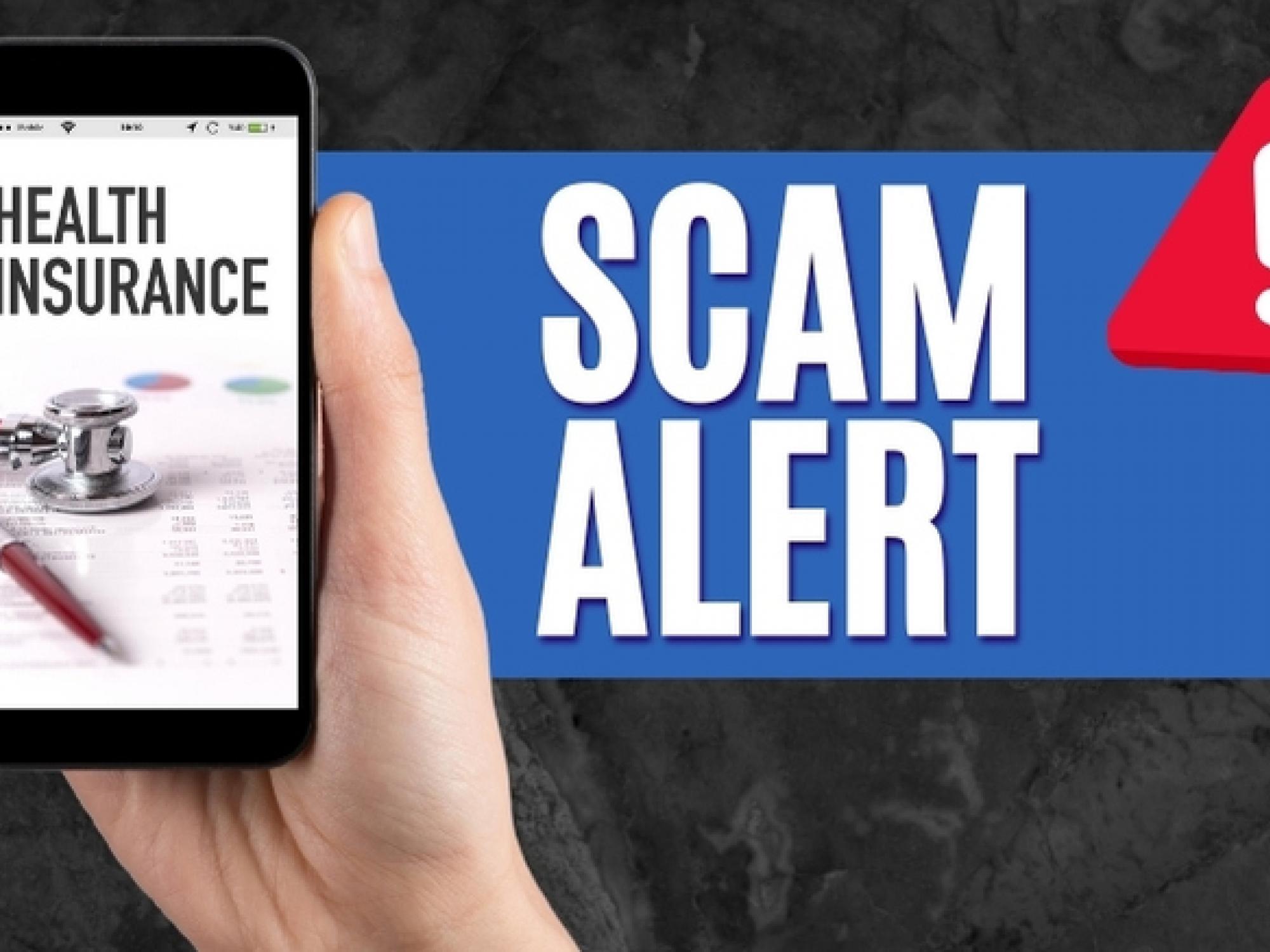

There With Health Insurance Health Insurance is a Scam?

Some scammers may market medical discount plans as health insurance to consumers, claiming low fees and discounts on services or goods. Still, these plans do not always meet coverage requirements under the Affordable Care Act. Always be aware of healthcare scams.

Is It A Bad Idea To Not Have Health Insurance?

Not having health insurance is terrible due to the financial risk of hefty medical bills.

Why Is Health Insurance So Unaffordable?

The high cost of health insurance is due to the complexity of the healthcare system, leading to administrative inefficiencies and increased operational costs for providers and insurers. These added expenses are passed on to consumers through higher premiums, deductibles, and copayments.

Conclusion

Health insurance may seem confusing and expensive, but it safeguards against financial ruin. It’s risky not to save coverage, as medical bills can quickly pile up. Beware of scams posing as health insurance, and always prioritize protecting your well-being.