Can You Add Spouse to Health Insurance at Any Time: A Complete Guide

Can You Add Spouse to Health Insurance at Any Time: You can only add your spouse to your health insurance during open enrollment or a qualifying life event. The process of adding a spouse to health insurance has specific timing requirements.

While this can typically be done during annual enrollment or immediately after getting married, it’s essential to understand the specific eligibility criteria and enrollment periods for the health insurance plan. Timing plays a critical role when it comes to adding a spouse to health insurance.

Usually, this can only be done during open enrollment or a qualifying life event. Understanding the specific timing requirements and eligibility criteria is essential for effectively adding a spouse to a health insurance plan. Whether you are navigating employer-sponsored health insurance or individual coverage, knowing the right time to add a spouse is crucial for securing comprehensive health coverage for your family. The process of adding a spouse to health insurance demands adherence to specific timelines and guidelines. Therefore, knowing when and how to add a spouse to health insurance is paramount for comprehensive family coverage.

Exploring The Option

Exploring the Option: Adding your spouse to your health insurance plan is a significant decision that requires thorough understanding and consideration. Let’s delve into the process and requirements.

Understanding The Enrollment Process

When it comes to adding your spouse to your health insurance, it’s essential to grasp the enrollment process. You can typically add your spouse during specific periods or qualifying life events.

- Open Enrollment: This annual period allows you to make changes to your health insurance plan, including adding your spouse.

- Particular Enrollment Period: Certain life events, such as marriage, birth of a child, or loss of other coverage, enable you to add your spouse outside of the regular enrollment period.

Ensuring Each Heading Adheres To HTML Syntax

To adhere to HTML syntax, each H3 heading must be enclosed in

Tags. This structure ensures proper formatting and hierarchy within the content.

Adding your spouse to your health insurance plan offers financial protection and peace of mind for both of you. Understanding the enrollment options helps you navigate the process effectively.

Considerations To Keep In Mind

Are you looking to add your spouse to your health insurance? The annual open enrollment period is the ideal time to do so. Alternatively, you can take advantage of qualifying life events, such as marriage, to make changes to your healthcare coverage.

Keep in mind, though, that adding your spouse outside of these periods may not be possible.

Adding a spouse to your health insurance plan is a significant decision that comes with several considerations. From cost implications to the comparison of benefits, it’s essential to examine various factors before making this choice.

Cost Implications Of Adding A Spouse

When adding your spouse to your health insurance plan, it’s crucial to understand the potential cost implications. Health insurance providers may charge an additional premium for spousal coverage, substantially impacting your monthly expenses. Analyzing the financial aspect and comparing it with individual coverage can help in making an informed decision.

Comparing Benefits With Individual Vs. Spousal Coverage

When considering adding your spouse to your health insurance plan, it’s essential to compare the benefits offered by individual and spousal coverage. Assessing the coverage, including deductibles, co-pays, and network providers, can provide insights into the advantages or disadvantages of spousal coverage. This comparison can help you determine the most suitable option based on your healthcare needs.

Knowing the potential cost implications when adding a spouse to your health insurance plan is crucial. Comparing the benefits of individual and spousal coverage is essential in making an informed decision.

Guidelines And Restrictions

To add your spouse to health insurance, you can usually only do so during open enrollment or after a qualifying life event. Adding a spouse may affect premium costs depending on the employer’s coverage policies. It’s essential to understand the guidelines and restrictions set by the insurance provider.

Guidelines And Restrictions

If you are considering adding your spouse to your health insurance, it is essential to understand the guidelines and restrictions that may apply. While the option to add a spouse is available, certain limitations and exceptions may apply.

Limitations On Adding Non-spouse Dependents

Most medical plans only allow you to add dependent family members, such as your spouse or children, to your health insurance plan. This means that adding a non-spouse dependent, such as an unmarried partner or a friend, may not be allowed under your plan’s terms and conditions.

It is essential to review your health insurance policy or contact your insurance provider to understand the specific limitations and restrictions on adding non-spouse dependents. This will help you determine your eligibility and coverage options.

Exceptions And Special Situations

While the general rule is to add only spouses and children to your health insurance plan, there are a few exceptions and special situations that may allow for additional coverage. One such exception is domestic partnership coverage.

If you are in a legally recognized domestic partnership, some health insurance plans may allow you to add your partner as a dependent. This can provide them with access to the same healthcare benefits as a spouse. However, it’s important to note that not all insurance providers offer domestic partnership coverage, so it’s advisable to check with your specific provider.

Another unique situation that may allow for adding non-spouse dependents is certain qualifying life events. These events, such as getting married, having a child, or losing existing coverage, may open a particular enrollment period outside of the standard open enrollment period. During this time, you may have the opportunity to add a non-spouse dependent to your health insurance plan.

In conclusion, while the ability to add a spouse to your health insurance is generally available, it is essential to be aware of any guidelines and restrictions that may apply. Understanding what is allowed under your specific plan and any exceptions or special situations can help you make an informed decision about adding a non-spouse dependent to your health insurance coverage.

Navigating Life Events

Adding your spouse to health insurance isn’t an anytime action; typically, it’s during open enrollment or after qualifying life events such as marriage. Employer coverage terms can affect costs.

Qualifying Life Events For Changes In Coverage

If you’re wondering whether you can add your spouse to your health insurance at any time, the answer is quite specific. Generally, you cannot add your spouse to your health insurance plan outside of the open enrollment period. However, certain qualifying life events allow you to make changes to your coverage at any time during the year.

Qualifying life events include:

- Marriage

- Divorce

- Birth or adoption of a child

- Loss of other health insurance coverage

- Change in residence

- Change in employment status

If you experience any of these life events, you have a limited window of time to make changes to your health insurance coverage and add your spouse or dependent.

Impact Of Marriage On Health Insurance Coverage

Getting married is one of the most significant life events that can impact your health insurance coverage. It opens up a particular enrollment period, allowing you to add your spouse to your insurance plan outside of the typical open enrollment period. This means you have the opportunity to take advantage of your employer-sponsored health insurance plan or enroll in a private health insurance plan together as a married couple.

Adding your spouse to your health insurance can bring various benefits, including:

- Consolidating your health coverage into one plan potentially leads to cost savings

- Access to a broader network of healthcare providers for both of you

- Peace of mind knowing that you and your spouse are both covered in case of unexpected medical expenses

Remember, each employer or private health insurance provider may have specific requirements and timelines for adding your spouse to your health insurance plan. If you have employer-sponsored coverage, contact your HR department or reach out to your insurance provider to understand the necessary steps and documentation to add your spouse to your plan.

Process And Timeline

Adding a spouse to health insurance is not possible at any time. It can only be done during open enrollment or after a qualifying life event, such as getting married. It is essential to check with your insurance provider for specific timelines and requirements.

Open Enrollment Periods For Adding A Spouse

During the open enrollment period, you have the opportunity to add your spouse to your health insurance plan. This enrollment period typically occurs once a year and lasts for a limited time. It’s crucial to note that you cannot add your spouse to your health insurance at any time outside of this specific period. Missing the open enrollment period means you will have to wait until the next enrollment period to add your spouse to your plan.

Timeline For Adding A Spouse To Your Health Insurance

Adding a spouse to your health insurance plan involves a specific timeline. To ensure a smooth process, it’s essential to understand the necessary steps and their respective timeframes. 1. Notify your employer or insurance provider: Once you decide to add your spouse to your health insurance, inform your employer or insurance provider about this decision as soon as possible. They will provide you with the necessary forms and instructions to proceed. 2. Gather required documents: Make sure you gather all the required documents, such as your spouse’s birth certificate, marriage certificate, and social security number. Having these documents ready will help speed up the process. 3. Complete necessary paperwork: Fill out the forms provided by your employer or insurance provider accurately and honestly. Ensure that you include all required information to avoid any delays in the processing of your request. 4. Submit the paperwork: Once you have completed the necessary paperwork, submit it to your employer or insurance provider within the specified timeframe. Be sure to meet any deadlines to avoid missing out on adding your spouse to your health insurance plan. 5. Wait for confirmation: After submitting the paperwork, you will need to wait for confirmation from your employer or insurance provider. The timeframe for receiving confirmation may vary, but usually, it takes a few days to a few weeks. 6. Review your new health insurance coverage: Once your request is approved, review your new health insurance coverage to ensure that your spouse is included. If you have any questions or notice any discrepancies, contact your employer or insurance provider immediately for clarification. Remember, it’s crucial to follow the specific timeline and instructions provided by your employer or insurance provider when adding a spouse to your health insurance. Missing any deadlines or incomplete paperwork can lead to delays and potential frustrations. By adhering to the process and timeline, you can efficiently add your spouse to your health insurance and provide them with the necessary coverage.

Credit: www.wikihow.com

Steps To Adding A Spouse

If you’re wondering whether you can add your spouse to your health insurance at any time, the answer is usually no. Generally, you can only add your spouse during open enrollment or after a qualifying life event, such as marriage.

It’s essential to check with your employer or insurance provider for specific details.

Initiating The Addition Process

Adding a spouse to health insurance requires following specific steps provided by your insurance provider.

Documentation Required For Adding A Spouse

Prepare necessary documents, such as marriage certificates and your spouse’s information, before initiating the process.

Understanding Policy Switches

Are you considering adding your spouse to your health insurance? To ensure a smooth transition, understand the process of switching policies.

Considerations Before Making A Policy Switch

- Review coverage benefits of both policies.

- Check for any waiting periods or restrictions.

- Consider cost implications and premium changes.

- Ensure your spouse’s policy aligns with your healthcare needs.

Switching To Your Spouse’s Health Insurance Policy

When changing to your spouse’s health insurance, be aware of the enrollment period restrictions and make an informed decision based on your healthcare requirements.

Credit: www.tdi.texas.gov

Dependent Enrollment

When it comes to managing your health insurance, it’s essential to understand the rules and options for adding dependents. Dependent enrollment allows you to add eligible family members, such as a spouse or children, to your health insurance plan. Knowing who can be added as a dependent and the process of adding dependents outside of open enrollment can help you make informed decisions about your coverage.

Who Can Be Added As A Dependent?

Adding a spouse as a dependent is a common practice for individuals with health insurance coverage. In most cases, spouses are eligible for dependent enrollment in health insurance plans. Additionally, children under a certain age, usually up to 26 years old, can also be added as dependents.

Adding Dependents Outside Of Open Enrollment

Adding dependents outside of the open enrollment period typically requires a qualifying life event. Events such as marriage, birth of a child, or loss of other coverage may qualify you to add a spouse or child to your health insurance plan outside of the regular enrollment period. It’s essential to check with your insurance provider to understand the specific requirements and deadlines for adding dependents due to a qualifying life event.

Credit: www.wikihow.com

Frequently Asked Questions

How Can You Add Spouse to Health Insurance at Any Time?

To add your wife to your health insurance, contact your insurance provider during open enrollment or right after getting married.

Why Is It So Expensive To Add A Spouse To Insurance?

Adding a spouse to insurance can be expensive, as employers often cover more of the employee’s premium.

Can You Add Someone Who Is Not Your Spouse To Your Health Insurance?

Yes, you can add someone who is not your spouse to your health insurance, such as dependent family members. This typically includes spouses and children, and there are exceptions like domestic partner coverage.

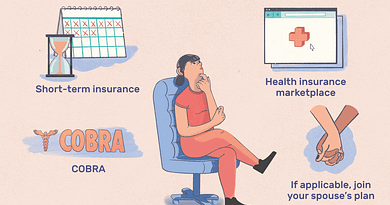

What Happens If You Can’t Afford Health Insurance In America?

If you can’t afford health insurance in America, you may face the risk of accumulating medical bills that you can’t pay. In the worst-case scenario, you could be sued, have your wages garnished, or even be forced into bankruptcy.

Conclusion

Adding your spouse to your health insurance may involve some considerations. It’s essential to be aware of the specific enrollment periods and qualifying life events that allow you to make changes to your coverage. Understanding the implications of adding a spouse to your insurance plan can help you make informed decisions about your healthcare coverage.