Which Mode of Payment is Not Used by Health Insurance? Find Out Now!

Which mode of payment is not used by health insurance companies? Is the single premium? Health insurance policies do not accept single premium payments.

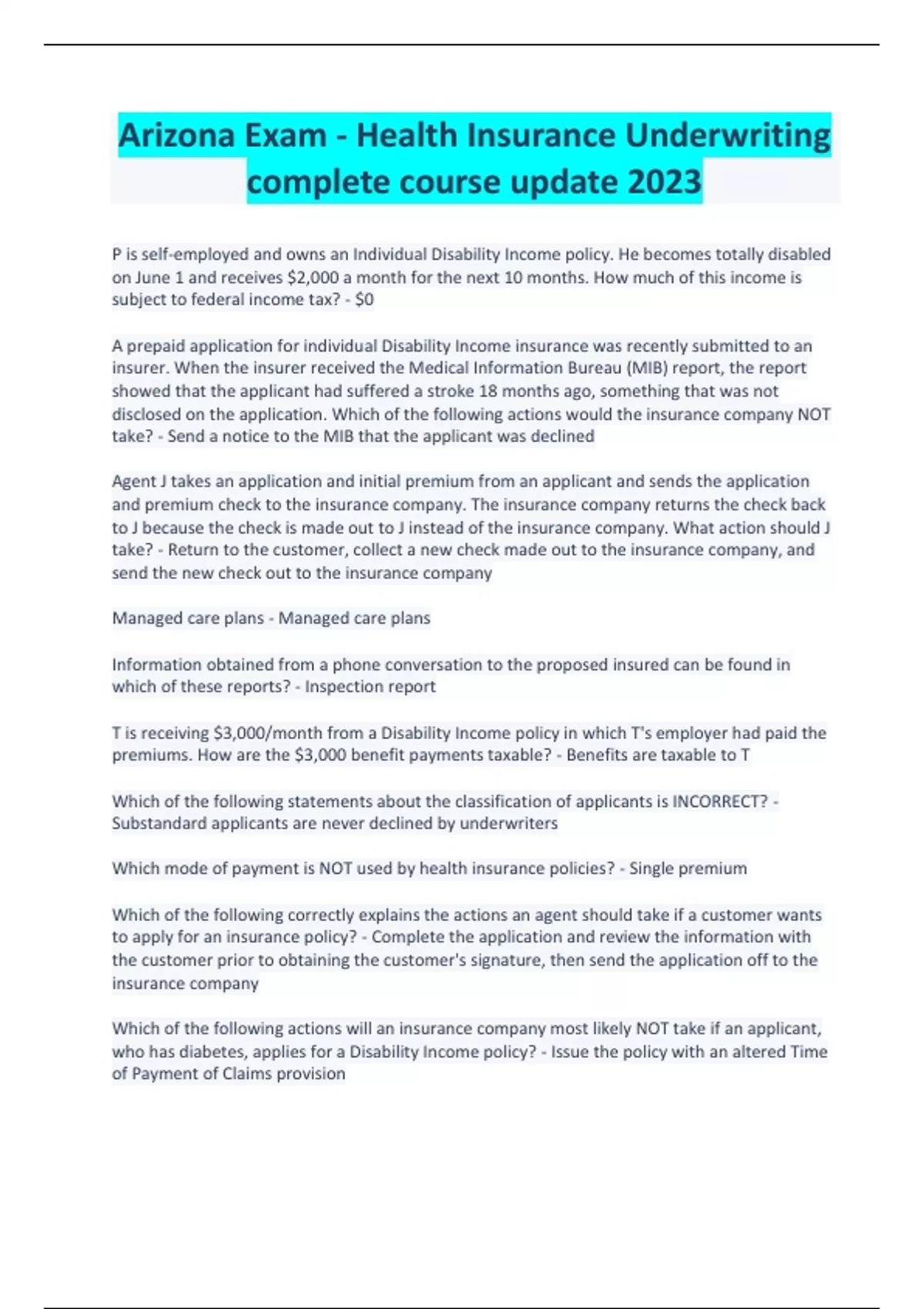

Understanding the different payment modes is crucial when purchasing health insurance. Premiums can be paid in various ways, but it’s essential to know which modes of payment are not accepted by health insurance companies. This knowledge can help you make informed decisions when setting up your health insurance plan.

Let’s explore the modes of payment commonly used in health insurance and why the single premium is not accepted. Understanding these details can streamline the process of choosing the correct payment method for your health insurance coverage.

Credit: www.stuvia.com

Understanding Payment Methods In Health Insurance

Health insurance involves several payment methods that policyholders need to understand in order to manage their healthcare costs effectively. Each technique, including Premiums, Deductibles, Copayments, and Coinsurance, plays a significant role in determining how much individuals pay for medical services.

Premiums

Premiums are the regular payments individuals make to maintain their health insurance coverage.

Deductibles

Deductibles represent the amount individuals must pay out of pocket before their insurance coverage kicks in.

Copayments

Copayments are fixed fees that insured individuals pay for specific services or medications.

Coinsurance

Coinsurance is the percentage that policyholders must contribute towards covered healthcare services after meeting their deductible.

Credit: www.livemint.com

Exploring Accepted Modes Of Payment

Health insurance policies do not accept a single premium mode of payment. Other accepted modes include monthly, annual, and semi-annual premiums.

Monthly Premium

One of the most common modes of payment for health insurance is the monthly premium. This method allows individuals to pay their insurance premiums on a monthly basis, spreading the cost of the premium throughout the year. The monthly premium is typically a fixed amount that policyholders need to pay every month to maintain their health insurance coverage. By paying the monthly premium, individuals ensure that their insurance policy remains active and they have access to the benefits and coverage provided by their health insurance plan.

Annual Premium

Another mode of payment accepted by health insurance providers is the annual premium. This payment method requires individuals to pay their entire insurance premium at once for the full year of coverage. Paying the yearly premium upfront offers several advantages, including cost savings and convenience. By paying the total amount for the year, individuals can often secure a discounted rate compared to monthly payments. Additionally, paying the annual premium upfront eliminates the need to worry about monthly payments and potential late fees. It provides financial peace of mind, knowing that their health insurance coverage is secure for the entire year.

Semi-annual Premium

For those who prefer a middle ground between monthly and annual payments, health insurance providers also accept semi-annual premium payments. This mode of payment allows policyholders to pay their insurance premiums twice a year. Similar to annual payments, paying the premium semi-annually offers potential cost savings compared to monthly payments. It also provides a more extended period of coverage compared to monthly payments, reducing the frequency of payment reminders and possible late fees. Semi-annual premium payments can be an attractive option for individuals who prefer to budget their expenses on a six-month basis.

In conclusion, health insurance providers accept various modes of payment to accommodate individuals’ financial preferences and needs. Whether it is through monthly, annual, or semi-annual premiums, individuals have options to manage their insurance payments effectively. Each payment method has its advantages and considerations, allowing individuals to choose the most suitable option based on their financial situation and convenience.

The Exclusion Of Single Premium

Explanation Of Why Single Premium Is Not Used In Health Insurance

Health insurance typically excludes the option of a single premium payment method, unlike other forms of insurance, such as life insurance or annuities. The exclusion of a single premium can be attributed to the dynamic nature of healthcare costs and benefits. Moreover, health insurance is designed to provide ongoing coverage and financial protection against unpredictable medical expenses, making the single premium model unsuitable for this purpose.

Consequences Of Non-payment

Failure to pay health insurance premiums may result in the termination of coverage.

Non-payment of premiums can lead to financial penalties, including possible tax penalties.

Tax Implications And Self-employed Health Insurance

Self-employed individuals have unique considerations regarding health insurance and tax implications. Understanding the tax implications of health insurance payments is essential for self-employed individuals, as it can significantly impact their financial situation. Additionally, being aware of the impact of Advance Premium Tax Credit (APTC), deductions, and premium tax credits is crucial for effective financial planning.

Impact Of Aptc On Total Payments

Advance Premium Tax Credit (APTC) is a crucial aspect for self-employed individuals when it comes to health insurance payments. It is important to note that APTC impacts the total payments made for self-employed health insurance. APTC provides financial assistance to help eligible individuals and families with low or moderate income advance payment of the premium tax credit to reduce their health insurance premiums.

Deductions And Premium Tax Credit

When it comes to self-employed health insurance, deductions and premium tax credits significantly influence total payments. Self-employed individuals can deduct 100% of their health insurance premiums from their taxable income, which can result in substantial tax savings. Additionally, those who are eligible for premium tax credits can further reduce their total payments for health insurance.

Credit: journals.plos.org

Employee Health Insurance Contributions

Health insurance often requires contributions from both the employer and the employee. Understanding the breakdown of these contributions is essential for employees to make informed decisions about their healthcare coverage.

Determining Percentage Of Employer Contribution

Employer contributions towards health insurance can vary and are typically determined based on a percentage of the total premium. The employer sets this percentage, which may differ from one company to another. Employees need to be aware of the specific percentage of the premium that their employer will cover.

Determining Percentage Of Employee Contribution

Employees are also required to contribute towards their health insurance coverage. The employer determines the percentage of the premium that employees have to cover. This percentage is often deducted from the employee’s paycheck on a regular basis to ensure continuous coverage.

Impact On Paycheck And Tax Implications

Employee contributions to health insurance directly impact their take-home pay. Understanding how these contributions affect net pay is crucial for employees to manage their finances effectively. Additionally, specific contributions may be tax deductible, providing potential benefits during tax filing.

Frequently Asked Questions

Which mode of payment is not used by health insurance companies?

The mode of payment that is not used by health insurance policies is the single premium.

Which Motor Payment Is Not Used By Health Insurance Policies?

Health insurance policies do not use a single premium mode of payment.

Which of the following actions may not be taken by an insurance company?

An insurance company may not alter the Time of Payment of Claims for an applicant with diabetes.

What Types Of Payments Must The Insured Person Make For Health Care?

The insured person must pay monthly premiums for health care coverage. Failure to pay may result in coverage termination.

Conclusion

Understanding which mode of payment is not used by health insurance policies can help individuals make informed decisions about their coverage. Single premium payment is one method that is not commonly used for health insurance, and knowing this can guide individuals in selecting the most suitable payment option for their needs.

Individuals need to stay informed about the different payment methods available and their implications for insurance coverage. Making the right choice can ultimately lead to better financial security and access to healthcare services.