Best Health Insurance Nevada: Find Affordable and Comprehensive Coverage

Best Health Insurance Nevada, consider Ambetter from SilverSummit for overall coverage and low MOOP plans. Other options include Imperial Insurance Companies, SelectHealth, and Anthem Health for young adults, as well as various plan types.

These health insurance companies provide comprehensive coverage and affordable options for individuals and families. Health insurance is a crucial aspect of maintaining financial stability and peace of mind in Nevada. With several options available in the state, it’s essential to explore the best health insurance providers to find the most suitable plan for your needs.

Nevada offers a range of health insurance plans, from comprehensive coverage to affordable options and specific care needs. Understanding the available options and discerning the best one for your situation is vital for ensuring optimal coverage and peace of mind. By evaluating the top health insurance providers in Nevada, individuals and families can secure the best possible coverage to meet their healthcare needs.

Credit: healthbenefits.net

Best Health Insurance Plans In Nevada

When it comes to choosing the best health insurance plans in Nevada, it’s essential to consider various factors such as coverage, affordability, and network providers. Here are some of the top health insurance plans available in Nevada:

Ambetter From Silversummit

- Best Overall in Nevada

- Best for PPO

Imperial Insurance Companies

- Best for Low MOOP

Select health

- Best Cheap

- Best for Young Adults

Anthem Health

- Best for EPO

National General Accident & Health

- Best Short-Term Insurance

Each of these health insurance providers offers unique benefits tailored to different individual needs. Whether you are looking for comprehensive coverage or affordable options, these top health insurance plans in Nevada have you covered.

Average Cost Of Health Insurance In Nevada

When it comes to health insurance, figuring out the average cost in Nevada is crucial for residents seeking coverage options. The average price of health insurance in Nevada can be influenced by various factors such as age, location, and plan type.

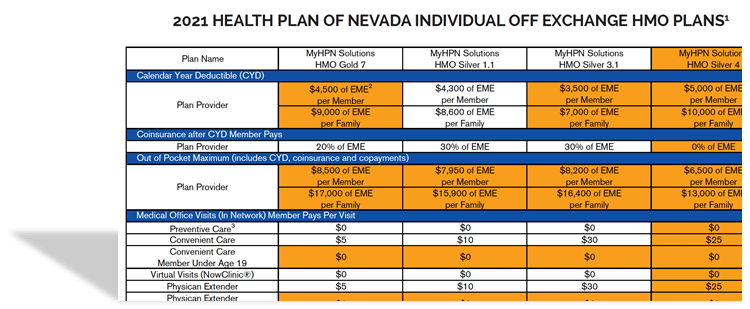

Comparison Of Costs

It’s essential to compare the costs of different health insurance plans in Nevada to ensure you make an informed decision. Below is a table showcasing the average monthly premiums for various health insurance plans in Nevada:

| Plan Type | Average Monthly Premium |

|---|---|

| Platinum | $450 – $600 |

| Gold | $380 – $500 |

| Silver | $300 – $450 |

| Bronze | $250 – $350 |

| Catastrophic | $150 – $250 |

Affordable Options

For individuals seeking affordable health insurance options in Nevada, there are several avenues to explore. Consider the following options:

- Enroll in an HMO (Health Maintenance Organization) plan.

- Explore subsidies and tax credits offered through the Nevada Health Link.

- Consider high-deductible health plans (HDHP) paired with a Health Savings Account (HSA) for potential cost savings.

Top Health Insurance Companies In Nevada

Are you looking for the top health insurance companies in Nevada? Look no further! Ambetter from SilverSummit is the best overall, offering affordable rates. Imperial Insurance Companies is the best for low out-of-pocket expenses, while SelectHealth is the best for budget-friendly options.

Blue Cross Blue Shield

When it comes to health insurance companies in Nevada, one name that stands out is Blue Cross Blue Shield. Known for its reliability and comprehensive coverage, Blue Cross Blue Shield offers some of the best health insurance plans in the state. With a vast network of healthcare providers, policyholders can easily find the care they need without breaking the bank. Blue Cross Blue Shield is committed to ensuring the well-being of its members, making it a top choice for individuals and families looking for quality healthcare coverage.

Kaiser Permanente

If you’re looking for high-quality health insurance plans in Nevada, look no further than Kaiser Permanente. This insurance company is known for its top-notch customer service and commitment to providing the highest quality of care. Kaiser Permanente offers a range of health management programs to help policyholders manage their health and lead healthier lives. With Kaiser Permanente, you can be confident that you’re receiving the best healthcare services available in Nevada.

Oscar

Oscar stands out when it comes to innovative health insurance solutions. Oscar is known for its user-friendly online platform and personalized healthcare recommendations. With Oscar, policyholders have access to a variety of health management tools and resources that can help them make informed decisions about their healthcare. Whether you’re a young adult or a family in need of comprehensive coverage, Oscar has health insurance plans that cater to your specific needs.

Aetna Cvs Health

For individuals who prioritize same-day care and convenient access to healthcare services, Aetna CVS Health is an excellent choice. This health insurance company understands the importance of quick and easy access to medical care, and they offer policies that prioritize same-day care. With Aetna CVS Health, policyholders can enjoy peace of mind knowing that they can receive the healthcare they need when they need it most.

When it comes to choosing the best health insurance company in Nevada, it’s essential to consider your individual needs and budget. Each of these top health insurance companies offers unique benefits and features that cater to different policyholders. By selecting a reputable health insurance provider like Blue Cross Blue Shield, Kaiser Permanente, Oscar, or Aetna CVS Health, you can ensure that you and your family have access to quality healthcare services when you need them most.

Credit: www.google.com

Individual & Family Health Insurance Plans

Having the right health insurance plan is essential for protecting your health and the health of your loved ones. In Nevada, various options are available for individual and family health insurance plans. Understanding your coverage options can help you find a plan that fits your needs and budget. At Anthem, we offer a variety of plan options for individuals and families, making it easier for you to find the right health insurance plan in Nevada.

At Anthem, we strive to provide comprehensive health insurance coverage for individuals and families in Nevada. Our goal is to help you find the perfect plan to meet your specific needs. By exploring the options available at Anthem, you can find a plan that offers the coverage you need at a price that fits within your budget.

Finding the right health insurance plan can seem overwhelming, but Anthem is here to help. We offer a range of plan options designed to meet the diverse needs of individuals and families in Nevada. Whether you’re looking for a plan with low monthly premiums, comprehensive coverage, or specific networks, we have options to suit your needs.

When exploring your options, consider your budget, healthcare needs, and the health of your family members. Our knowledgeable representatives can help you find a plan that provides the coverage you need at a price you can afford.

Here are some key factors to consider when choosing a health insurance plan:

- Network Coverage: Ensure that the plan you choose includes your preferred doctors, hospitals, and specialists within its network.

- Benefits and Coverage: Review the plan’s coverage for preventive care, prescriptions, and other essential healthcare services.

- Deductibles and Co-Payments: Understand your financial responsibilities, such as deductibles and co-payments, associated with the plan.

- Premium Costs: Evaluate the monthly premium costs, taking into account both your budget and the level of coverage provided.

By carefully considering these factors, you can find a health insurance plan that meets your needs and provides peace of mind.

For more information on individual and family health insurance plans in Nevada, visit our website at Anthem.

Nevada Health Insurance Options

When it comes to healthcare, it’s crucial to have access to the right health insurance plans. In Nevada, individuals have a variety of health insurance options to choose from. Understanding the available options can help you make informed decisions regarding your healthcare coverage.

ACA Plans

ACA (Affordable Care Act) plans, also known as Obamacare, provide comprehensive coverage that meets the requirements set forth by the Affordable Care Act. In Nevada, individuals and families can explore a range of ACA plans offered through the state’s health insurance marketplace, Nevada Health Link. These plans provide essential health benefits, including coverage for preventive care, pre-existing conditions, and prescription drugs.

Medicare And Medicaid Coverage

Medicare and Medicaid are government-funded healthcare programs designed to assist specific groups of individuals. Medicare caters to seniors aged 65 and above, as well as those with particular disabilities. On the other hand, Medicaid serves low-income individuals and families. Both programs provide various coverage options, including hospital visits, doctor’s appointments, and prescription medications, ensuring essential healthcare needs are met.

Short-term Plans

Short-term health insurance plans offer temporary coverage for individuals facing gaps in their insurance or searching for immediate, affordable coverage. These plans are designed to provide essential protection and may not offer comprehensive benefits like traditional health insurance. Nevertheless, they can serve as an interim solution while individuals are transitioning between healthcare plans or experiencing lapses in coverage due to life changes.

Comparing Health Insurance Plans

When comparing health insurance plans in Nevada, consider factors like coverage, costs, and provider networks. Some of the top options in Nevada include Ambetter from SilverSummit for overall coverage, Imperial Insurance Companies for low MOOP, and SelectHealth for affordability and coverage tailored to young adults.

Evaluate the different plans to find the best fit for your needs and budget.

Moneygeek’s Recommendations

MoneyGeek’s top pick for the best health insurance in Nevada for Silver HMO plans is Ambetter from SilverSummit. They offer an average plan rate…

Nevada Health Link

When it comes to finding the right health insurance plan in Nevada, Nevada Health Link is a valuable resource. They provide a range of options to suit various needs and budgets.

Consider the following factors when comparing health insurance plans:

- Cost of premiums

- Extent of coverage

- Provider networks

- Out-of-pocket expenses

To make an informed decision, evaluate the benefits and limitations of each plan based on your healthcare requirements.

| Plan | Best For |

|---|---|

| Bronze Plan | Low Premiums |

| Silver Plan | Balance of Cost and Coverage |

| Gold Plan | Higher Coverage |

Comparing health insurance plans allows you to find the most suitable coverage that aligns with your needs and budget.

Tips For Choosing Health Insurance In Nevada

When selecting health insurance in Nevada, it’s important to consider critical factors to ensure you get the most suitable coverage for your needs. Here are some tips to help you navigate through the process:

Bronze Plans

Bronze plans offer lower premiums but higher out-of-pocket costs. They are ideal for individuals who don’t anticipate frequent medical visits or prescriptions.

Comparing Rates

Comparing rates from different insurance providers can help you find the most cost-effective option that aligns with your budget and coverage requirements.

Using Nevada Health Link

Using Nevada Health Link can simplify your search for health insurance by providing a centralized platform to explore various plans, compare prices, and enrol in a suitable policy.

Credit: www.moneygeek.com

Frequently Asked Questions

Which health plan in Nevada is the best health insurance in the state?

The best health plan in Nevada varies by criteria. Some top options include Ambetter from SilverSummit for overall coverage, Imperial Insurance for low MOOP, and SelectHealth for affordability. Anthem Health and National General Accident & Health also offer quality plans.

What is the average cost of the best health insurance in Nevada?

In Nevada, the average cost of health insurance varies, with rates ranging from $300 to $600 monthly.

What Are The Top 3 Best Health Insurance Nevada?

The top three health insurance companies are Blue Cross Blue Shield, Kaiser Permanente, and Oscar. These companies offer high-quality, comprehensive coverage.

Which Health Insurance Company Has The Best Coverage?

The best health insurance company for coverage in Nevada is Ambetter from SilverSummit. They offer the best overall plans and options for low MOOP, cheap rates, and young adults. Anthem Health is also a top choice for EPO plans.

Conclusion

Finding the best health insurance in Nevada is crucial for ensuring comprehensive coverage that meets your specific needs. By comparing plans from top-rated providers like Ambetter from SilverSummit, Blue Cross Blue Shield, and Kaiser Permanente, you can make an informed decision for your health and financial well-being.

Explore options with Nevada Health Link and make a choice that prioritizes your health and peace of mind.