Health Insurance in between Jobs: Secure Your Coverage Now!

Health Insurance in between Jobs: Consider temporary health insurance to maintain coverage during job transitions. It offers immediate protection for your health needs.

Navigating health insurance between jobs can be challenging, especially when ensuring continuous coverage for you and your family. When you leave a job and lose your employer-sponsored health insurance, there is a gap before you start a new job or secure a new plan.

This gap can leave you vulnerable to unexpected medical expenses or emergencies. In such situations, temporary health insurance can be a valuable bridge to maintain coverage until a more permanent solution is in place. Temporary health insurance typically offers immediate coverage, easy online enrollment, and affordable rates, making it a practical option during job transitions. It provides peace of mind knowing that you have protection while navigating your next steps in securing long-term health insurance.

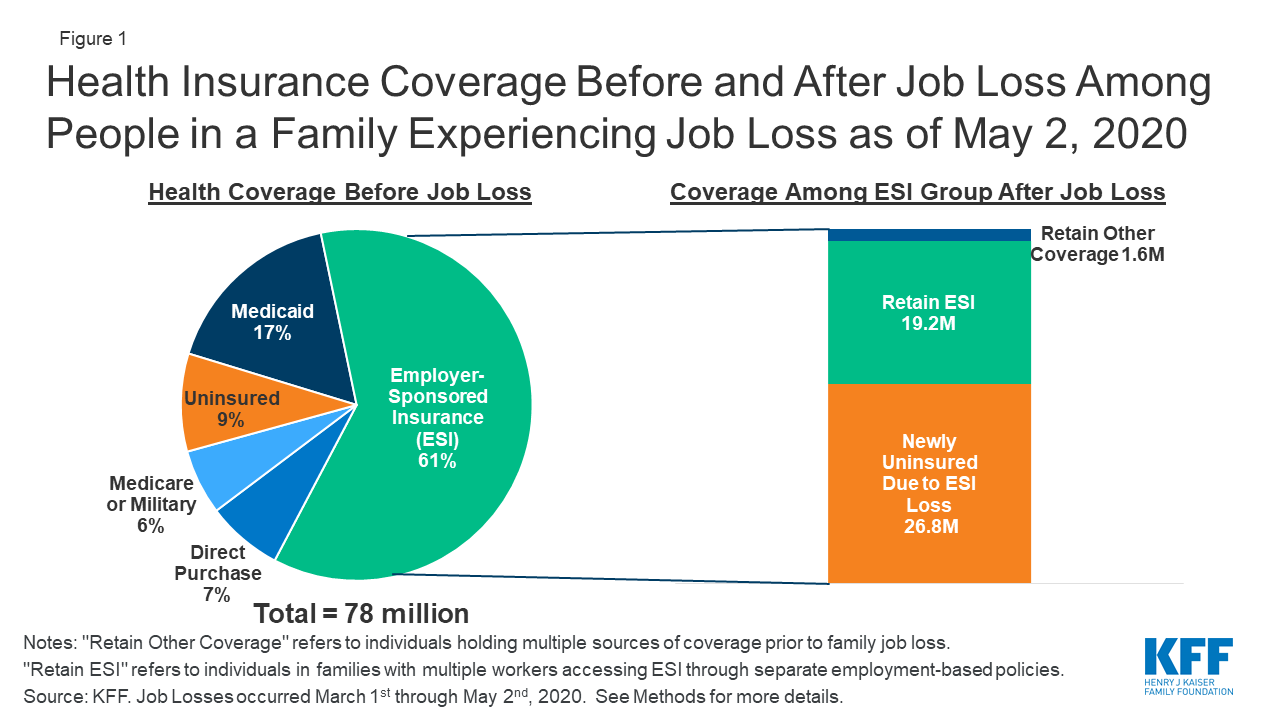

Credit: www.kff.org

Why Secure Health Insurance Between Jobs

Many individuals temporarily lack coverage from their employer’s health insurance plan when transitioning between jobs. Securing health insurance between jobs is essential to ensure continuity of coverage and prevent financial risk. This article will discuss the importance of maintaining continuity in health insurance and how it helps prevent potential financial burdens, highlighting the necessity of securing health insurance between jobs.

Importance Of Continuity

Continuity in health insurance coverage is crucial to maintaining access to necessary medical care, prescriptions, and preventive services. Uninterrupted coverage ensures that individuals can continue their ongoing treatments and receive timely care without gaps or delays. It also helps manage chronic conditions and prevents health complications due to lack of access to essential healthcare services.

Preventing Financial Risk

Securing health insurance between jobs is vital to preventing the financial risk associated with unexpected medical expenses. Continuous coverage safeguards individuals from high healthcare costs in case of unforeseen illnesses or injuries. Without health insurance, a single medical emergency could lead to substantial medical debt, affecting the financial stability of individuals and their families.

Credit: apollo-insurance.com

Understanding Cobra Insurance

COBRA Insurance offers temporary health coverage when switching jobs, ensuring continued protection until new benefits kick in. It provides a safety net during transitions, preventing gaps in health insurance that could leave individuals vulnerable.

Qualifying Events

Certain events, such as termination or reduced work hours, qualify you for COBRA insurance when you leave a job.

Coverage Duration

COBRA coverage typically lasts up to 18 or 36 months, depending on the qualifying event that caused the loss of health insurance.

COBRA is a crucial bridge that ensures uninterrupted healthcare coverage during job transitions.

It allows individuals to retain their prioremployer’smployer’s insurance plan, albeit at a higher cost.

Marketplace Plan Enrollment

Are you currently in between jobs and worried about your health insurance coverage? Don’t, because there are options available to ensure you stay protected. One option to consider is enrolling in a MarketplaLet’san. Let’s delete the benefits of Marketplace plans and how they can help you during this transition period.

Options For Job Loss

When you leave your job and lose your job-based health insurance, exploring your options to maintain coverage is essential. While losing health insurance can be a stressful experience, there’s to panic. With Marketplace plans, you can find suitable coverage that meets your needs.

Marketplace plans are offered through the Health Insurance Marketplace or HealthCare.gov. This online platform allows individuals and families to compare and enrol in health insurance plans provided by private companies. Marketplace plans are typically more affordable than purchasing individual plans directly from insurance providers.

Benefits Of Marketplace Plans

One significant advantage of enrolling in a Marketplace plan is the potential cost savings. These plans are eligible for premium tax credits and cost-sharing reductions, which can make health insurance more affordable for individuals and families.

Another benefit of Marketplace plans is the wide variety of coverage options available. You can choose from different coverage levels, such as bronze, silver, gold, or platinum. Each level corresponds to different cost-sharing arrangements, allowing you to find a plan that fits your budget and healthcare needs.

Additionally, Marketplace plans offer essential health benefits that are required by law. These benefits include preventive care, prescription drugs, hospitalization, emergency services, maternity care, mental health services, and more. By enrolling in a Marketplace plan, you can ensure comprehensive coverage throughout your transition period.

Enrolling in a Marketplace plan is straightforward. You can visit HealthCare.gov to create an account, provide necessary information, and browse available plans in your area. The website offers helpful tools to compare plans based on cost, coverage, and provider network. If you’ve decided on a plan that fits your needs, you can complete the enrollment process online in just a few steps.

Rit’sber, it’s critical to review the enrollment deadlines for Marketplace plans. Open enrollment typically occurs once a year, but special enrollment periods are available for individuals who experience certain life events, such as job loss. Be sure to check the specific dates and eligibility requirements to ensure you don’t miss out on the opportunity to enrol in a Marketplace plan.

In conclusion, enrolling in a Marketplace plan is a viable solution if you are between jobs and have lost your job-based health insurance. These plans offer affordability, choice, and essential benefits that can provide you with the coverage you need during this transition period. Take advantage of the Marketplace and secure your health insurance today.

Credit: www.calhealth.net

Temporary Health Insurance

Temporary health insurance can provide a safety net for individuals between jobs, ensuring continued coverage and peace of mind. This short-term solution offers flexibility and quick enrollment, bridging the gap until long-term insurance is secured. Stay protected while transitioning into the job market with temporary health insurance.

Immediate Coverage

When transitioning between, it’s critical to have temporary health insurance in place to ensure continuous coverage. Temporary or short-term health insurance provides immediate coverage for individuals who have recently left their jobs and are seeking alternative health insurance options. This type of coverage is designed to bridge the gap until you can secure long-term health insurance.

Considerations And Limitations

While temporary health insurance provides a quick and easy solution, it’s essential to understand its considerations and limitations.

- Duration: Temporary health insurance typically lasts a shorter duration, usually up to 12 months. It is important to note that this coverage is not intended for long-term use.

- Benefits and Coverage: Temporary health insurance may not offer the same comprehensive coverage as long-term health insurance plans. It typically covers essential health benefits, such as emergency services, lab tests, and preventative care, but may have limitations on pre-existing conditions and specialized treatments.

- Cost: Temporary health insurance plans are often more affordable than traditional plans. However, it is essential to carefully evaluate the costs, including monthly premiums, deductibles, and co-pays, to ensure they fit your budget.

- Eligibility: Temporary health insurance plans may have specific eligibility requirements. For example, some plans may not be available to individuals with pre-existing conditions or those above a certain age. Checking the eligibility criteria with the insurance provider before enrolling is crucial.

Short-Term Medical Plans

Short-term medical plans are a viable option for individuals in between jobs seeking health insurance. These plans provide temporary coverage to bridge the gap until new employer-sponsored insurance starts. With easy enrollment and quick coverage, short-term medical plans offer peace of mind during transitions.

Coverage Considerations

When you find yourself in a gap betweit’sobs, it’s critical to have health insurance coverage to safeguard your well-being and finances. Short-term medical plans are a viable option to consider during this transitional period.

Restrictions And Viability

Short-term medical plans are designed to provide coverage for a limited duration, usually ranging from a few months to a year. They offer temporary protection in case of unexpected medical emergencies and ensure access to essential healthcare services.

However, it’s important to note that short-term medical plans have certain restrictions to consider before opting for them. These plans typically do not cover pre-existing conditions, preventive care, maternity care, or mental health services.

While short-term medical plans may not provide comprehensive coverage, they can still be viable if you are in good health and need temporary protection during your job transition. These plans can help bridge the gap until you secure new employment or qualify for employer-sponsored health insurance.

Before opting for a short-term medication, assessing your coverage needs and understanding the limitations is critical. Consider factors such as your current health condition, ongoing medications, and any potential future medical needs.

Short-term Medical Plans

Short-term medical plans offer a range of benefits, including:

- Emergency medical care coverage

- Hospitalization and surgery coverage

- Prescription drug coverage

- Access to a network of healthcare providers

- Flexible coverage periods

These plans can be an affordable alternative for individuals who require temporary health insurance coverage. Before deciding, comparing different plans and understanding their benefits and limitations is essential.

Remember, short-term medical plans should not be considered a long-term solution. They are designed to provide temporary coverage during job transitions or other similar circumstances.

Seeking Alternative Options

When facing a change in employment, it’s critical to plan for the transition of health insurance coverage. Seeking alternative options during this pivotal time can provide a safety net for unforeseen medical events. Understanding the available resources can ease the stress of navigating health insurance between jobs.

Community Support And Advice

Community engagement can provide valuable insights and advice when seeking alternative health insurance options. Local support groups and online forums can offer firsthand experiences and suggestions, aiding decision-making. Through these platforms, individuals can better understand available options and potential pitfalls to avoid.

Local, State-based Programs

Exploring local and state-based programs is essential for individuals navigating the gap between job-based health insurance coverage. These programs may include subsidies, low-cost or free coverage options, and specific eligibility criteria. Researching these programs can uncover valuable alternatives that align with individual needs and financial circumstances.

Healthcare Coverage Decisions

One crucial decision to consider when transitioning between jobs is securing health insurance coverage. The absence of employer-sponsored healthcare can create a coverage gap, leading to potential financial and health risks. Making informed choices about healthcare coverage during job transitions is vital for ensuring uninterrupted access to medical care.

Tips For Choosing Coverage

- Compare available insurance plans to find the most suitable option.

- Consider enrolling in a short-term health insurance plan to bridge the gap.

- Explore options in the healthcare marketplace for affordable coverage.

- Assess your specific healthcare needs and those of your family.

Factors To Consider

- Cost of premiums, deductibles, and co-pays for different plans.

- Coverage for pre-existing conditions under the selected insurance.

- Availability of preferred healthcare providers wiplan’she plan’s plan.

- Inclusion of essential health benefits such as prescription drugs and preventive care.

Next Steps After Securing Coverage

Transitioning To New Employment

Once you secure health insurance between jobs, transitioning to new employment may affect your age. Make sure you understand how your current plan will carry over to your new job’s package.

Long-term Health Insurance Planning

While securing coverage in the interim, it’s essential to consider long-term health insurance planning. Explore options like COBRA or Marketplace plans to ensure uninterrupted coverage.

Frequently Asked Questions

How Long Are You Covered On Insurance After Leaving Health Insurance in Between Jobs?

After leaving a job, you can continue insurance coverage through COBRA for up to 18 months.

Do I Get Cobra If I Quit?

If you quit your job, you can get COBRA coverage to continue your health insurance.

Is It Bad To Have A Gap In Health Insurance Coverage?

A gap in health insurance coverage can have negative consequences. Studies have shown that individuals with disrupted coverage are less likely to have access to care, resulting in unmet healthcare needs and potential medical debt. It is essential to bridge the gap with temporary health insurance options or enrol in a Marketplace plan to ensure continuous coverage.

Does Cobra Coverage Begin Immediately?

COBRA coverage begins immediately upon paying required premiums after a qualifying event. The length of coverage varies based on the event.

Conclusion

Are you navigating health insurance between jobs? Remember, explore temporary plans like COBRA for seamless cDon’tgrDon’tapsrDon’taps. Take charge of your health today.