First Enroll Health Insurance: Get Your Coverage Now!

First Enroll Health Insurance: visit FirstEnroll for a seamless billing and enrollment process. FirstEnroll ensures a smooth experience for all your insurance needs from lead to payment.

Focusing on customer service and efficiency, FirstEnroll streamlines enrollment, making it easy and accessible for individuals and families in Austin, Texas, and across the United States. Providing a one-stop solution for health insurance, FirstEnroll simplifies the often complex and overwhelming task of securing adequate coverage.

By choosing FirstEnroll, you can rest assured that your health insurance needs will be efficiently managed, allowing you to focus on what matters most – your health and well-being.

Credit: www.sandiegouniontribune.com

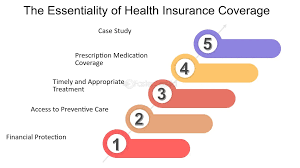

The Importance Of Health Insurance

Health insurance is vital in safeguarding our well-being and ensuring access to quality healthcare when needed. It provides financial protection, allowing individuals and families to manage unexpected medical expenses without facing overwhelming financial burdens. In this section, we will explore the importance of health insurance, focusing on two key aspects:

Financial Protection

One of the primary benefits of health insurance is its ability to provide financial protection. Medical expenses, especially in emergencies or chronic illnesses, can be exorbitant. With health insurance, individuals can mitigate the risk of incurring substantial healthcare costs. Insurance coverage allows patients to access necessary medical treatments, procedures, and prescription medications without bearing the entire financial burden.

Moreover, health insurance helps individuals budget their healthcare expenses effectively. Instead of paying out-of-pocket for every doctor’s visit, test, or medication, insurance plans offer various cost-sharing options such as copayments or deductibles. These mechanisms ensure that individuals pay a reasonable portion of the healthcare costs while the insurance provider covers the rest.

In addition to financial protection, health insurance also incentivizes preventive care. Many insurance plans cover routine check-ups, vaccinations, and screenings, encouraging individuals to prioritize their overall health and catch potential health issues early on. This proactive approach can help prevent more significant health complications in the future.

Access To Quality Healthcare

Another critical aspect of health insurance is the access it provides to quality healthcare. Without insurance, individuals may face limited options when seeking medical care. Health insurance networks typically have a wide range of healthcare providers, including doctors, specialists, hospitals, and clinics, ensuring that policyholders have ample choices for their healthcare needs.

Insurance plans often negotiate prices with healthcare providers, resulting in more affordable rates for policyholders. This negotiation process helps keep healthcare costs under control, making quality healthcare more accessible to a broader population. Additionally, insurance plans may offer access to specialist care and necessary treatments that might otherwise be expensive or difficult to obtain without insurance coverage.

In conclusion, health insurance is paramount as it offers financial security and access to quality healthcare. It protects individuals and families from the burden of skyrocketing medical costs while ensuring they have a wide range of healthcare options to meet their needs. Next, we will delve into enrolling in health insurance and the various options available.

Understanding The Enrollment Process

When getting health insurance, understanding the enrollment process is crucial. Knowing the eligibility criteria and enrollment periods can help you navigate the process smoothly and ensure you have the coverage you need. In this section, we will break down these two aspects of the enrollment process to help you make informed decisions about your health insurance.

Eligibility Criteria

Before enrolling in health insurance, it’s essential to determine if you meet the eligibility criteria. These criteria may vary depending on the type of insurance you are applying for, but generally, they include:

- Citizenship or residency status in the relevant country

- Age requirements

- Income limits

- Employment status

- Any existing medical conditions

Meeting these criteria is essential to qualify for health insurance coverage. It’s advisable to check with your local insurance providers or government agencies to verify the specific eligibility requirements for the insurance plan you are interested in.

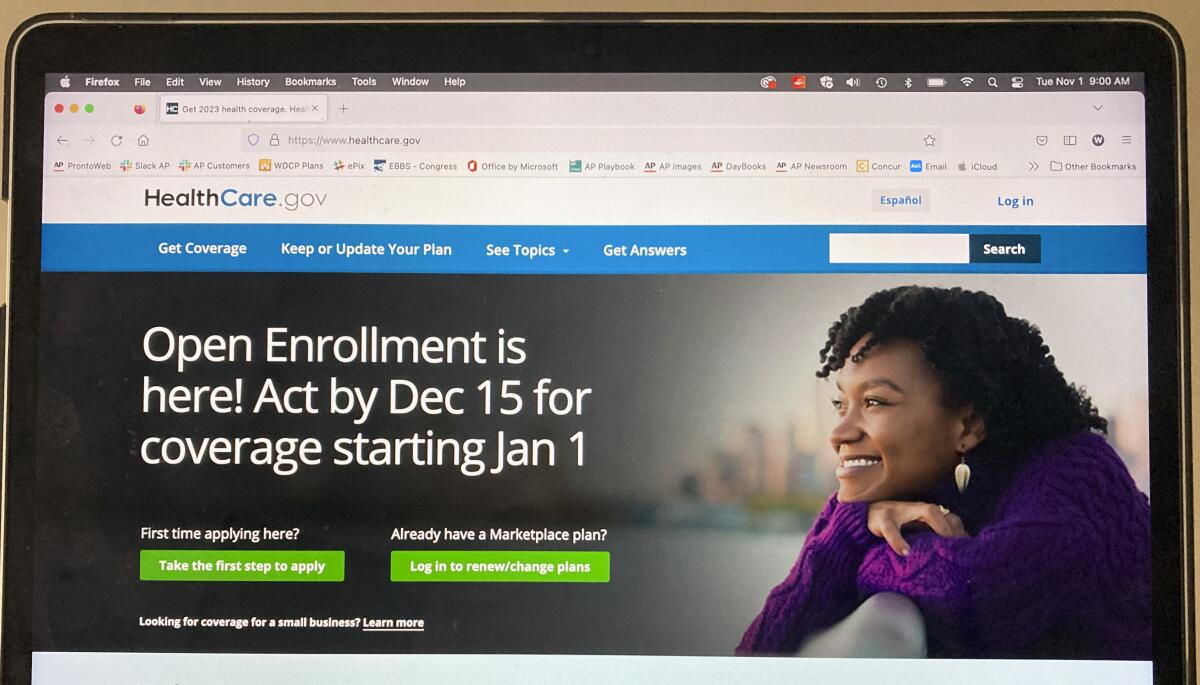

Enrollment Periods

Understanding the enrollment periods is crucial to enrolling in health insurance at the right time. In most countries, including the United States, there is an annual open enrollment period during which individuals can sign up for health insurance or make changes to their existing plans. This period usually occurs once a year and has a specified start and end date.

However, there are also special enrollment periods for individuals who experience certain life events, such as losing employer-sponsored coverage, getting married, having a baby, or moving to a new location. These events may qualify you for a particular enrollment period, allowing you to obtain health insurance outside the regular open enrollment period.

It’s important to note that missing the open enrollment period or not qualifying for a particular one may result in a gap in your health insurance coverage. To avoid this, staying informed about the enrollment periods is crucial, as well as taking timely action to ensure you and your family have continuous health insurance coverage.

Choosing The Right Plan

Choosing the Right Plan:

It is crucial to make an informed decision when selecting a health insurance plan. From understanding the different types of plans to comparing coverage and costs, here’s a guide to help you navigate the process.

Types Of Health Insurance Plans

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

Comparing Coverage And Costs

| Plan Type | Coverage | Costs |

|---|---|---|

| HMO | Restricted to network providers | Lower premiums, copayments |

| PPO | Flexibility to see out-of-network providers | Higher premiums, deductibles |

| EPO | Strictly network-only coverage | Moderate premiums, out-of-pocket costs |

Navigating The Enrollment Process

When you are ready to enrol in a health insurance plan, you must navigate the enrollment process. This can seem daunting, but several options are available to help guide you through this critical step. Here are a few ways to help simplify the process and make the best choice for your health insurance needs:

Applying Online

Applying for health insurance online can be a convenient and efficient way to enrol in a plan. Many insurance providers offer a user-friendly online application process, allowing you to compare different plans and submit your application quickly.

Seeking Assistance From Insurance Agents

If the online application process seems overwhelming, seeking assistance from insurance agents could be a good option. Insurance professionals can provide personalized guidance and help you navigate the various plan options.

This section of the blog post provides valuable information about navigating the health insurance enrollment process. It offers tips on how to apply online and seek assistance from insurance agents. By breaking down the enrollment process into manageable steps, individuals can feel more empowered and informed when making important decisions about their health insurance coverage.

Making The Most Of Your Coverage

When maximizing your health insurance coverage, understanding how to maximize your benefits is crucial.

Understanding Networks And Providers

- Networks: Networks refer to the group of doctors, hospitals, and other healthcare providers your insurance plan has contracted with. Stay within your network to maximize cost savings and coverage.

- Providers: Know your in-network healthcare providers to ensure smooth claims processing and minimal out-of-pocket expenses.

Utilizing Preventive Services

- Regular Check-ups: Schedule annual check-ups to prevent health issues and detect potential problems early.

- Vaccinations and Screenings: Take advantage of preventive services like vaccinations and screenings covered by your insurance.

Leverage your health insurance by knowing your network, utilizing preventive services, and staying informed about your coverage.

Credit: consumer.ftc.gov

Critical Considerations For The Self-employed

When self-employed, prioritizing health insurance enrollment is crucial for financial security and safeguarding against medical expenses. Taking proactive steps to secure coverage ensures peace of mind and access to essential healthcare services when needed.

Critical Considerations for the Self-Employed As a self-employed individual, purchasing health insurance requires careful consideration. Exceptional enrollment opportunities and tax implications are crucial aspects to understand.

Special Enrollment Opportunities

Special enrollment periods allow self-employed individuals to sign up for health insurance outside the open enrollment period. Circumstances such as marriage, childbirth, or loss of other coverage may qualify for special enrollment. It is essential to be aware of these opportunities to ensure continuous coverage.

Tax Implications

The self-employed may be eligible for tax deductions related to health insurance premiums. Understanding the tax implications of health insurance is vital for maximizing potential tax benefits. Consulting a tax professional can provide valuable insights into leveraging these benefits. By being attentive to exceptional enrollment opportunities and tax implications, the self-employed can confidently navigate the complexities of health insurance.

Understanding Cobra Coverage

Understanding COBRA coverage is crucial when enrolling in health insurance for the first time. COBRA allows individuals to maintain their health insurance coverage after certain qualifying events, such as job loss or divorce. Ensure you comprehend the details of COBRA to make informed decisions about your health insurance.

Health insurance is a vital aspect of your financial and physical well-being. However, circumstances change, and there may come a time when you need to transition from one insurance plan to another. One such situation where understanding COBRA coverage becomes essential is when you experience a job loss or reduced work hours. COBRA, an acronym for Consolidated Omnibus Budget Reconciliation Act, allows you and your dependents to continue the same health insurance coverage you had through your employer for a limited period. Let’s delve deeper into the qualifications, cost, and duration of COBRA coverage.

Qualifying For Cobra

If you find yourself in a situation where you lose your job or experience a significant reduction in hours, you may be eligible for COBRA coverage. COBRA allows employees and their dependents to continue the same group health insurance plan they had through their employer. To qualify for COBRA, you must meet specific criteria:

- You must be part of a group health insurance plan your employer provides.

- Your employment must have been terminated, or you must have experienced reduced hours.

- You must have been enrolled in the group health insurance plan during your employment termination or reduced hours.

Cost And Duration

While COBRA coverage ensures the continuation of your health insurance, it is essential to consider the cost and duration of this coverage. COBRA coverage typically lasts 18 to 36 months, depending on the circumstances surrounding your job loss or reduced hours. However, it is crucial to note that COBRA coverage can be pretty expensive compared to employer-sponsored group plans.

The cost of COBRA coverage can be broken down into two components: the employer’s portion and the employee’s portion. Typically, employers subsidize a significant portion of the health insurance premium. However, when you opt for COBRA, you are responsible for covering the entire premium cost, including the portion previously paid by your employer.

It is vital to carefully evaluate the cost of COBRA coverage compared to alternative options, such as health insurance plans available through the marketplace or government programs. Exploring these alternatives can help you determine the most cost-effective and suitable choice for your healthcare needs.

Conclusion And Next Steps

First Enroll Health Insurance is a reliable solution for all your billing and enrollment needs. From lead generation to payment processing and customer service, First Enroll has you covered. Contact them today to enrol in your health insurance plan.

Reviewing Your Plan Regularly

Once you have enrolled in your health insurance plan through FirstEnroll, your journey towards a secure future has just begun. It is crucial to understand that health insurance is not a one-time decision. Regularly reviewing your plan helps you stay updated with any changes in coverage, benefits, or costs that may affect your healthcare needs.

As your life evolves, so do your healthcare requirements. Marriage, starting a family, or even getting a new job can impact the coverage you need. It’s essential to reassess your plan annually to ensure it aligns with your current healthcare needs. Keeping track of changes in your health status, such as new diagnoses or chronic conditions, is also essential in making informed decisions about your plan.

Seeking Additional Resources

Managing your health insurance can be challenging, especially if you are new to the world of healthcare. Fortunately, FirstEnroll provides additional resources to assist you in navigating the complexities of health insurance.

FirstEnroll offers reliable and user-friendly customer support services to address any questions, concerns, or issues you may encounter. Their experienced representatives are well-equipped to guide you through the process, ensuring you feel confident and well-informed about your coverage choices.

Furthermore, FirstEnroll’s website features a dedicated members section. This section includes educational materials, frequently asked questions, and tips for managing your health insurance effectively. It is a valuable resource for staying updated on industry news, policy changes, and best practices.

Remember, health insurance is an investment in your well-being and financial security. By reviewing your plan regularly and seeking additional resources, you can ensure that your coverage remains suitable for your evolving needs, allowing you to access the healthcare you deserve.

Credit: www.healthcare.gov

Frequently Asked Questions On First Enroll Health Insurance

Is Health Insurance Mandatory In the US?

Health insurance is not mandatory in the US. The government does not provide health benefits, and the cost of medical care is the responsibility of individuals.

Is Health Insurance Free In The US?

Health insurance is not accessible in the US. The government does not provide health benefits, so someone has to pay for medical care.

When Did Health Insurance Start?

Health insurance started in the 1920s when the first employer-sponsored plans were introduced.

How To Get Insurance In USA?

You can use the ACA health insurance marketplace or work with a broker, insurer, or association health plan to get insurance in the USA.

Conclusion

Enrolling with FirstEnroll is an intelligent choice for your health insurance needs. Get started today for peace of mind and financial protection. With our user-friendly services, you can ensure your health is safeguarded—Trust FirstEnroll for all your insurance needs.

Reach out now!