Health Insurance Philippines: Protect Your Health and Finances

Health Insurance Philippines: Before moving, consider comprehensive international plans. Affordable options from companies like Cigna Global provide expats with full coverage.

A robust health insurance plan is essential for Filipino citizens and expatriates in the Philippines. The country offers a mix of public and private healthcare services, with the national insurance program PhilHealth providing coverage to citizens. Expats are recommended to secure international health insurance to access quality healthcare facilities during their stay.

Understanding the nuances of the Philippine healthcare system and the available insurance options is crucial for anyone residing or planning to live there. With a diverse range of plans and providers, expats can choose suitable coverage tailored to their needs.

Credit: www.pacificprime.com

The Importance Of Health Insurance In The Philippines

Health insurance in the Philippines is essential for both Filipino citizens and expats. Private health insurance coverage gives individuals access to quality healthcare facilities and services. Investing in an international health insurance plan before moving to the Philippines is highly recommended to ensure comprehensive coverage.

The Importance of Health Insurance in the Philippines Health insurance is paramount. It is crucial in ensuring access to quality healthcare and financial protection against medical expenses. This article will delve into the role of health insurance and its numerous benefits to individuals and families in the Philippines.

The Role Of Health Insurance

Health insurance in the Philippines acts as a safety net, providing individuals with access to medical services and treatments. It serves as a preventive measure, encouraging regular health check-ups and early treatment, thereby reducing the burden on the public healthcare system. Additionally, health insurance promotes a sense of security and peace of mind, knowing that one is covered in the event of illness or injury.

Benefits Of Having Health Insurance

- Financial Protection: Health insurance shields individuals from the financial strain of high medical costs, ensuring they can receive the necessary treatment without depleting their savings.

- Access to Quality Healthcare: With health insurance, individuals can access a network of healthcare providers, including hospitals and specialists, ensuring timely and efficient medical care.

- Preventive Care: Many health insurance plans offer coverage for preventive services such as vaccinations, screenings, and wellness programs, promoting overall well-being.

- Peace of Mind: Health insurance provides peace of mind, knowing that one is prepared for unexpected medical emergencies and can focus on recovery without the added financial stress.

Understanding The Healthcare System In The Philippines

In the Philippines, the healthcare system comprises a mix of public and private options, offering various services to its citizens and residents.

Philippine Health Insurance Corporation (Philhealth)

PhilHealth is the primary government agency responsible for providing health insurance coverage to Filipino citizens.

PhilHealth ensures that all Filipinos have access to essential healthcare services and financial assistance in times of medical need.

Private Health Insurance Options

Private health insurance plays a crucial role in augmenting PhilHealth’s coverage.

Private health insurance in the Philippines offers additional benefits and services, allowing individuals to access a broader range of healthcare facilities and specialists.

Choosing The Right Health Insurance Plan

When it comes to your health, choosing the right health insurance plan is crucial. Whether you are a local citizen or an expat living in the Philippines, comprehensive health insurance coverage is essential to ensure you have access to the best healthcare facilities and services. In this article, we will discuss critical considerations for expats and compare international insurance companies to help you make an informed decision.

Considerations For Expats

As an expat, it is essential to consider certain factors when choosing a health insurance plan in the Philippines:

- Coverage: Look for a comprehensive plan for inpatient and outpatient treatments and emergency medical care.

- Network of Hospitals and Clinics: Check if the insurance company has a vast network of hospitals and clinics in the Philippines, especially in the area where you reside. This ensures that you have easy access to quality healthcare services.

- Medical Evacuation: Ensure the insurance plan includes medical evacuation coverage in a medical emergency. This ensures that you will be transferred to a better-equipped hospital in the Philippines or your home country if needed.

- Optional Add-ons: Depending on your specific needs, consider whether the insurance plan offers additional benefits such as dental, vision, or maternity coverage.

Comparison Of International Insurance Companies

Here is a comparison of some leading international insurance companies that offer health insurance plans in the Philippines:

| Insurance Company | Coverage | Network of Hospitals and Clinics | Medical Evacuation | Optional Add-ons |

|---|---|---|---|---|

| Cigna Global | Comprehensive | Extensive network | Included | Dental, vision, and maternity coverage available |

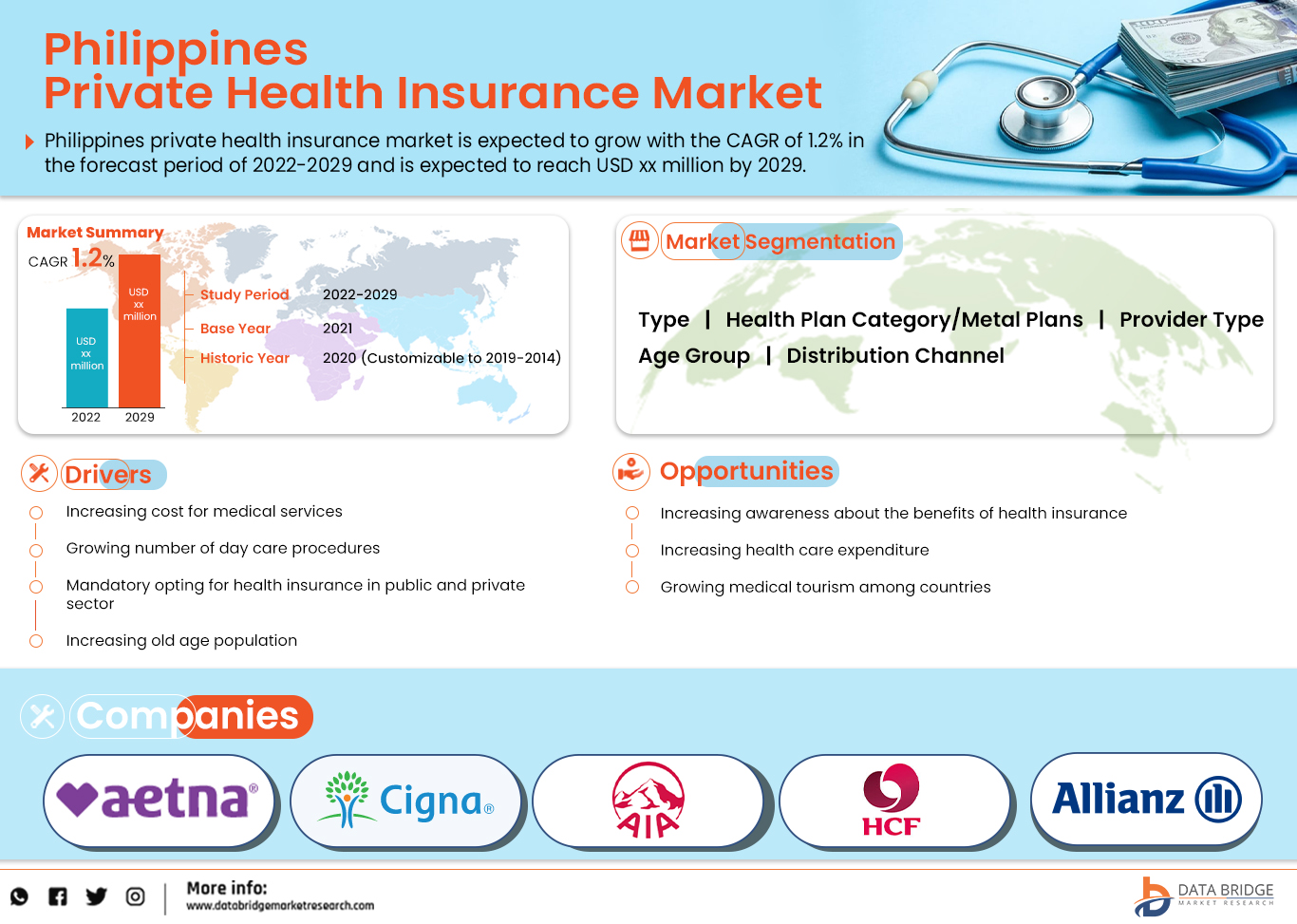

| Allianz Care | Comprehensive | Broad network | Included | Additional coverage options are available |

| Sun Life | Flexible options | Wide network | Optional | Additional coverage options are available |

It is essential to carefully review each insurance plan’s terms and conditions, coverage limits, and exclusions before deciding. Consider your healthcare needs and budget to choose the right plan that offers you and your family the best value and protection.

Navigating The Expat Health Insurance Process

Navigating the expat health insurance process in the Philippines is crucial for ensuring access to quality healthcare. Expats can secure adequate coverage before relocating with a comprehensive international health insurance plan from reputable companies such as Cigna Global. Private health insurance supplements the local healthcare system and grants expats full access to hospitals and clinics.

Obtaining International Health Insurance

As an expatriate in the Philippines, navigating the health insurance process is crucial to ensure access to comprehensive healthcare during your stay. One of the first steps you should take is obtaining international health insurance coverage. This type of insurance provides extensive medical coverage, protecting you from any unforeseen medical emergencies. When obtaining international health insurance, it is essential to consider a few key factors. Firstly, determine the coverage options that are available to you. Look for a plan that includes coverage for hospital stays, doctor visits, prescription medications, and medical procedures. This way, you can have peace of mind knowing that you will be financially protected if you need these services.

Moreover, carefully reviewing the policy details and fine print is essential. Understand the limitations, exclusions, and pre-existing conditions that may affect your coverage. If you have any existing medical conditions, disclose them to the insurance provider to avoid future issues.

Coverage For Medical Procedures And Facilities

When choosing international health insurance, it is essential to ensure the policy provides coverage for medical procedures and facilities in the Philippines. The country has various medical facilities, including hospitals and clinics, offering multiple healthcare services. To make the most of your insurance coverage, look for a policy that allows you to access a network of reputable healthcare providers in the Philippines. This way, you can receive high-quality medical care without worrying about the financial burden. Ensure the insurance policy covers inpatient and outpatient procedures and emergency room visits. In addition, the insurance plan’s flexibility when choosing medical facilities should be considered. Some policies restrict you to specific hospitals or clinics, while others offer a more extensive network. More options allow you to select the medical facility that best fits your needs and preferences. Navigating the expat health insurance process may seem overwhelming at first. Still, by obtaining international health insurance and ensuring coverage for medical procedures and facilities, you can have peace of mind knowing that you are financially protected and have access to quality healthcare services during your stay in the Philippines.

Evaluating The Quality Of Healthcare In The Philippines

Evaluating the Quality of Healthcare in the Philippines involves considering various factors such as the availability of medical facilities, qualifications of healthcare professionals, and access to essential services, including health insurance. Expats moving to the Philippines are advised to invest in international health insurance to ensure comprehensive coverage for their medical needs.

Expertise Of Medical Staff

Medical staff’s expertise is a crucial factor to consider when evaluating healthcare quality in the Philippines. Filipino healthcare professionals undergo rigorous training and education to ensure their competence in providing high-quality medical care. The country is known for producing skilled doctors, nurses, and specialists who excel in their fields. Filipino healthcare professionals also pursue further education and training abroad, gaining international exposure and expertise.

The presence of highly skilled medical staff ensures that patients receive accurate diagnoses, effective treatments, and compassionate care. Their expertise covers various medical specialties, including cardiology, oncology, orthopedics, and more. In addition, Filipino healthcare professionals are renowned for their warm and friendly bedside manner, making patients feel comfortable and well-cared for.

Facilities And Infrastructure

The facilities and infrastructure of healthcare institutions play a significant role in assessing the quality of healthcare in the Philippines. While some healthcare facilities in the country may not match the standards of high-end US or European institutions, many modern and state-of-the-art facilities are still available.

Hospitals in major cities and urban areas have advanced medical equipment, sophisticated operating theatres, and well-equipped intensive care units. These facilities are equipped to handle complex medical procedures and emergencies. Additionally, private hospitals often provide patients with luxurious amenities and comfortable accommodations.

It’s important to note that healthcare facilities in rural and remote areas might have limited resources and infrastructure. However, efforts are being made to improve healthcare access and facilities in these areas, including establishing telemedicine services and deploying medical missions.

In conclusion, when evaluating the quality of healthcare in the Philippines, considering the expertise of medical staff and the facilities and infrastructure available is essential. Filipino healthcare professionals are highly qualified and skilled, ensuring patients receive the best possible care. While there may be variations in the quality of facilities and infrastructure, the country is continuously working towards enhancing healthcare accessibility and improving standards across the nation.

Legal And Financial Aspects Of Health Insurance In The Philippines

Legal and Financial Aspects of Health Insurance in the Philippines

Regulations And Compliance

Costs And Affordability

Summary:

Prominent Health Insurance Providers In The Philippines

When looking for health insurance providers in the Philippines, finding a reliable and reputable company that offers comprehensive coverage is essential. A health insurance provider’s prominence is crucial, reflecting their credibility and capability to safeguard your health and well-being. In the Philippines, several prominent health insurance providers offer a range of products and services to cater to the diverse needs of individuals and families.

Sun Life Philippines

Sun Life is a well-established and trusted health insurance provider in the Philippines, offering various health protection plans and insurance products. With a strong reputation for reliability and financial stability, Sun Life has been serving policyholders for many years. Their health insurance products are designed to provide comprehensive coverage, including medical consultations, hospitalization, and other healthcare benefits. Sun Life Philippines prioritizes the well-being of their clients, making them a prominent choice for individuals seeking quality health insurance in the country.

Cigna Global

Cigna Global is a prominent international insurance company that offers comprehensive health insurance plans for expatriates and individuals residing in the Philippines. With a global presence and a strong focus on customer satisfaction, Cigna Global is known for its extensive network of healthcare providers and innovative insurance solutions. Their health insurance plans are tailored to meet the specific needs of expatriates and provide access to quality healthcare services in the Philippines. Bglobal’signa Global’s prominence in the health insurance industry makes it a reliable choice for individuals seeking comprehensive coverage and peace of mind.

Credit: www.databridgemarketresearch.com

Guidance For Filipino Citizens In Choosing Health Insurance

Guidance for Filipino Citizens in Choosing Health Insurance

Types Of Medical Insurance Available

Different types of medical insurance are available for Filipino citizens in the Philippines. Some standard options include:

- Individual Health Insurance

- Family Health Insurance

- Group Health Insurance

- Senior Citizen Health Insurance

Considerations For Optimal Coverage

When selecting health insurance, Filipino citizens should consider the following factors to ensure optimal coverage:

- Coverage Limits

- Network of Hospitals and Clinics

- Pre-existing Conditions Coverage

- Co-payment and Deductibles

Credit: kwik.insure

Frequently Asked Questions

Can Americans Get Healthcare In The Health Insurance Philippines?

Americans can get healthcare in the Philippines by purchasing an international health insurance plan.

Can You Buy Private Health Insurance In The Philippines?

Yes, you can buy private health insurance in the Philippines. Many Filipino citizens and expats have covePhilippines’ Philippines’ Healthcare System Good?

The healthcare system in the Philippines is generally high-quality, with highly qualified medical staff. However, the facilities may not be as advanced as those in the US or Europe. It is recommended that expats invest in international health insurance before arriving in the country.

Should You Get A Health Insurance In The Philippines?

Invest in international health insurance before arriving in the Philippines for comprehensive coverage.

Conclusion

In the Philippines, having international health insurance is crucial for expats. Access to quality healthcare services requires proper coverage from leading insurers. It is advisable to secure health insurance before relocating to ensure comprehensive medical protection. Consider options from reputable companies like Cigna Global for peace of mind.