Health Insurance in Montana: Your Guide to Affordable Coverage

Health Insurance in Montana offers various plans for individuals and families. Blue Cross Blue Shield of Montana is one of the top providers, offering individual and Medicare plans.

In contrast to some states, Montana does not operate a state-run health insurance marketplace, but residents can still find affordable plans through private insurers like Kaiser Permanente and Oscar. Medicaid is also available for those who qualify based on income.

Additionally, supplemental plans for dental, vision, and accident insurance can be obtained year-round through UnitedHealthOne. Coverage can be applied online, by phone, or in person through the federal Health Insurance Marketplace.

Credit: www.google.com

State Of Health Insurance In Montana

Montana’s iMonmMMontana’ss is a blend of offerings catering to its residents’ diverse healthcare needs. Understanding the state of health insurance in Montana is crucial for individuals and families seeking adequate coverage.

Landscape Of Health Insurance Market

The health insurance market in Montana offers various options from different providers, offering a range of coverage levels and premiums to meet the varying needs of consumers across the state.

Types Of Health Insurance Plans Available

- Blue Cross Blue Shield: Offers comprehensive individual and family plans, as well as Medicare options.

- Kaiser Permanente: Known for its high-quality plans and focus on member health.

- Oscar: Provides innovative health management programs for better care.

- Aetna CVS Health: Ideal for urgent care needs with same-day care options.

While comparing different health insurance providers, it’s essential to consider factors such as cit’sc’s benefits, network providers, and costs to make an informed decision.

Individuals in Montana can also explore Medicaid options based on income eligibility, ensuring access to essential healthcare services.

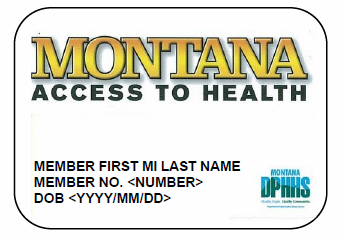

Credit: dphhs.mt.gov

Affordability Factors

Find affordable health insurance options in Montana based on your budget and needs. Compare different plans and get an instant quote from licensed insurance agents.

Cost Of Health Insurance In Montana

When considering health insurance in Montana, one of the primary concerns for individuals and families is the cost of premiums. Montana Health Insurance premiums can vary based on several factors, including the type of plan, coverage level, and the insurance provider. It is essential to carefully assess the cost of premiums and evaluate how it fits within your budget.

Subsidies And Financial Assistance Options

Subsidies and financial assistance options are available to help make health insurance more affordable for individuals and families in Montana. The Montana Health Insurance Marketplace provides financial assistance and tax credits to eligible individuals and families, reducing the overall cost of insurance premiums. Understanding and exploring these options is crucial to accessing affordable healthcare coverage.

| Insurance Providers | Recommended Plans |

|---|---|

| Blue Cross Blue Shield of Montana | Individual and Family Plans, Medicare Plans |

| Kaiser Permanente | Highest Quality Plans |

| Aetna CVS Health | Best for Same-Day Care |

When exploring health insurance options in Montana, it is crucial to consider the various health management programs offered by different providers, as well as the accessibility of care for other medical needs.

Maximum Income And Medicaid Eligibility

Understanding the maximum income threshold to qualify for Medicaid in Montana is essential for individuals and families seeking reduced-cost health coverage. The eligibility criteria for Medicaid should be thoroughly assessed to determine the availability of financial assistance for obtaining health insurance.

- Apply for Medicaid and reduced-cost health coverage through the federal Health Insurance Marketplace.

- Evaluate eligibility for subsidies and tax credits

- Compare individual and family plans offered by different insurance providers

By exploring these affordability factors, individuals and families can make informed decisions regarding their health insurance options in Montana, ensuring access to quality healthcare coverage while maintaining financial stability.

Choosing The Right Plan

Choosing the right plan for health insurance in Montana is crucial. With various options available, it is essential to consider factors such as coverage, cost, and network providers to ensure that you have the best plan that fits your needs and budget.

Factors To Consider While Selecting A Plan

Choosing the right health insurance plan can be a daunting task, especially with the numerous options available in Montana. To make an informed decision, it is essential to consider various factors that will ensure the plan aligns with your specific needs. Here are some key factors to consider:

- Coverage: Assess the coverage provided by different plans and determine whether it includes the services and treatments you require. Look for coverage that provides for doctor visits, hospital stays, prescriptions, and preventive care.

- Cost: Evaluate the costs associated with each plan, including premiums, deductibles, co-pays, and coinsurance. Calculate how much you can afford to pay upfront and compare the overall costs of each plan.

- Network: Check whether your preferred healthcare providers are included in the plan’s network. If you plan to continue seeing specplan’san’sntinueensure, they are within the network to avoid additional out-of-pocket expenses.

- Prescriptions: If you take regular medications, review each plan’s prplan’stion coverage. EnsurplanEnsurplan’stion plans areplan’sareplan’sancopayments or coinsurance are required.

- Fl are assessedexibility: Consider the plan’s fleplan’sty. Some plans may limit your choices of healthcare providers or require referrals for specialist visits, while others provide more freedom in choosing providers.

- Additional Benefits: Look for additional benefits offered by the plan, such as wellness programs, telehealth services, or discounts on gym memberships. These extra perks can enhance your overall healthcare experience.

Comparison Of Major Health Insurance Providers In Montana

When it comes to choosing the right health insurance plan in Montana, understanding the significant providers can help you make an informed decision. Here’s a cHere’ssoncoHere’sonf the leading health inHere’sidinHere’sideHere’sre’se

| Key Features | |

|---|---|

| Blue Cross Blue Shield of Montana | Offers a range of individual and family healthcare plans |

| Kaiser Permanente | Known for providing the highest quality plans with comprehensive coverage |

| Oscar | Offers extensive health management programs for personalized care |

| Aetna CVS Health | Best for same-day care and convenient access to CVS pharmacies |

By comparing these major health insurance providers, you can gain a better understanding of the different offerings and find the plan that best suits your needs.

Remember, when choosing a health insurance plan in Montana, you must consider factors such as coverage, the city’s entity’s netit’sit’sescriptionsity, and additional benefits. By carefully evaluating these factors and comparing significant providers, you can make an informed decision and select the right plan for your healthcare needs.

Credit: www.valuepenguin.com

Specialized Health Programs

Montana offers several specialized health programs to ensure residents have access to quality healthcare coverage. Below are details about Medicaid eligibility and expansion, as well as the HELP Plan for health insurance coverage in the state.

Medicaid Eligibility And Expansion In Montana

Medicaid in Montana provides health coverage for eligible low-income individuals and families. To qualify, individuals must meet specific income requirements set by the state.

- Income limits determine Medicaid eligibility.

- The program assists low-income individuals.

- Expansion increases coverage options.

Help Plan For Health Insurance Coverage In The State

The HELP Plan in Montana offers health insurance coverage to individuals who do not qualify for traditional Medicaid but still need assistance. This program provides crucial healthcare services to those in need.

- Designed for individuals not eligible for Medicaid

- Provides essential healthcare services

- Supports those requiring assistance

Navigating The Enrollment Process

Navigating the enrollment process for health insurance in Montana can be complex. Understanding your options and finding a plan that fits your budget is crucial. Seek assistance from licensed agents or utilize online resources to compare and select the best plan for your needs.

Navigating the Enrollment Process Applying for Health Insurance in Montana When it comes to securing health insurance in Montana, navigating the enrollment process can seem daunting. However, understanding the different application methods and essential deadlines can simplify the process and ensure you get the coverage you need. Here’s a comprehensive guide to help you navigate the HeHere’sreHeHere’sre’sntor health insurance in Montana.

Application Methods For Health Insurance In Montana

When it’s time, it’s time for health insurance in Montana, convenience is available. Whether you prefer online applications or face-to-face assistance, you have options to choose from:

- Online Application through the Federal Health Insurance Marketplace

- Applying by Phone

- Applying in Person for Medicaid and Other Reduced-Cost Health Coverage

Deadlines And Important Information To Remember

When securing health insurance in Montana, it’s crucial to be aware of important deadlines, and keitinfoitkeitinfoit’sionit’sit’somedetails to keep in mind:

- Open Enrollment Period: The annual open enrollment period typically runs from November 1 to December 15. During this time, individuals and families can apply and make changes to their health coverage.

- SpecParticularollment Period (SEP): If you experience a qualifying life event, such as marriage, having a baby, or losing other health coverage, you may be eligible for a specparticularollment period outside the annual open enrollment period.

- Medicaid and CHIP Enrollment: Eligible individuals and families can apply for Medicaid and the Children’s Children’s Children’s Program (CHIP) year-round. ChiChildreChiChildreChildren’sen’slinesrmationure you don’t miss the opportunity for childcare coverage. In conclusion, navigating thedon’tltthedon’tlthedon’tlldon’ton’tessth in Montana involves understanding the application methods and keeping track of important deadlines. By being informed and proactive, you can successfully secure the right health insurance coverage for yourself and your family.

Additional Health Coverage Options

Are you looking to enhance your health coverage in Montana? Explore Additional Health Coverage Options that can help you secure comprehensive protection for your well-being.

Supplemental Insurance Plans In Montana

- Supplemental plans offer added benefits for medical expenses not covered by standard insurance.

- These plans can provide extra financial support during critical health situations.

- Popular options include critical illness coverage and hospital indemnity plans.

Dental, Vision, And Other Health Plan Add-ons

- Consider adding dental or vision coverage to ensure holistic health protection.

- Going for add-ons like prescription drug coverage can help manage medication expenses.

- Wellness programs and telemedicine services are additional benefits to look out for.

Frequently Asked Questions

How Much Is Health Insurance Per Month In Montana?

In Montana, health insurance costs vary. Monthly premiums can range from $200 to $800.

Does Montana Have State Health Insurance?

Montana does not have a state-run health insurance marketplace. Residents can find coverage through private insurers.

What is the maximum income required to qualify for Medicaid in Montana?

In Montana, the maximum income to qualify for Medicaid varies based on individual circumstances.

What Are The Top 3 Health Insurances?

The top 3 health insurances are Blue Cross Blue Shield, Kaiser Permanente, and Oscar.

Conclusion

Navigating the world of health insurance in Montana can be overwhelming, but with the correct information and guidance, you can find a plan that fits your needs and budget. Whether it’s indiiit’siindiit’svidualerag or suppsupplementalns, there are options available.

Take the time to explain, and it’s the choice for your health and well-being.