Health Insurance in Vermont: Your Guide to Affordable Coverage

Health insurance in Vermont offers affordable coverage through Vermont Health Connect, the state’s insurance marketplace. Eligible Vermonters can access health insurance with financial assistance.

BlueCross BlueShield is one of the popular insurance providers in the state, offering a range of plans for individuals, families, and businesses. Medicaid and Dr. Dynasaur programs provide free or low-cost health coverage for eligible residents, with special enrollment periods available for specific life changes.

It’s essential to explore the available options and compare plans to find the best health insurance coverage in Vermont that fits your needs and budget. Accessing quality healthcare is crucial, and having the right insurance can provide peace of mind and financial protection.

Credit: vtlawhelp.org

Health Insurance Options

Medicaid And Dr. Dynasaur

Medicaid and Dr. Dynasaur are Vermont programs that offer free or low-cost health coverage for eligible residents. These programs provide essential medical services and are designed to ensure that all Vermonters have access to quality healthcare.

Qualified Health Plans On Vermont Health Connect

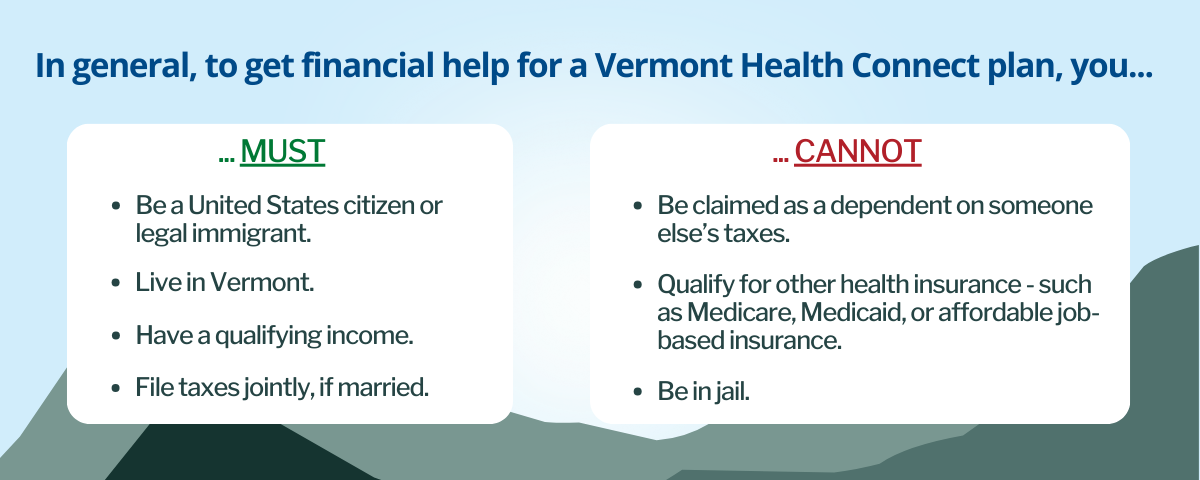

Vermont Health Connect is the state’s health insurance marketplace, providing eligible Vermonters with access to affordable health insurance plans with financial assistance. The platform offers a range of qualified health plans to cater to different needs, ensuring comprehensive coverage for individuals and families.

Private Insurance Providers

Vermont also has private insurance providers offering a variety of health insurance plans, giving residents the flexibility to choose coverage that aligns with their specific healthcare needs. These providers provide diverse options, giving Vermonters the opportunity to select insurance plans that best suit their requirements.

Eligibility And Enrollment

Health insurance in Vermont is accessible to eligible individuals through various programs and enrollment processes. Understanding the eligibility criteria and enrollment procedures is crucial for obtaining the right healthcare coverage.

Income Limits For Medicaid

Vermont’s Medicaid income limits determine who is eligible for low-cost or free health coverage through this program. Vermonters can check the income guidelines set by the state to see if they qualify for Medicaid.

Special Enrollment Periods

Vermonters experiencing qualifying life events, such as marriage, birth of a child, or loss of job-based coverage, may be eligible for a particular enrollment period. This allows individuals to enroll in a health insurance plan outside of the regular open enrollment periods.

How To Apply For Health Insurance

Applying for health insurance in Vermont involves a few steps to ensure individuals find suitable coverage for their needs. The process typically includes exploring available plans, determining eligibility, and submitting an application through Vermont Health Connect or other avenues.

- Explore available health insurance plans.

- Determine eligibility based on income and other criteria

- Complete the application process through Vermont Health Connect

For individuals seeking health insurance coverage in Vermont, it is essential to understand the options available, meet the eligibility requirements, and follow the necessary steps to enroll in a suitable plan.

Cost And Coverage

One of the most important factors to consider when choosing health insurance in Vermont is the cost and coverage options available. It’s crucial to find a plan that not only fits within your budget but also provides comprehensive coverage for your healthcare needs. In this section, we will explore the affordable plan options, tax penalties and subsidies, and the details of the benefits and coverage that you need to know before making a decision.

Affordable Plan Options

When it comes to finding affordable health insurance in Vermont, there are several plan options to consider. The Vermont Health Connect marketplace offers a range of plans with different levels of coverage and costs. These plans include Bronze, Silver, Gold, and Platinum options, each with its own set of benefits and premiums.

Medicaid and Dr. Dynasaur programs are also available for individuals and families with lower incomes. These programs offer free or low-cost health coverage for eligible Vermonters, providing an additional affordable option for those in need.

Tax Penalties And Subsidies

Understanding the tax penalties and subsidies associated with health insurance in Vermont is essential for making an informed decision. If you do not have health insurance, you may face a tax penalty when filing your state taxes. However, certain exemptions may apply, such as financial hardship or religious beliefs.

On the other hand, if you meet the income requirements, you may be eligible for subsidies that help lower the cost of your health insurance premium. These subsidies, provided through the Vermont Health Connect marketplace, can significantly reduce the financial burden of health insurance and make it more affordable for individuals and families.

Benefits And Coverage Details

Before choosing a health insurance plan in Vermont, it’s essential to understand the benefits and coverage details under each option. The different plan levels – Bronze, Silver, Gold, and Platinum – provide varying levels of coverage and out-of-pocket costs.

For example, Bronze plans typically have lower monthly premiums but higher deductibles, making them suitable for individuals who require minimal healthcare services. On the other hand, Platinum plans come with higher monthly premiums but lower deductibles and out-of-pocket costs, making them a better fit for those who anticipate more frequent and comprehensive medical needs.

Additionally, all plans in Vermont must adhere to certain essential health benefits mandated by the Affordable Care Act. These include coverage for preventive services, hospitalizations, prescription medications, and mental health services, among others. It’s essential to review the specific benefits and coverage details of each plan to ensure it meets your personal healthcare needs.

Credit: info.healthconnect.vermont.gov

Choosing The Right Plan

When it comes to health insurance in Vermont, selecting the appropriate plan is crucial for individuals and families. Understanding the available options and comparing various plans can help you make an informed decision. Here, we delve into the vital aspects to consider when choosing the right health insurance plan in Vermont.

Comparison Of Plans

Before enrolling in a health insurance plan in Vermont, it is essential to compare the available options. Consider factors such as coverage, premiums, deductibles, and provider networks to determine the most suitable plan for your needs.

Bluecross Blueshield Plans

BlueCross BlueShield is one of the most popular health insurance providers in Vermont. Their plans offer comprehensive coverage and access to a vast network of healthcare providers across the state. Reviewing the BlueCross BlueShield plans can help you find a plan that meets your healthcare needs.

Considerations For Individuals And Families

- Assess your healthcare needs and those of your family members.

- Consider any pre-existing conditions that require specific coverage.

- Evaluate the affordability of the plan, including premiums and out-of-pocket costs.

- Review the provider network to ensure your preferred healthcare providers are included.

- Check for additional benefits such as prescription drug coverage or wellness programs.

| Plan Name | Coverage | Premiums | Deductibles | Provider Network |

|---|---|---|---|---|

| Plan A | Comprehensive | $$ | $$ | Wide network |

| Plan B | Basic | $ | $$$ | Limited network |

Finding Assistance

Local Help Resources

Vermont offers a range of local help resources for individuals seeking assistance with health insurance. These resources include community health centers, free clinics, and local government offices. These local resources provide personalized support to help individuals navigate the process of obtaining health insurance.

Assistance Programs

Several assistance programs are available in Vermont to help individuals access health insurance coverage. Medicaid and Dr. Dynasaur are free or low-cost health coverage programs for eligible Vermonters. Additionally, Vermont Health Connect offers financial help to eligible residents, allowing them to enroll in qualified health plans.

Online Resources

Online resources can be invaluable when looking for assistance with health insurance in Vermont. The Vermont Health Connect website serves as the state’s health insurance marketplace, providing tools to compare plans and eligibility criteria. The Vermont Department of Health website also offers information on finding health insurance for children and youth.

Credit: vermontbiz.com

Maintaining Coverage

As a Vermont resident, it’s crucial to understand the process of maintaining health insurance coverage. Whether it’s renewing Medicaid, accessing member services and support, or utilizing your coverage effectively, staying informed is essential.

Renewal Process For Medicaid

Renewing Medicaid in Vermont is a crucial step to maintaining health insurance coverage. It’s important to be aware of the Medicaid renewal process to ensure continuous access to healthcare services. The state of Vermont provides clear guidelines and assistance to help individuals navigate the Medicaid renewal process smoothly.

Member Services And Support

Accessing member services and support is vital for individuals to make the most out of their health insurance coverage. Vermont offers extensive member services and supports to assist individuals in understanding their coverage, finding healthcare providers, and addressing any inquiries related to their insurance plan.

Utilizing Health Insurance Coverage

Effectively utilizing health insurance coverage is critical to managing healthcare needs. Understanding the benefits, coverage options, and network providers is crucial for Vermont residents. By using their health insurance effectively, individuals can access the necessary medical services without experiencing financial strain.

Frequently Asked Questions

How Much Does Health Insurance Cost Per Month In Vermont?

The cost of health insurance per month in Vermont varies. You can find affordable options that fit your budget. Medicaid and Dr. Dynasaur offer free or low-cost coverage for eligible Vermonters. You can also explore plans through Vermont Health Connect, where you may receive financial assistance.

Is Health Insurance Free In Vermont?

No, health insurance is not accessible in Vermont. Eligible Vermonters can sign up for Medicaid or Dr. Dynasaur, which offers free or low-cost health coverage for eligible individuals. Some life changes may allow for a Special Enrollment Period to sign up for or change coverage.

(41 words)

What Is The Most Popular Health Insurance In Vermont?

BlueCross BlueShield is the most popular health insurance in Vermont, offering comprehensive coverage options.

What Is The Income Limit For Vermont Medicaid?

The income limit for Vermont Medicaid varies based on family size and income. It offers free or low-cost health coverage for eligible residents. For specific income guidelines, visit the official Vermont Health Connect website.

Conclusion

Navigating health insurance in Vermont just got easier with Vermont Health Connect, offering various plans tailored to fit your needs and budget. From Medicaid to qualified health plans, finding coverage is crucial for Vermonters. Secure your health and financial well-being today with the right health insurance plan.