Health Insurance in Oklahoma: Your Ultimate Guide to Affordable Coverage

Health insurance in Oklahoma offers essential coverage for individuals and families, protecting against unexpected health costs. CommunityCare HMO is a leading provider of health insurance in Oklahoma, owned and operated locally by Saint Francis Health System and Ascension St. Oklahoma. Residents have various options to access healthcare, including through individual policies, employer-sponsored plans, or government programs like Medicare and SoonerCare.

Finding the best health insurance plan in Oklahoma involves considering factors such as coverage benefits, provider networks, and cost. Blue Cross and Blue Shield of Oklahoma is recognized for offering quality and affordable health insurance statewide. By exploring different insurance options and understanding your coverage needs, you can secure adequate healthcare protection in Oklahoma.

Understanding Affordable Coverage

Understanding Affordable Coverage is crucial when it comes to ensuring you and your family have access to the healthcare services you need without breaking the bank. In Oklahoma, various factors can affect the affordability of health insurance plans. It’s essential to consider these factors to make informed decisions when selecting a plan that meets your healthcare needs without straining your budget.

Factors Affecting Affordable Coverage

When looking for affordable health insurance in Oklahoma, several vital factors can impact the cost and availability of coverage. These factors include:

- Age and gender of the individual

- Health history and pre-existing conditions

- Income level and household size

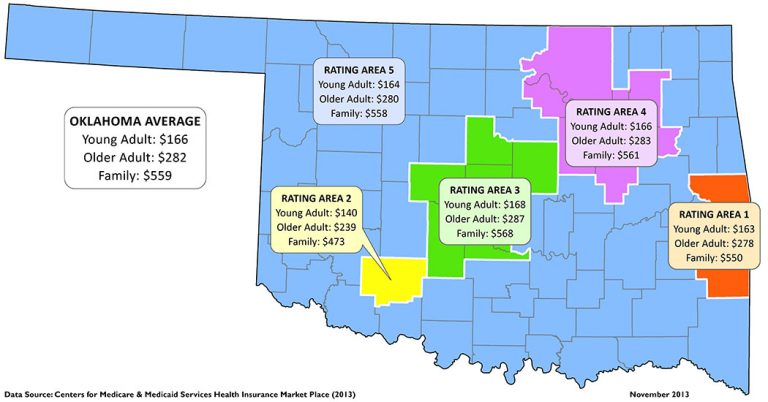

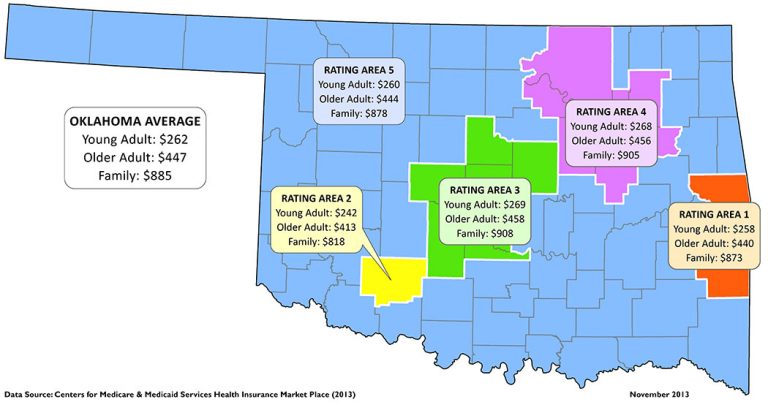

- Geographic location

- Plan type and coverage options

Government-sponsored Plans In Oklahoma

Oklahoma offers several government-sponsored health insurance plans to help individuals and families access affordable coverage, including:

- SoonerCare (Medicaid) – Provides healthcare coverage to eligible low-income individuals.

- Medicare is a federal program that primarily serves seniors aged 65 and older and individuals with specific disabilities.

- VA Healthcare – Offers healthcare benefits to eligible veterans and their families.

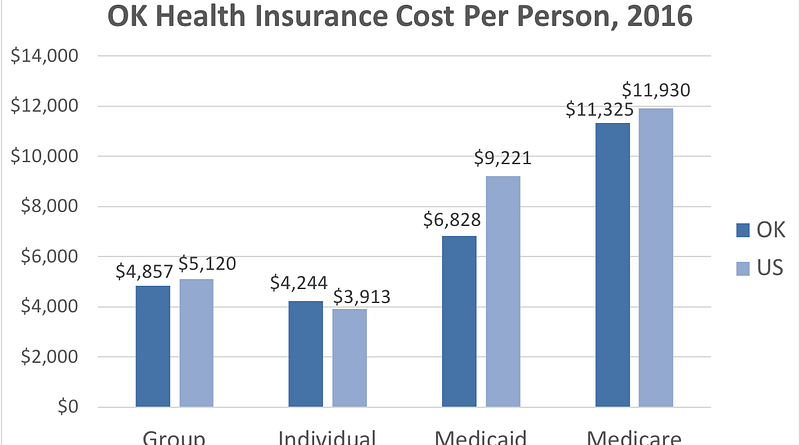

Credit: extension.okstate.edu

Available Health Insurance Providers

Start of blog post section about Available Health Insurance Providers in Oklahoma

Exploring available health insurance providers in Oklahoma can be crucial for making informed decisions about your healthcare needs. Below are two prominent health insurance providers in Oklahoma:

Community care Hmo

CommunityCare HMO is a leading health insurance provider that stands out for its local ownership and operation by Saint Francis Health System and Ascension St.

Blue Cross And Blue Shield Of Oklahoma

Blue Cross and Blue Shield of Oklahoma is the sole statewide customer-owned health insurer in Oklahoma, emphasizing consumer and employer satisfaction.

Finding The Best Health Insurance

Having the right health insurance coverage is crucial for securing your health and well-being. This is especially true in Oklahoma, where finding the best health insurance plan can seem daunting. With so many options available, it’s essential to compare plans and utilize resources to find the most affordable coverage that suits your specific needs. In this article, we will explore the importance of comparing plans and provide resources that can help you find the best health insurance in Oklahoma.

Comparing Plans

When it comes to health insurance, comparing plans is essential to ensure you’re getting the best coverage at the most affordable price. To compare plans effectively, consider the following factors:

- Coverage: Assess the extent of coverage provided by each plan. This includes doctor visits, hospital stays, prescription medications, and more.

- Network: Determine if your preferred healthcare providers are included in the plan’s network. This ensures that you have access to the doctors and specialists you trust.

- Costs: Evaluate the monthly premiums, deductibles, copayments, and out-of-pocket maximums for each plan and understand how these costs may impact your overall budget.

- Additional Benefits: Note any additional benefits offered by the plan, such as wellness programs, preventive care coverage, or telehealth services.

By carefully evaluating these factors, you can make an informed decision that aligns with your healthcare needs and budget.

Resources For Finding Affordable Plans

Fortunately, there are numerous resources available to help you find affordable health insurance plans in Oklahoma. Consider utilizing the following:

| HealthCare.gov | Find a Health Insurance Plan |

| Obamacare Plans | Find ObamaCare Plans |

| United Healthcare | Private Healthcare Plans – Need Health Coverage Now? |

| Sidecar Health | Healthcare Insurance Quotes – See Any Doctor |

| Blue Cross and Blue Shield of Oklahoma | Oklahoma Health Insurance |

These resources provide valuable information and support in finding the best and most affordable health insurance plans in Oklahoma. Remember to explore multiple options and compare quotes to ensure you find the coverage that suits your needs.

Credit: extension.okstate.edu

Navigating Health Insurance Options

Health insurance is crucial for protecting your well-being in Oklahoma. Understanding the various options available can help you make informed decisions about your coverage.

Individual Insurance Policies

Individual insurance policies provide coverage for those who are not covered under an employer-sponsored plan. These policies are tailored to meet the specific needs of individuals and families.

Employer-sponsored Plans

Companies offer employer-sponsored plans to their employees as part of their benefits package. These plans often provide comprehensive coverage and are a convenient option for many individuals.

Government Plans

Government plans, such as Medicare, SoonerCare (Medicaid), and VA health benefits, offer healthcare coverage to eligible individuals. These plans are designed to provide affordable healthcare options for those who qualify.

Understanding Premiums And Costs

When selecting a health insurance plan in Oklahoma, it’s crucial to understand the components that contribute to the cost, namely premiums and various associated expenses. By comprehending these factors, individuals can make informed decisions about their healthcare coverage.

Factors Influencing Premiums

Several factors influence the premiums of health insurance plans in Oklahoma. Provider Network: Plans with more extensive provider networks tend to have higher premiums, offering more flexibility in choosing healthcare providers. Deductibles and Copayments: Plans with lower deductibles and copayments generally have higher premiums. Age and Medical History: Older individuals and those with pre-existing conditions often face higher premiums due to increased healthcare utilization and risk. Geographic Location: Premiums may also vary based on the location within Oklahoma. Urban areas might have higher costs compared to rural areas.

Comparing Costs Of Different Plans

When comparing the costs of different health insurance plans in Oklahoma, several aspects must be evaluated. Premiums are fixed monthly payments, while Deductibles represent the amount individuals must pay out of pocket before the insurance company starts covering costs. Other crucial factors to consider include Copayments, Coinsurance, and Out-of-Pocket Maximums. It’s advisable to assess these elements to determine the overall cost and benefits of each plan.

Seeking Affordable Healthcare Solutions

Health insurance is an essential coverage that helps protect you and your family. However, finding affordable healthcare solutions can be challenging, especially in Oklahoma. This article aims to explore some options to bridge the gap and make healthcare more accessible to individuals and families in need.

Short-term Gap Coverage

Short-term gap coverage is a viable option for individuals who find themselves in between health insurance plans. This type of coverage provides temporary financial protection and peace of mind during unforeseen circumstances. Whether you are transitioning between jobs or waiting for open enrollment, short-term gap coverage can help ensure that you have access to essential healthcare services when you need them most.

Exploring Alternative Coverage Options

When it comes to seeking affordable healthcare solutions, it is essential to explore alternative coverage options. One such option is Medicaid, also known as SoonerCare in Oklahoma. This government program provides health insurance to low-income individuals and families who meet the eligibility criteria. Medicaid offers comprehensive coverage at a reduced cost, making it an attractive option for those who need affordable healthcare.

- Another alternative coverage option to consider is the Health Insurance Marketplace. Companies like Blue Cross and Blue Shield of Oklahoma offer a wide range of health insurance plans tailored to different needs and budgets. You can compare and select a plan that suits your requirements, ensuring access to quality healthcare without breaking the bank.

- Furthermore, joining an association group or obtaining coverage through your employer-sponsored health plan can provide cost-effective healthcare solutions. These options often offer group rates and additional benefits, making healthcare more affordable for individuals and their families.

Overall, seeking affordable healthcare solutions in Oklahoma requires exploring different coverage options and finding the one that best fits your needs and budget. Whether it’s short-term gap coverage, Medicaid, or alternative private insurance plans, taking proactive steps toward securing affordable healthcare can create a significant impact on your overall well-being.

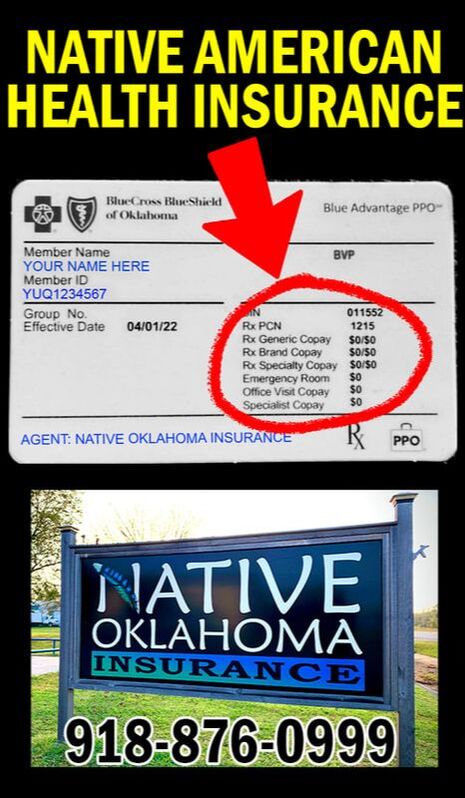

Credit: www.nativeokinsurance.com

Frequently Asked Questions

How Much Is Health Insurance Per Month In Oklahoma?

Health insurance costs in Oklahoma vary depending on several factors. To find the exact amount, it is best to get quotes from different providers. CommunityCare Blue Cross and Blue Shield of Oklahoma are among the most significant health insurance companies in the state.

It is essential to consider individual needs when choosing the best health insurance plan.

What Is The Largest Health Insurance Provider In Oklahoma?

CommunityCare is the largest health insurance provider in Oklahoma. Locally owned and operated, it is backed by Saint Francis Health System and Ascension St.

How Do I Get Health Care In Oklahoma?

In Oklahoma, health care is available through individual insurance, employer-sponsored plans, group associations, or government programs like Medicare or Medicaid. CommunityCare is a state primary health insurance provider. For more options, visit the Oklahoma Insurance Department’s website.

What Is The Best Health Insurance In Oklahoma?

The best health insurance in Oklahoma is offered by CommunityCare HMO, a locally owned and operated provider. You can receive coverage through an individual policy, employer-sponsored plan, or government program. Blue Cross and Blue Shield of Oklahoma are also reputable options.

Conclusion

Navigating health insurance in Oklahoma can be complex. Finding the right plan is crucial. Whether through individual policies, employer-sponsored plans, or government options, ensure you and your family are covered. CommunityCare is a top choice, offering quality care in the state.

Prioritize your health and peace of mind.