Can Your Employer Cancel Your Health Insurance? Find Out Your Rights Now!

Can Your Employer Cancel Your Health Insurance? at any time? The decision is based on the employer’s discretion and can happen without prior notice.

Health insurance is vital to overall well-being, providing coverage for medical expenses. However, it’s essential to understand the circumstances under which an employer may cancel health insurance and the potential consequences for employees. Employers hold the authority to terminate health insurance benefits, making it crucial for individuals to be informed about their rights and available options.

Awareness of the possibilities can help employees prepare for sudden changes and seek alternative coverage. In this comprehensive guide, we will explore the circumstances under which an employer can cancel health insurance and the implications for employees, empowering individuals with the knowledge needed to navigate potential disruptions in their health coverage.

Exploring Employer Rights

Your employer has the right to cancel your health insurance, especially if you’re absent from work or your employment status changes. This could happen during an amendment to the existing plan or a termination of the plan. Understanding your rights in such situations is essential, and seeking legal advice if needed.

Insurance Policy Amendments By Employers

An employer can change or terminate existing health insurance plans at any time.

Impact Of Employer Size On Insurance Termination

Large businesses typically cannot cancel health insurance coverage, while small companies may have the legal authority.

California protects against employer retaliation, ensuring coverage cannot be discontinued when filing a workers’ compensation claim.

Employers can adjust health benefits for retired former employees who become eligible for Medicare without violating employment laws.

Understanding Employee Rights

Employers can cancel health insurance, especially for plan amendments or employee status changes. Small businesses may halt coverage, but protections exist against unfair actions, such as stopping insurance due to workers’ compensation claims. California law safeguards employees in such instances.

Rights Of Employees For Canceling Insurance

As an employee, you have certain rights regarding your employer canceling your health insurance. The Employee Retirement Income Security Act (ERISA) outlines these rights, ensuring you are not unfairly deprived of health coverage.

Here are the fundamental rights employees have when it comes to canceling insurance:

- Protection under the Employee Retirement Income Security Act (ERISA).

- The right to continued coverage through COBRA in the event of job loss or certain other qualifying events.

- The right to be informed about any changes to your health insurance coverage promptly.

Limitations On Canceling Insurance

While employees have rights related to health insurance cancellation, there are also limitations on canceling insurance that employers must adhere to. Understanding these limitations can help protect your coverage.

- Employers cannot arbitrarily cancel health insurance coverage without giving employees proper notice.

- Under the Affordable Care Act (ACA), employers are subject to rules and regulations regarding cancellations and changes to health insurance plans.

Navigating Health Insurance Policies

Employers can cancel health insurance policies, particularly in small businesses. However, workers’ compensation claims in California ensure protection against such actions. Knowing your rights and seeking assistance is essential if faced with such a situation.

Cancellation Procedures For Employees

As an employee, it is essential to understand the procedures and regulations surrounding canceling your health insurance. While it is generally challenging for employers to cancel your health insurance coverage, certain circumstances may warrant such actions. Familiarizing yourself with the cancellation procedures can help you navigate any unforeseen changes.

When canceling health insurance, your employer is generally not allowed to terminate your coverage without providing notice and valid reasons. However, reviewing your employment contract to understand the specific terms and conditions regarding health insurance cancellation is crucial. Some employers may include clauses that outline the circumstances under which your coverage can be canceled.

If your employer wants to cancel your health insurance, it is essential to communicate with them and understand why they decided. This will allow you to assess the impact on your healthcare coverage and explore alternative options, if necessary.

Exceptional Cases: Workers’ Compensation

Workers’ compensation is a unique scenario that can affect your health insurance coverage. In California, for example, if you file a workers’ compensation claim, your employer cannot discontinue your health insurance coverage in retaliation. However, it is essential to note that protections may vary depending on the size of your employer.

Large businesses generally cannot cancel your health insurance coverage while you are on workers’ compensation. However, they may legally terminate your coverage if you work for a smaller company. You must know your state’s specific laws and regulations to understand your rights and protections as an employee.

If your health insurance coverage is at risk due to workers’ compensation, it is advisable to consult legal resources or relevant authorities to ensure that your rights are protected.

Credit: thelawdictionary.org

Insight Into Open Enrollment

Open enrollment is a specific period designated by your employer during which you can change your health insurance coverage. This is typically the only time you can enroll or cancel your health insurance outside qualifying life events. Understanding the rules and options during open enrollment is crucial to navigating potential health insurance coverage changes.

Periodic Options For Insurance Cancellation

Your employer cannot cancel your health insurance coverage at this time. However, there are specific periods when you can cancel your employer-sponsored group health insurance if you change your life status. Here are some instances when you may have the option to cancel your insurance:

- When you get married or divorced

- When you have a child or adopt a child

- When your spouse or dependent loses coverage

You may cancel your employer-sponsored health insurance and explore other options during these life status changes. You must check with your employer’s HR department to understand the specific rules and timeframes for cancellation during such events.

Effects Of Life Status Changes On Insurance Cancellation

Life status changes can have significant impacts on your insurance cancellation options. For example, if you get married, you can join your spouse’s employer-sponsored health insurance or switch to a family plan. On the other hand, if you go through a divorce, you may need to find alternative insurance coverage, such as through the Health Insurance Marketplace or COBRA.

Considering the potential consequences of canceling your employer-sponsored health insurance is essential. If you cancel your insurance without securing a new plan, you may face a coverage gap, leaving you vulnerable to unexpected medical expenses. Before making a final decision, take the time to fully understand the implications of canceling your health insurance.

In conclusion, open enrollment allows you to adjust your health insurance coverage to suit your needs better. Periodic life status changes also enable you to reconsider your insurance options. Whether you choose to cancel your employer-sponsored health insurance or not, carefully evaluate your choices and seek guidance from your employer’s HR department to ensure that you maintain adequate health coverage.

Managing Group Health Plans

Managing your group health plan is crucial for your overall well-being as an employee. It’s essential to understand your options for canceling your group health insurance and the considerations you need to make before dropping coverage.

Employee’s Options For Canceling Group Plans

If you find yourself in a situation where you want to cancel your group health insurance, a few options are available. These options include:

- Open Enrollment Period: Most employers provide an open enrollment period during which employees can change their health insurance coverage. This is typically the most accessible and convenient time to cancel your group plan and explore other options.

- Qualifying Life Event: Certain life events, such as getting married, having a baby, or losing coverage through another source, may be eligible for a particular enrollment period. You can cancel your group plan and enroll in a different health insurance plan during this time.

- COBRA Coverage: If you leave your job or experience reduced work hours, you may be eligible for COBRA coverage. COBRA allows you to continue your group health insurance plan for a limited period, even after leaving your job.

Considerations Before Dropping Group Coverage

Before you drop your group health insurance coverage, it’s essential to consider certain factors that may impact your future healthcare needs and finances. These considerations include:

- Cost: Evaluate the cost of alternative health insurance plans and compare them to your current coverage. Consider premiums, deductibles, copayments, and out-of-pocket maximums.

- Network: Determine whether the alternative health insurance plans you are considering have a network of healthcare providers that meet your needs. Ensure that your preferred doctors and hospitals are included.

- Benefits: Assess the benefits your current group health plan provides and the benefits offered by alternative insurance options. Consider prescription coverage, preventive care, and mental health services.

- Health Status: Evaluate your current health status and any ongoing medical needs. If you have pre-existing conditions or require regular medical attention, ensure that alternative insurance plans adequately cover your healthcare needs.

By considering these factors and weighing your options, you can decide whether canceling your group health insurance is right for you. Consult with a healthcare professional or insurance advisor to ensure your decision aligns with your circumstances.

Ensuring Notification Rights

Your employer generally cannot cancel your health insurance coverage in Austin, Texas. However, if you work for a small business, they may legally stop your coverage. California protects against retaliation if your employer discontinues your coverage due to a workers’ compensation claim.

Employer Obligation To Notify For Insurance Termination

Employers are required to inform employees about any changes to their health insurance coverage, including termination.

Legal Aspects Of Termination Notification

Employers must comply with legal regulations to terminate health insurance plans to protect employees’ rights.

Steps To Can Your Employer Cancel Your Health Insurance?

To cancel your health insurance provided by your employer, you may need to wait until the open enrollment period unless you experience a qualifying life event. Reviewing your options and being aware of potential penalties for ending coverage mid-year is essential.

Cancellation Process For Employer-sponsored Plans

To cancel your employer-sponsored health insurance, follow these steps:

- Review your policy documents to understand cancellation policies.

- In writing, notify your HR department or benefits administrator about canceling.

- Ensure you have alternative coverage in place before canceling your current plan.

- Complete any required forms or paperwork for the cancellation process.

- Follow up with your employer to confirm the cancellation of your health insurance.

Guidelines For Individual Health Insurance Cancellation

If you have individual health insurance, the cancellation process may vary:

- Contact your insurance provider directly to initiate the cancellation.

- Check for any cancellation fees or penalties in your policy terms.

- Provide any necessary information requested by the insurer for the cancellation.

- For your records, we request written confirmation of the cancellation.

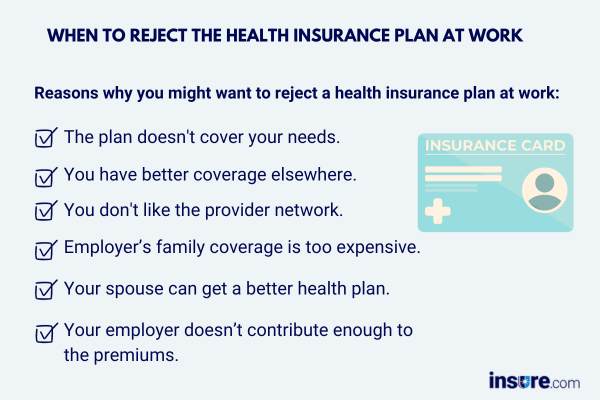

Credit: www.insure.com

Preventing Unwarranted Cancellations

Understanding the potential for unwarranted cancellations of your health insurance by your employer can help you take proactive measures to protect against any unforeseen loss of coverage. By gaining insight into regulatory measures and protection against unreasonable insurance termination, you can ensure that your health coverage remains secure.

Regulatory Measures Against Insurer Cancellations

Awareness of the regulatory measures is essential to prevent employers from unjustly canceling health insurance policies. Under regulatory guidelines, certain protections exist to safeguard employees from sudden and unwarranted termination of their health coverage. These measures serve as a safety net to ensure that employees are not left vulnerable to unexpected loss of insurance benefits.

Protection Against Unreasonable Insurance Termination

Employees should be informed about their rights and protections against unreasonable termination of their health insurance. By understanding these protections, individuals can take proactive steps to safeguard their coverage and mitigate the risk of facing sudden cancellations without cause. Awareness of the available defenses can empower employees to address any unjust termination of their health insurance.

Credit: thelawdictionary.org

Frequently Asked Questions

Can An Insurance Company Cancel Your Policy Without Notice?

An insurance company can cancel your policy without notice, depending on the terms and conditions.

Does Health Insurance End The Day You Quit Or Get Fired?

Your health insurance typically ends the day you quit or get fired.

Who Can Cancel An Insurance Policy At Any Time For Any Reason?

Policyholders may cancel their insurance policies at any time for any reason. However, penalties or a new policy may be necessary to avoid an insurance lapse.

Can My Employer Cancel My Health Insurance While On Workers’ Comp In California?

Your employer generally cannot cancel your health insurance coverage while on workers’ comp in California, primarily if you work for a big business. However, if you work for a small business, it may legally stop your coverage. In California, there are protections against retaliation, such as discontinuing coverage because you filed a workers’ compensation claim.

Conclusion

When your employer can cancel your health insurance without notice, it’s crucial to understand the legalities and your rights. Depending on your employer’s size, protections may be in place to prevent sudden cancellations. It’s advisable to stay updated on the latest employee benefit regulations to ensure you are aware of your entitlements.