Innovative Partners Health Insurance Reviews: Expert Insights.

Innovative Partners Health Insurance Reviews in Austin, Texas, United States, provide mixed feedback about their coverage and services. Some customers have reported negative experiences, stating that the insurance plan offers little to no coverage.

Before signing up with Innovative Partners, alternative options should be carefully evaluated and considered. They are not BBB accredited and do not market or sell insurance or health plans.

Credit: innovationpartners.org

The Importance Of Health Insurance Coverage

Innovative Partners Health Insurance Reviews highlight the importance of reliable health insurance coverage. With their affordable rates and flexible payment options, Innovative Partners offers quality coverage tailored to individuals’ unique health needs. Their commitment to customer satisfaction sets them apart in the industry.

Ensuring Access To Quality Healthcare

Health insurance ensures that individuals can access high-quality medical care, including preventive services, routine check-ups, and specialized treatments. With adequate insurance coverage, individuals can visit doctors, specialists, and hospitals for necessary medical care without experiencing financial barriers.

Protecting Against Financial Strain

Health insurance protects individuals from the potentially overwhelming costs of medical treatments and procedures. Adequate coverage provides a financial safety net, reducing the risk of significant medical bills that could lead to economic hardship.

Understanding Innovative Partners Health Insurance

Innovative Partners Health Insurance offers individuals and families a range of healthcare coverage options. In this blog post, we’ll explore its various aspects, giving you a better understanding of its offerings and unique features.

Overview Of Innovative Partners

When considering health insurance, it’s essential to understand the company behind the coverage clearly. Innovative Partners Health Insurance is known for its commitment to providing affordable and quality healthcare solutions to individuals and families. They offer a range of plans tailored to meet different healthcare needs.

With a focus on flexibility and comprehensive coverage, Innovative Partners aims to ensure customers have access to the healthcare services they need while managing costs effectively. Innovative Partners has positioned itself as a reliable and customer-centric health insurance provider in this competitive market.

Unique Features And Offerings

One of Innovative Partners HealthInsurance’s unique features is its emphasis on affordability without compromising on the quality of coverage. They offer a range of plans that cater to diverse healthcare needs, ensuring that individuals and families can find the right fit for their requirements.

- Comprehensive Coverage Options

- Affordable Rates

- Customized Plans

- Flexible Payment Options

Moreover, Innovative Partners is committed to providing a seamless and customer-friendly experience, focusing on responsive customer support and efficient claims processing. These unique features contribute to its reliable and consumer-focused health insurance provider position.

Benefits Of Choosing Innovative Partners

When it comes to health insurance, choosing the right provider is crucial. Innovative Partners stands out as a trusted and reliable option, offering a range of top-tier benefits. Here are some reasons why selecting Innovative Partners is an intelligent decision for comprehensive coverage and advanced healthcare solutions.

Comprehensive Coverage Options

Innovative Partners understands that everyone has unique health needs. That’s why they offer comprehensive coverage options catering to individuals and families. Their plans include preventive care, routine check-ups, and more specialized treatments and surgeries.

Innovative Partners has you covered if you’re looking for a health insurance provider that covers all your medical needs. With their comprehensive coverage options, you can have peace of mind knowing that you won’t be left with hefty medical bills in case of unexpected health issues.

Advanced Healthcare Solutions

At Innovative Partners, they believe in staying ahead of the curve when it comes to healthcare. They partner with leading hospitals and healthcare facilities to ensure their members access advanced healthcare solutions. You can expect high-quality care, cutting-edge treatments, and the latest medical technologies.

Whether you need complex surgery, specialized therapy, or ongoing medical management, Innovative Partners has the resources to provide you with the best healthcare options. By choosing Innovative Partners, you’re ensuring that you receive the most advanced and effective healthcare solutions for your specific needs.

With Innovative Partners, you’re not just getting health insurance – you’re getting a comprehensive and advanced healthcare experience. Trustworthy coverage options and access to advanced medical solutions make Innovative Partners the ideal choice for anyone who values their health and well-being.

Customer Satisfaction And Reviews

When making informed decisions about health insurance, customer satisfaction and reviews are pivotal in guiding individuals towards the right choice.

Reviewing Customer Experiences

Reviewing customer experiences provides valuable insights into the quality of services offered by Innovative Partners Health Insurance. Real-life experiences shared by customers help potential clients gauge the trustworthiness and reliability of the insurance provider.

Rating System And Feedback

The rating system and feedback mechanism enable customers to express their opinions through ratings and reviews. This transparent feedback loop assists in improving service quality and allows prospective clients to assess the overall satisfaction levels of existing customers.

Comparison With Traditional Health Insurance

Innovative Partners Health Insurance offers a fresh take on healthcare coverage, providing an alternative to traditional health insurance. With affordable rates and a flexible payment approach, they aim to provide quality coverage tailored to individual health needs. Customer feedback on Trustpilot and Better Business Bureau can provide insights into their services.

Cost-effectiveness And Value

One key consideration when comparing Innovative Partners Health Insurance with traditional health insurance plans is its cost-effectiveness and value. Traditional health insurance often comes with high premiums, deductibles, and copayments, making it expensive for individuals and families.

However, Innovative Partners Health Insurance takes a different approach by providing affordable rates and flexible payments. This ensures that everyone, regardless of their budget, can access quality healthcare coverage that fits their unique needs.

With Innovative Partners Health Insurance, individuals can enjoy lower monthly premiums and often have lower deductibles and copayments than traditional plans. This helps save money in the long run and ensures that individuals can receive the necessary medical care without incurring a significant financial burden.

Flexibility And Customization

An advantage of Innovative Partners Health Insurance is the flexibility and customization it offers to its members. Traditional health insurance plans often have limited options and rigid structures that may not meet individual needs and preferences.

On the other hand, Innovative Partners Health Insurance provides a wide range of coverage options and customization features. This allows individuals to select the coverage levels and benefits that suit their healthcare needs. Whether it is coverage for preventive care, prescription medications, or specialized treatments, Innovative Partners Health Insurance can be tailored to provide the right level of coverage.

Furthermore, Innovative Partners Health Insurance also offers the flexibility to choose healthcare providers and facilities. Unlike traditional plans with a restricted network of providers, Innovative Partners Health Insurance often has a more extensive network that includes a diverse range of healthcare professionals and facilities. This ensures that individuals can access quality healthcare services from their preferred providers, improving overall satisfaction and convenience.

Credit: openfuture.ai

Accessibility And Network Coverage

Innovative Partners Health Insurance is known for its accessible and comprehensive network coverage. Understanding the provider network overview and coverage area analysis is crucial when evaluating health insurance options.

Provider Network Overview

When assessing Innovative Partners Health Insurance, it’s essential to delve into the provider network to ensure accessibility to quality healthcare services. The network includes a wide range of healthcare providers and facilities to cater to the diverse healthcare needs of the members.

Coverage Area Analysis Innovative Partners HealthInsurance’s coverage area analysis highlights the network’s geographical reach. By understanding the coverage areas, members can ascertain the availability of healthcare services in their location and beyond.

Challenges And Limitations

Innovative Partners Health Insurance has garnered attention for its innovative approach to healthcare coverage. Still, like any insurance provider, it also faces its challenges and limitations that consumers must be aware of. Understanding these can help individuals make informed decisions about their health insurance.

Potential Drawbacks

- Network Limitations: Innovative Partners Health Insurance may have limited healthcare provider networks, which could restrict policyholders’ choice of healthcare professionals.

- Coverage Limitations: The insurance coverage provided by Innovative Partners may have specific limitations or exclusions that policyholders should thoroughly review and understand before enrolling.

- Claim Processing Time: Claim processing could be delayed and inconvenient for policyholders.

Addressing Common Concerns: Innovative Partners Health Insurance must address common concerns and clarify how it is actively working to overcome limitations. For instance, ensuring a wider network of healthcare providers, offering comprehensive coverage, and streamlining the claim process can help mitigate these challenges.

Future Trends And Industry Impact

In today’s rapidly evolving healthcare landscape, future trends and industry impact on health insurance are crucial to the overall quality of care and access to services. With ongoing advancements and innovations, it’s essential to explore how these changes are influencing the trajectory of the health insurance industry.

Innovations In Health Insurance

The health insurance sector is experiencing a wave of transformative innovations reshaping how individuals access and utilize healthcare services. Advanced technologies like telemedicine and wearable health devices are redefining the patient experience, enabling more personalized care and proactive health management.

Shaping The Future Of Healthcare

These innovations not only profoundly impact the current healthcare landscape but are also shaping the future of healthcare by fostering greater efficiency, cost-effectiveness, and improved patient outcomes. As the industry continues to embrace these advancements, it’s clear that the evolution of health insurance will play a pivotal role in driving positive changes across the entire healthcare ecosystem.

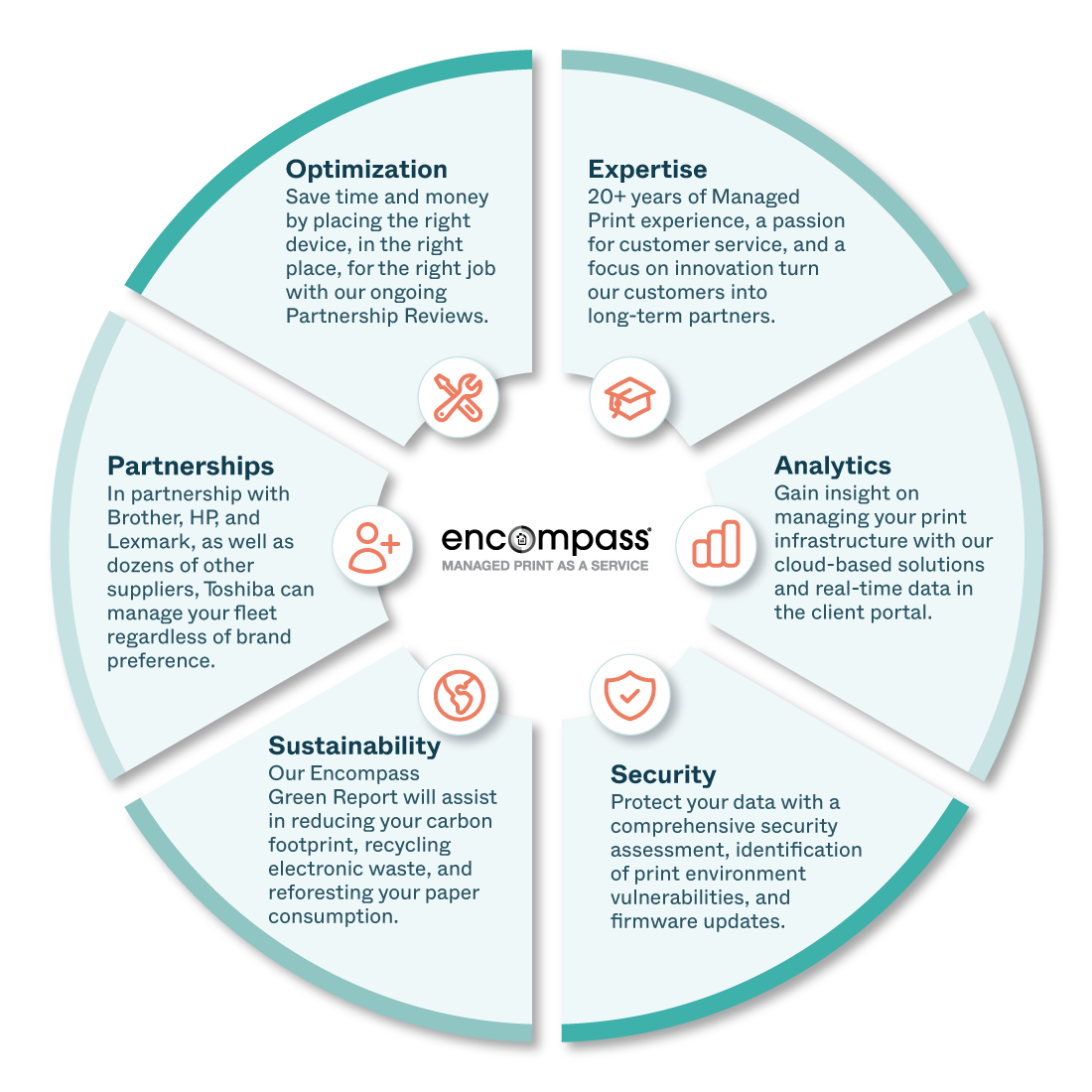

Credit: business.toshiba.com

Frequently Asked Questions For Innovative Partners Health Insurance Reviews

What Is The Best Health Insurance Company To Go With?

Different health insurance companies may be best for different individuals. It’s essential to compare coverage, networks, and costs to find the most suitable one for your needs. Research reviews and ratings to make an informed decision.

Who Owns Innovative Partners First Health Network?

First Health Network is owned by Aetna, a subsidiary of CVS Health,which is further expanding its national provider network.

Does Aviva Health Insurance Cover Pregnancy?

No, Aviva health insurance does not cover treatment for pregnancy and childbirth. However, it does cover related conditions and specific complications mentioned in the terms and conditions.

Are Innovative Partners Health Insurance Rates Affordable?

Innovative Partners offers competitive rates, ensuring quality coverage tailored to unique health needs.

Conclusion

Innovative Partners Health Insurance demonstrates its commitment to providing affordable and flexible coverage that caters to individual health needs. With a national provider network, insured individuals can access quality healthcare nationwide. Although it is essential to weigh the opinions and experiences of others, it is crucial to conduct thorough research and analysis before making any decisions about health insurance providers.

Innovative Partners strives to address customer service concerns and prioritizes their customers’ well-being.