Philadelphia American Health Insurance Reviews: Unbiased Insights

Philadelphia American Health Insurance Reviews. Customers appreciate the range of products offered but complain about payment issues.

Despite criticisms, the company remains popular among Austin residents seeking diverse coverage options. Philadelphia American Life Insurance Co provides annuities, life, health, and disability insurance products catering to various needs. This diverse range of insurance products ensures that individuals can find suitable coverage that aligns with their unique requirements.

While some customers have reported challenges with payment processes, Philadelphia American Health Insurance continues to be a sought-after provider in Austin, Texas, offering comprehensive and versatile insurance solutions to meet the community.

Credit: www.mdpi.com

Overview Of Philadelphia American Health Insurance

Philadelphia American Life Insurance Co. is recognized as a prominent insurer based in the United States, offering various insurance products and services, including annuities, life, health, and disability insurance. Focusing on providing comprehensive coverage, the company has established a strong presence in the insurance industry, ensuring a robust and reliable offering to its policyholders.

Philadelphia American Health Insurance offers a wide range of health insurance plans tailored to meet the varying needs of individuals and families. These plans encompass comprehensive coverage, including, but not limited to, preventive care, hospitalization, prescription drugs, and specialized treatments.

Credit: whyy.org

Coverage And Benefits

When considering an American health insurance company, it is crucial to evaluate the coverage and benefits they offer. Let’s delve into Philadelphia American Health Insurance’s insurance and benefits, including medical services, prescription drug coverage, and preventive care benefits.

Medical Services Covered

Philadelphia American Health Insurance ensures comprehensive coverage for a wide range of medical services, including:

- Doctor visits

- Hospital stays

- Emergency care

- Laboratory tests

- Specialist consultations

- Surgical procedures

Prescription Drug Coverage

Philadelphia American Health Insurance provides robust prescription drug coverage, making essential medications accessible to policyholders. The coverage includes generic and brand-name drugs, ensuring individuals can afford the necessary prescriptions for their well-being.

Preventive Care Benefits

Under Philadelphia American Health Insurance, policyholders can take advantage of a range of preventive care benefits, such as:

- Annual wellness exams

- Immunizations and vaccines

- Cancer screenings

- Preventive screenings for chronic conditions

- Health education and counseling

Network And Providers

Understanding the network and providers is crucial when selecting a health insurance plan. Philadelphia American Health Insurance offers a comprehensive network of healthcare providers to ensure you can access quality care when needed.

In-network Providers

Philadelphia American Health Insurance prioritizes in-network providers to offer cost-effective and accessible healthcare services. By choosing providers within the network, you can benefit from lower out-of-pocket expenses and streamlined claims processing.

Out-of-network Coverage

While in-network providers are preferred, Philadelphia American Health Insurance also provides coverage for out-of-network services. It allows you to seek care from providers outside the network, although the costs may be higher than in-network options.

Provider Network Size And Accessibility

The size and accessibility of the provider network are essential factors to consider when evaluating a health insurance plan. Philadelphia American Health Insurance boasts a vast network of healthcare professionals, ensuring you have a wide range of choices for your medical needs. Whether you require primary care, specialists, or hospitals, the network offers comprehensive coverage.

Moreover, provider accessibility is critical to receiving timely care. Philadelphia American Health Insurance strives to make it easy to schedule appointments and access healthcare services promptly.

Customer Satisfaction

Philadelphia American Health Insurance is dedicated to customer satisfaction. Offering a range of insurance products and services, including annuities, life, health, and disability coverage, it strives to meet the diverse needs of its customers in Austin, Texas, and across the United States.

Reviewing Customer Feedback

When choosing the right health insurance provider, customer satisfaction is an essential factor to consider. One way to gauge customer satisfaction is by reading and evaluating the reviews of Philadelphia American Health Insurance. By reviewing customer feedback, you can get real insights into the experiences and opinions of the policyholders.

Rating And Rankings

Philadelphia American Health Insurance has consistently received positive ratings and rankings from various sources. The insurance company has been recognized for its excellent customer service, comprehensive coverage options, and competitive pricing. Let’s take a look at the rating and rankings of Philadelphia American Health Insurance:

| Source | Rating |

|---|---|

| Better Business Bureau | A+ |

| A.M. Best Company | B+ |

| Yelp | 4 out of 5 stars |

These ratings and rankings demonstrate policyholders’ trust and satisfaction in Philadelphia American Health Insurance. The company’s ability to provide reliable and adequate health insurance solutions is reflected in these accolades.

If you are looking for the best health insurance in Pennsylvania, Philadelphia American Health Insurance should be on your list. The positive customer feedback and high ratings make it a reputable choice for individuals and families seeking quality healthcare coverage.

Claims Process

The claims process is a crucial aspect of health insurance that impacts policyholders’ overall experience. Understanding an insurance provider’s claims process is essential for ensuring a smooth and hassle-free experience when filing and getting claims approved. In this section, we will discuss the claims process offered by Philadelphia American Health Insurance, including filing a claim, turnaround time, and claims approval and denial.

Filing A Claim

Filing a claim with Philadelphia American Health Insurance is straightforward. Policyholders can initiate the process by contacting the insurance company’s customer service or accessing their online portal. They must provide all necessary documentation and details to support the claim, including medical records and bills. Philadelphia American Health Insurance aims to streamline the claims filing process for the convenience of its policyholders.

Turnaround Time

Once the claim has been submitted, Philadelphia American Health Insurance focuses on ensuring a prompt turnaround time for processing. The insurance provider strives to expedite the review process and provide timely responses to policyholders. The efficient turnaround time reflects the company’s commitment to delivering quick and efficient claims processing services to its customers.

Claims Approval And Denial

Philadelphia American Health Insurance is dedicated to fair and transparent claims procedures. Upon reviewing the submitted claim, the insurance company promptly notifies policyholders about the status of their claim. Whether a claim is capital or denied, Philadelphia American Health Insurance ensures clear communication and considers the well-being of its policyholders a top priority.

Credit: www.digitalbenefitshub.org

Costs And Pricing

Understanding the costs and pricing of Philadelphia American Health Insurance is crucial for making informed decisions about your healthcare coverage. Below, we break down the critical aspects related to costs and pricing:

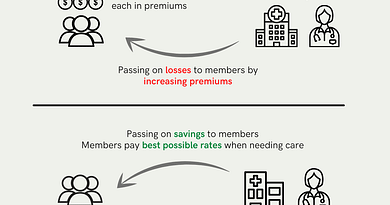

Premiums And Deductibles

- Monthly payments to maintain insurance coverage

- Varies based on the selected plan

- The amount you must pay out-of-pocket before insurance coverage kicks in

- It can vary depending on the plan selected

Copayments And Coinsurance

- A fixed amount you pay for covered services

- Usually due at the time of service

- Percentage of costs you pay for covered services after meeting the deductible

- Insurance rates can vary based on the plan

Out-of-pocket Expenses

- Include any costs not covered by insurance

- This can include deductibles, copayments, and coinsurance

- Maximum out-of-pocket limits may apply

Pros And Cons

When considering health insurance options, it is crucial to weigh the advantages and disadvantages. Philadelphia American Health Insurance has pros and cons that can influence your decision. Understanding these factors can help you make an informed choice for your healthcare needs.

Advantages Of Philadelphia American Health Insurance

- Flexible coverage options for different healthcare needs

- Quick and efficient claims processing, ensuring timely reimbursements

- The vast network of healthcare providers offering access to quality care

- Comprehensive coverage for various medical services and treatments

Disadvantages To Consider

- Some policyholders have reported challenges with claim approvals

- Limited coverage for specific specialized treatments and procedures

- Potential restrictions on the choice of healthcare providers within the network

- Higher premiums compared to other insurance providers

Frequently Asked Questions Of Philadelphia American Health Insurance Reviews

What Kind Of Insurance Is Philadelphia American?

Philadelphia American Life Insurance offers annuities, life, health, and disability insurance products and services.

Is Philadelphia American A Ppo?

Yes, Philadelphia American is a PPO health insurance provider accepted by many healthcare providers.

What is the best health insurance In PA?

Philadelphia American Life Insurance offers the best health insurance in PA. With a strong reputation and diverse offerings, it’s a top place for coverage in Pennsylvania. Customers can benefit from various options for their healthcare needs.

Who Owns Philadelphia American Life Insurance Company?

New Era Life Insurance Company owns Philadelphia American Life Insurance Company.

Conclusion

As you consider Philadelphia American Health Insurance, you’ll find an array of insurance products. With reputable services and coverage options, Philadelphia American strives to efficiently meet your health insurance needs. Make an informed decision based on your requirements and desired coverage.

Choose wisely.