Insurance for Home Health Care: Protecting Your Loved Ones

Insurance for Home Health Care provides coverage for services needed at home and offers protection for various healthcare needs.

As the demand for home health care services continues to rise, individuals must have appropriate insurance coverage in place. By securing the right insurance policy, individuals can ensure that they receive the necessary care and support in the comfort of their own homes.

Home health care insurance can cover a range of services, including skilled nursing care, physical therapy, occupational therapy, and personal care assistance. With the proper insurance in place, individuals can have peace of mind knowing that their healthcare needs are taken care of, even when they are at home.

Understanding Home Health Care Insurance

As the need for home health care continues to rise, it’s essential to understand the importance of having appropriate insurance coverage to meet the varied medical and personal needs of individuals. Home health care insurance provides vital financial protection, ensuring peace of mind for both patients and their families. In this section, we will explore the fundamental aspects of home healthcare insurance, including what it entails and why it is essential.

What Is Home Health Care

Home health care refers to a wide range of skilled medical and non-medical services provided in a patient’s home, patient or injury, or to assist with daily activities. This type of care is often more convenient and less expensive than care received in a hospital or nursing facility.

Importance Of Home Health Care Insurance

Home health care insurance plays a crucial role in ensuring that individuals receive the necessary care without facing financial hardships. It covers various aspects of home health care, including medical treatments, personal care, therapy, and equipment, offering comprehensive support to patients in need.

Credit: blog.newhorizonsmktg.com

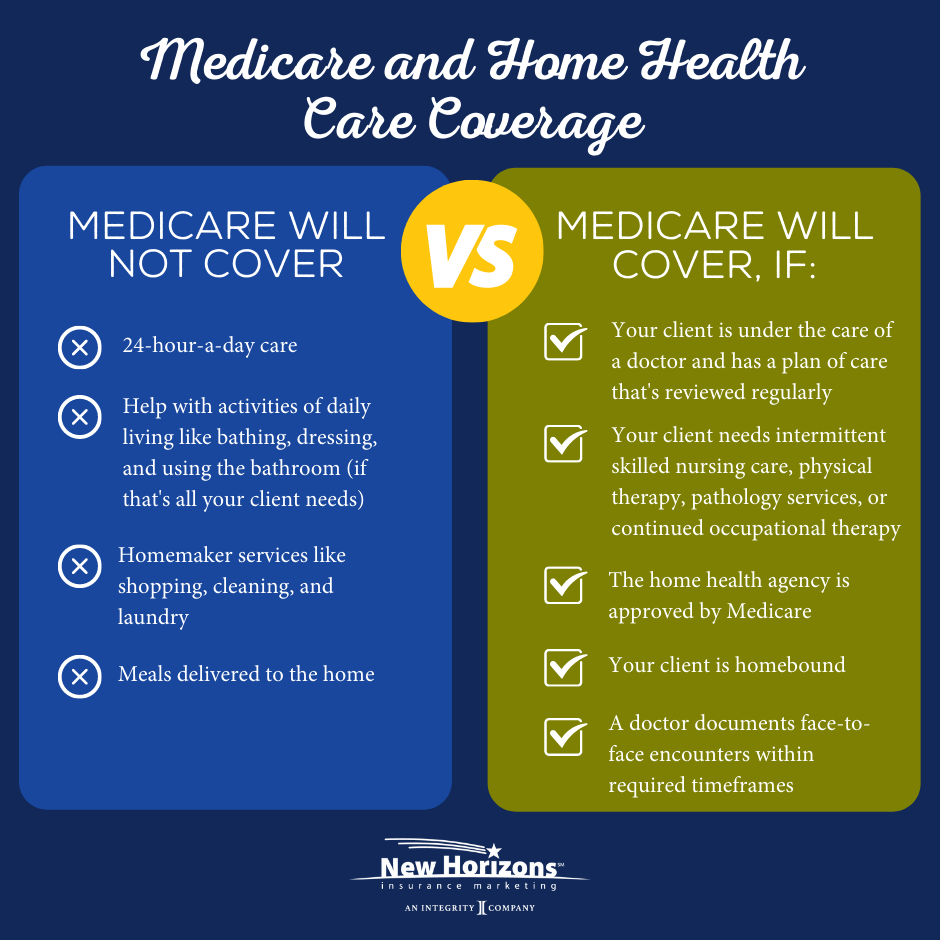

Coverage Provided By Medicare

Medicare offers crucial coverage for home health care services, assisting individuals in receiving necessary medical assistance in the comfort of their homes.

Medicare Coverage For Home Health Care

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services.

Part B includes ensuring doctors’ medical supplies and preventive services to manage health needs effectively.

Limitations Of Medicare Coverage

- Medicare will not pay for a home aide if personal care is the sole requirement without skilled medical needs.

- It covers medical social services as directed by your physician for emotional well-being related to the illness.

Types Of Insurance For Home Health Care

Insurance plays a crucial role in providing financial protection and peace of mind for home health care providers and caregivers. Several types of insurance are specifically designed to address the unique risks associated with this industry. In this article, we will explore three critical types of insurance for home health care: Long-Term Care Insurance, Professional Liability Insurance for Home Health Care, and a Home Health Care Insurance Program.

Long-term Care Insurance

Long-Term Care Insurance is an essential policy for individuals who may require extended care in their homes. This type of insurance provides coverage for services such as personal care, assistance with daily activities, and basic medical needs. With long-term care insurance, you can ensure that you receive the necessary care without depleting your savings or burdening your loved ones financially.

Professional Liability Insurance For Home Health Care

Professional liability insurance is a must-have for all home health care providers. This insurance policy protects professionals against claims arising from errors, omissions, negligence, or malpractice. In the home healthcare industry, where caregivers provide crucial medical assistance and personal care to patients, professional liability insurance offers financial protection against potential lawsuits and legal expenses.

Home Health Care Insurance Program

If you own a home health care agency or work as a caregiver, the Home Health Care Insurance Program is tailored to meet your specific needs. This comprehensive insurance program offers package P&C (property and casualty) coverage for home health and hospice providers, medical equipment suppliers, and companion care professionals. With this program, you can safeguard your business assets, protect your employees, and ensure the continuity of your services.

Selecting The Right Insurance Policy

Choosing the right insurance policy for home health care is crucial. Ensure it caters to your specific needs for optimal coverage. Consider policies with comprehensive services like long-term care, ensuring peace of mind for you and your loved ones.

Considerations For Choosing A Policy

When it comes to selecting the right insurance policy for home health care, several important considerations must be made. These considerations will help you make an informed decision and ensure that your policy meets your specific needs. Let’s take a look at what you should consider when choosing a policy.

Comparing Different Insurance Options

Comparing different insurance options is crucial to finding the policy that best fits your needs. By comparing various options, you can evaluate the coverage, costs, and benefits offered by different insurance providers. Here are some key factors to consider when comparing insurance options:

- Coverage: Assess the extent of coverage provided by each policy. It is essential to understand what services and treatments are covered, as well as any limitations or exclusions.

- Cost: Evaluate the price of each insurance policy, including monthly premiums, deductibles, and co-pays. Consider your budget and ensure that the cost policy fits your financial capabilities.

- Network: Check if the insurance provider has a network of preferred healthcare providers. Having access to a wide range of healthcare professionals and facilities can be beneficial.

- Customer Reviews: Look for customer reviews and ratings about each insurance provider. Feedback from other policyholders can give you insights into the quality of service and customer satisfaction.

- Flexibility: Consider the policy’s flexibility if it allows for changes in coverage or providers as your needs evolve.

Comparing different insurance options based on these considerations will enable you to make an informed decision. Remember that selecting the right insurance policy is crucial to ensuring adequate coverage for your home health care needs.

Costs And Payment Options

Understanding the costs involved and the payment options available is essential when it comes to home health care. Whether you are seeking care for yourself or a loved one, it’s necessary to know how much you can expect to pay and what financial arrangements can be made. In this section, we will explore the different factors that affect the costs of home health care and the various payment options that can help manage these expenses.

Understanding The Costs

The costs of home health care can vary depending on several factors. Some of the critical factors that can influence the costs include:

- The level of care needed: Different individuals may require different levels of care, ranging from essential assistance with daily tasks to more intensive medical care.

- Duration of care: The length of time for which home health care services are needed can impact the overall costs.

- Location: The cost of home health care can also vary depending on the geographical area.

- Specific services required: Additional services such as therapy, medication management, or specialized care may incur extra costs.

It’s important to discuss the home health care agency or provider to get a clear understanding of the costs involved. They can provide you with a detailed breakdown of the fees associated with the services you require.

Payment Options Available

Fortunately, there are several payment options available to help cover the costs of home health care. Some of the standard payment options include:

- Medicare: Medicare may provide coverage for certain home health care services if specific criteria are met. It’s essential to check with Medicare to understand what services are covered and what eligibility requirements are.

- Medicaid: Medicaid provides financial assistance for low-income individuals and families. Depending on eligibility, Medicaid may cover home health care services.

- Long-term care insurance: Having a long-term care insurance policy can help cover the costs of home health care. It’s essential to review and ensure it includes coverage for home health care services.

- Private insurance: Private health insurance policies may offer coverage for some home health care services. It’s essential to view the policy terms and contact the insurance provider to determine what is covered.

- Out-of-pocket payments: Some individuals may choose to pay for home health care services out-of-pocket. Discussing the payment options and devising a payment plan with the home healthcare agency can help manage these costs.

It is essential to have coverage, including Medicare, Medicaid, or private insurance policies, to understand what services are covered and what expenses are your responsibility. Consulting with a financial advisor or insurance agent can provide additional guidance on the payment options available and help you make informed decisions.

Credit: www.amwins.com

Finding The Best Insurance Provider

When evaluating insurance providers for home healthcare, it’s crucial to consider customers and ratings. Analyzing feedback from other clients can give you insight into the quality of service and support provided by the insurance companies. Look for patterns in the reviews that indicate consistent satisfaction or recurring issues. Additionally, prioritize insurance providers with higher overall ratings to ensure reliability and customer satisfaction.

Conduct thorough research to identify insurance providers that specialize in home health care coverage. Explore their website, review the types of policies offered, and assess their experience in handling claims related to home health care. Researching multiple providers allows you to compare coverage options, pricing, and any specific benefits they may offer for home health care insurance.

Essential Coverage For Home Health Care

Start of Essential Coverage for Home Health Care

When it comes to home healthcare, it’s crucial to have the right insurance coverage to protect both professionals and patients. From professional and general liability coverage to long-term care coverage, having the necessary protection in place is important. Let’s deLet’snto Let’s Essentials to learn about the different options for home health care and understand the significance of each.

Professional and General Liability Coverage

Professional And General Liability Coverage

In the realm of home health care, professional and general liability coverage is indispensable. This insurance protects healthcare professionals in case of alleged or actual negligence in providing care to patients, as well as any property damage or bodily injury resulting from their services.

Long-Term Care Coverage

Long-term Care Coverage

Long-term care coverage is designed to provide extended care to individuals who are unable to perform certain activities of daily living without assistance. This coverage encompasses a wide range of services, including personal and custodial care, making it essential for home healthcare providers to ensure a comprehensive protection plan.

Credit: www.gacquote.com

Conclusion And Final Considerations

Conclusion and Final Considerations:

Ensuring Comprehensive Coverage

When considering insurance for home health care, it is imperative to ensure you have comprehensive coverage that caters to your specific needs. Evaluate the policy details meticulously to ensure it encompasses all necessary aspects of home health care services.

Securing Financial Protection For Loved Ones

One crucial aspect of home health care insurance is securing financial protection for loved ones. This not only provides peace of mind but also ensures that your family members are safeguarded financially in case of unforeseen circumstances.

Frequently Asked Questions

Does Medicare Pay For A Home Assistant?

Medicare does not cover a home assistant for personit’sare; skillitit’selonlskillit’sareit’sareit fully pays for doctor-ordered medical social services.

Does Medicare Part B Cover Caregivers?

Medicare Part B does not cover caregivers unless you require skilled care services. Personal care services are not covered.

What Is The Most Common Diagnosis For Home Health Care?

The most common diagnoses for Home Health Care include emphysema, pneumonia, asthma, COPD, cancer, stroke, and joint replacement.

How Much Does Medicare Pay For Home Health Care Per Hour In Florida?

Medicare pays for Home Health Care per hour in Florida.

Conclusion

Securing home health care insurance is crucial for ensuring optimal care. It provides financial protection and peace of mind for you and your loved ones. Understanding the coverage options and benefits can help you make informed decisions for your specific needs.

Choose wisely for a secure future.