Life And Health Insurance Exam Cheat Sheet: Master the Test with These Power Tips

Life And Health Insurance Exam Cheat Sheet: Pass your Life and Health Insurance Exam easily using a comprehensive cheat sheet for success. Master critical topics and ace your exam effortlessly with expert preparation tips and study resources available.

Prepare to excel in your exam and embark on a successful career in the insurance industry. Stay focused and confident as you navigate complex insurance concepts with the right tools and guidance. Access valuable insights and strategies to enhance your understanding and boost your chances of passing the exam with flying colours.

Engage with proven study materials and tips to ensure a smooth and successful exam experience. Enjoy a seamless learning journey towards achieving your Life and Health Insurance certification.

Understanding The Exam

When preparing for the Life and Health Insurance exam, it is crucial to understand its critical aspects to ensure success. From the difficulty level to the number of questions and the exam process, having a clear understanding will help you approach the exam confidently and quickly.

Difficulty Level

The Life and Health Insurance exam is known for its challenging nature, with complex insurance policies and regulations to grasp. Understanding various insurance concepts and their applications is essential in tackling the exam effectively. However, success is achievable with thorough preparation and a solid grasp of the material.

Number Of Questions

The exam consists of 150 questions, covering a wide range of life and health insurance topics. This comprehensive coverage requires a deep understanding of the subject matter and diligent preparation to answer each question confidently.

Exam Process

During the exam, candidates will encounter a variety of questions that test their knowledge of insurance policies, regulations, and ethical practices. It is essential to remain focused and manage time effectively to address each question accurately.

Test Preparation

Test Preparation

Adequate test preparation is critical before tackling the Life and Health Insurance exam. You can increase your chances of success with the right study resources, practice tests, and cheat sheets.

Study Resources

Study Resources

- Utilize online platforms like Study.com for comprehensive video tutorials.

- Access YouTube channels such as ProTeam and Miguel Camargo for in-depth study sessions.

- Explore various topics to enhance your knowledge, including policies, premiums, coverage, etc.

Practice Tests

Practice Tests

- Engage in practice tests to evaluate your understanding of key concepts.

- Regularly assess your knowledge of human life value, insuring clauses, and term writers.

- Prepare yourself for the exam format and timing by taking simulated practice tests.

Cheat Sheets

Cheat Sheets

- Create personalized cheat sheets summarizing complex information for quick reference.

- Focus on critical details like sediment options, reinstatement clauses, and Roth IRAs to reinforce your memory.

- Use cheat sheets as a last-minute revision tool to boost your confidence before the exam.

Important Topics

Type Of Policies

Understanding the different types of life and health insurance policies is crucial for passing the exam. Here are the main policy types you should focus on:

- Term Life Insurance: Provides coverage for a specified term, typically 10, 20, or 30 years.

- Whole Life Insurance: Offers coverage for the insured’s entire lifetime and includes a cash value component.

- Universal Life Insurance: Combines a death benefit with a savings account, allowing for flexibility in premium payments and death benefit amounts.

- Health Insurance: Covers medical expenses and provides protection against high healthcare costs.

Premium Payments

Knowing how premium payments work is essential for understanding the financial aspect of insurance policies. Here are the key points to remember:

- Premium Amount: The regular payment you must make to maintain your coverage.

- Payment Options: Understand the different ways to pay your premiums, such as monthly, quarterly, or annually.

- Grace Period: The time you have after the due date to pay without your policy lapsing.

- Lapse: If you fail to make premium payments within the grace period, your policy will expire.

Coverage Duration

Knowing the duration of coverage is crucial for understanding the benefits and limitations of insurance policies. Here are the key points to remember:

- Term Life Insurance: Provides coverage for a specific period after the policy expires.

- Whole Life Insurance: Offers coverage for the entire lifetime of the insured.

- Health Insurance: Coverage duration varies depending on the type of plan and the individual’s needs.

Mastering these essential topics will prepare you to tackle the life and health insurance exam. Remember to study each topic thoroughly and familiarize yourself with the specific details of each policy type, premium payments, and coverage duration.

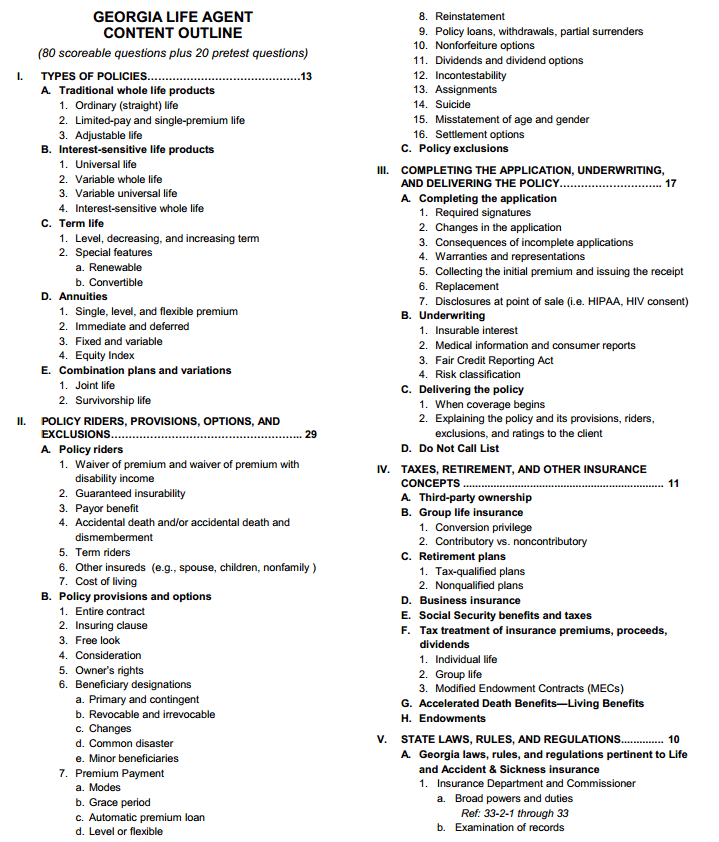

Credit: www.nationalonlineinsuranceschool.com

Key Concepts

Are you preparing for your Life and Health Insurance Exam? It can be overwhelming with all the information you need to remember. We’ve created this cheat sheet to help you focus on the key concepts. This section will cover the essential concepts related to face amount, policy duration, and whole-life policies. Let’s dive into it:

Face Amount

The face amount, or the death benefit, is the money your beneficiaries will receive if you pass away during the policy term. It is the sum you choose to insure your life for and is specified in the insurance policy document. The face amount can be fixed or may vary depending on the type of policy.

Policy Duration

The policy duration refers to the time the insurance policy is in effect. It determines how long you are covered and how long you need to pay premiums. The duration can vary depending on the type of policy you choose and the terms outlined in the contract. It is crucial to understand the policy duration to ensure you have coverage for the desired period.

Whole Life Policies

Whole life insurance policies are permanent life insurance that provides coverage for your entire life as long as premiums are paid. These policies offer a death benefit to your beneficiaries upon your death, but they also have a cash value component that grows over time. The cash value can be used for borrowing or as an investment vehicle, making whole-life policies a popular choice for individuals seeking long-term financial protection.

Understanding these key concepts is essential for passing your Life and Health Insurance Exam. It will help you grasp the fundamentals of life insurance and make informed decisions when choosing a policy that suits your needs. Study these concepts thoroughly and practice applying them to real-life scenarios to enhance your exam preparation.

Exam Tips And Tricks

Master your Life and Health Insurance Exam with our Cheat Sheet with essential tips and tricks. Ace the exam by understanding policies, premium payment methods, coverage expiration, and more. Prepare effectively and confidently for your insurance licensing exam.

Preparing for a life and health insurance exam can be daunting, but you can improve your chances of success with the right tips and tricks. In this section, we will discuss some critical concepts that you need to know for the exam. By understanding these essential topics, you’ll be well-prepared to tackle any questions that come your way.

Human Life Value

The concept of human life value is an essential aspect of life insurance. It refers to the economic value a person provides to their dependents over their lifetime. Understanding this concept is crucial because it helps insurers determine the appropriate amount of coverage an individual needs. So, make sure you grasp the calculations involved and the factors that influence human life value.

Paid Up Dividend

Paid-up dividends are an exciting feature of specific life insurance policies. These dividends can purchase additional coverage without the insured paying extra premiums. It’s crucial to understand how paid-up dividends work, as they can significantly affect a policy’s cash value and death benefit. Study the different options available and how they can benefit policyholders.

Insuring Clause

The insuring clause is the heart of any insurance policy. It outlines the essential details of the coverage offered and the obligations of the insurer and the insured. It’s crucial to understand the terms and conditions in the insurance clause to ensure you choose the right policy for your needs. Take the time to read and comprehend this clause, as it forms the foundation of your insurance contract.

Remember, focusing on these key concepts—human life value, paid-up dividend, and insuring clause—will give you the knowledge and confidence needed to excel in your life and health insurance exam. So, study them thoroughly, practice with sample questions, and approach the exam positively. Good luck!

Challenges And Tips

Preparing for the Life and Health Insurance Exam can be daunting, but you can overcome the challenge with a suitable cheat sheet. Focus on essential topics like policies, premium payments, and coverage expiration. Utilize cheat sheets, practice tests, and consistent learning for a successful exam experience.

Challenges In The Exam

Passing the Life and Health Insurance Exam may seem daunting, especially with its complex concepts and extensive coverage. However, with the proper preparation and strategies, success is within reach. Here are some of the key challenges you may face during the exam:

- Tackling complex health insurance policies

- Understanding the intricacies of life insurance policies

- Navigating through various terminology and jargon

- Maintaining focus and concentration throughout the exam

- Managing time effectively to complete all questions

Tips For Success

Now that you know the challenges, it’s time to equip yourself with some valuable tips to ensure your success in the Life and Health Insurance Exam:

- Start with a study plan: Create a schedule for sufficient time for each topic. Break down the curriculum into manageable sections to ensure thorough understanding.

- Utilize reliable study materials: Choose comprehensive study guides, textbooks, and online resources to deepen your understanding of the key concepts and principles.

- Practice with sample exams: Take advantage of practice exams to familiarize yourself with the exam format and assess your level of preparedness. This will help you identify your weak areas and focus your studying accordingly.

- Focus on understanding: Instead of memorizing facts, focus on understanding the underlying principles. This will enable you to answer questions even if they appear in a different format.

- Review and revise: Regularly review the material you have covered to reinforce your knowledge. Take concise and organized notes to refer back to during your revision.

- Stay calm and manage stress: The exam can be stressful, so practice relaxation techniques such as deep breathing and visualization to stay calm and composed during the test. Remember to take breaks and get enough rest before the exam.

- Read and analyze each question carefully: Take your time to read and understand each question before selecting your answer. Pay attention to keywords and phrases that may indicate the correct answer.

- Answer all questions: Even if you are unsure about an answer, attempt to answer all questions. Leaving questions unanswered will not earn you any points, whereas guessing gives you a chance to answer correctly.

- Manage your time: Divide your allotted time for each exam section and adhere to it. Avoid too much time on challenging questions and prioritize completing the exam.

By implementing these tips, you can improve your chances of taking the Life and Health Insurance Exam. Remember, consistent effort and dedication are crucial to your success. Good luck!

Life Insurance Medical Exam

When applying for a life insurance policy, it’s common for insurance companies to require a medical exam to assess your overall health and determine the risk involved in insuring you. This process helps insurers set accurate premium rates and coverage limits. Understanding what to expect, the procedure, and how to prepare for a life insurance medical exam can help ease any apprehension about the process.

What To Expect

During a life insurance medical exam, you can expect various measurements and tests to be conducted to evaluate your health status. Your height, weight, pulse, and blood pressure will typically be recorded. You may also be asked to provide a urine sample and blood drawn to check for health issues such as elevated cholesterol or blood sugar levels. The exam may also include screening for nicotine and drug use to assess your lifestyle and potential health risks.

Procedure

A life insurance medical exam procedure involves a series of standard health assessments and tests. These assessments may vary slightly depending on the insurance company conducting the exam, but generally, they entail basic physical measurements and sample collection for laboratory tests. It’s crucial to follow the instructions provided by the insurer regarding fasting or any specific preparations before the exam, as this can affect the accuracy of the results.

Preparation Tips

- Ensure you get a good night’s sleep before the exam to obtain accurate measurements.

- Avoid intense physical activity or heavy meals before the exam to maintain stable vitals.

- Stay hydrated, as this can make it easier to provide a urine sample.

- To streamline the process, prepare necessary documents and information, such as a list of current medications and recent medical history.

- Follow any dietary or lifestyle recommendations the insurance company provides to ensure accurate results.

Credit: google.com

Additional Resources

Looking for additional resources to ace your Life and Health Insurance Exam? Find cheat sheets, practice tests, and study guides on YouTube. Study. Com, and Forbes for valuable insights. With helpful tips on policies, premiums, and medical exams, you’ll be well-prepared to succeed in your exam.

`cheat Sheet Flashcards`

`online Study Guides`

`licensing Exam Cram`

Credit: www.etsy.com

Frequently Asked Questions

What Is The Hardest Insurance Exam To Pass?

The Health insurance exam is considered the most challenging due to the complexity of health policies. The property insurance exam is more accessible than the Casualty insurance exam.

How Many Questions Are On The Life Insurance?

The life insurance exam has 150 questions. Be prepared for a comprehensive assessment of your knowledge.

What Happens During A Life Insurance Medical Exam?

Your height, weight, pulse, and blood pressure will be recorded during a life insurance medical exam. You may also need to provide a urine sample and have blood drawn to test for health issues like high cholesterol or blood sugar levels and to screen for nicotine and drug use.

How To Pass The Florida Life And Health Exam?

To pass the Florida Life and Health exam, practice regularly with practice tests until test day. Being prepared will help you recall the material effectively.

Conclusion

Remember to practice consistently in your journey towards mastering life and health insurance. Utilize resources like cheat sheets and practice tests to reinforce your knowledge. Stay focused and confident during the exam, knowing that preparation increases your chances of success.

Best of luck on your insurance exam journey!