Health Insurance Usa : Essential Guide for Americans

Health Insurance USA: Various companies, such as UnitedHealth Group, Aetna, and Blue Cross Blue Shield, provide Health Insurance in the USA. Medicaid and the Children’s Health Insurance Program (CHIP) also offer free or low-cost health coverage to eligible individuals and families.

You can enrol or change health insurance plans based on certain life events or income qualifications or if you qualify for Medicaid or CHIP. To find the right health insurance plan for you or your family, you can explore options on websites like HealthCare.

Gov, Aetna, and UnitedHealthcare. These sites provide information on different plans, prices, and coverage options to meet your healthcare needs while staying within your budget.

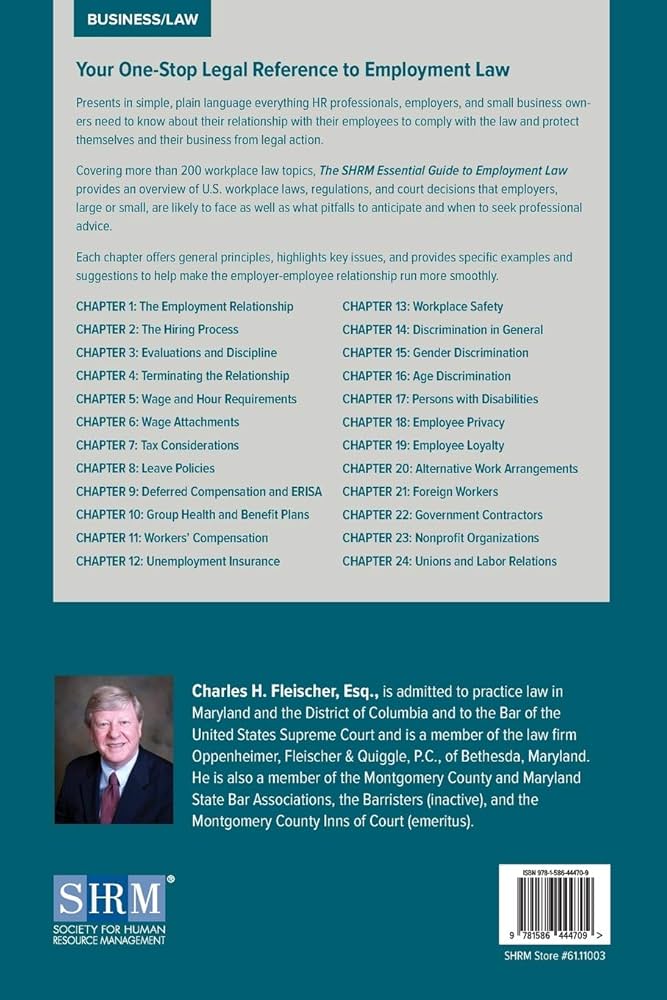

Credit: www.amazon.com

The Importance Of Health Insurance

Health insurance ensures individuals access quality medical care without incurring substantial financial burdens. It provides much-needed protection against high medical costs while promoting preventive healthcare services, ultimately contributing to an individual’s well-being.

Protection Against High Medical Costs

Health insurance protects individuals from the overwhelming expenses of medical treatments, surgeries, and hospital stays. Without insurance, these costs can lead to significant financial strain or bankruptcy for many families. With the right health insurance coverage, individuals can mitigate the economic impact of unexpected illnesses or injuries, ensuring they can seek necessary medical care without worrying about the associated expenses.

Preventive Healthcare Services

Health insurance facilitates access to vital preventive healthcare services, including regular check-ups, vaccinations, and screenings. By covering these services, insurers enable individuals to prioritize proactive measures for maintaining their health, reducing the likelihood of developing severe health conditions. This emphasis on preventive care further lowers overall healthcare costs while promoting healthier communities.

Types Of Health Insurance Plans

Regarding health insurance in the USA, it’s crucial to understand the different types of insurance plans. Each type has advantages and limitations, so choosing one that suits your healthcare needs and financial situation is essential. Let’s delve into the various types of health insurance plans:

Health Maintenance Organization (HMO)

An HMO plan typically requires individuals to choose a primary care physician from a network of healthcare providers. This physician is the main point of contact for all medical needs and coordinates referrals to specialists when necessary.

- Requires a primary care physician (PCP)

- Referrals required for specialist visits

- Lower out-of-pocket costs

- Restricted to network healthcare providers

Preferred Provider Organization (PPO)

A PPO plan offers greater flexibility in choosing healthcare providers. While there is a network of preferred providers, individuals can seek care outside the network, albeit at a higher cost.

- No requirement for a PCP

- No referrals are needed for specialist visits

- Out-of-network coverage (though at a higher cost)

- Higher out-of-pocket costs compared to HMOs

Exclusive Provider Organization (EPO)

Like an HMO, an EPO plan typically requires individuals to select a primary care physician from within the specified network of providers. However, EPOs often do not cover out-of-network care, making them more restrictive regarding provider options.

- No out-of-network coverage

- Requires a PCP

- No referrals are needed for specialist visits

- Potentially lower premiums compared to PPOs

Point Of Service (pos) Plan

A POS plan combines elements of both HMO and PPO plans. Individuals typically choose a primary care physician from within a network of providers but also have the option to seek care outside the network, although at a higher cost.

- Requires a PCP

- Referrals required for specialist visits

- Coverage for both in-network and out-of-network care

- Varying out-of-pocket costs based on provider selection

Key Features To Consider When Choosing A Health Insurance Plan

When choosing a health insurance plan in the USA, you should consider several critical features before deciding. These features can have a significant impact on your coverage and out-of-pocket expenses. By understanding these features, you can ensure that you find a plan that meets your specific needs.

Premiums

The premiums of a health insurance plan refer to the amount of money you pay every month in exchange for coverage. It is essential to consider your budget and affordability when choosing a plan. Low premiums may seem attractive, but they often come with high deductibles and limited coverage. On the other hand, higher premiums may provide more comprehensive coverage and lower out-of-pocket costs. Consider your healthcare needs and financial situation when evaluating a plan’s plan’s premiums.

Deductibles

The deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Plans with higher deductibles generally have lower premiums and vice versa. When selecting a deductible, it is essential to understand your healthcare expenses and anticipate potential medical needs. Remember that you will be responsible for paying the deductible before your insurance starts covering the costs of your healthcare services.

Network Coverage

Network coverage refers to the healthcare providers and facilities included in your health insurance plan’s network. In-network providers typically have negotiated rates with the insurance company, resulting in lower costs for you. Review the list of doctors, hospitals, and specialists that are in-network to ensure you have access to the healthcare professionals and facilities you prefer. Out-of-network providers may be more expensive or not covered, so consider your preferred providers when evaluating network coverage.

Prescription Drug Coverage

Prescription drug coverage is essential to consider if you take medications regularly. Not all health insurance plans offer the same level of coverage for prescription drugs. Review the plan’s formulary, a list of covered medications and the associated costs, such as copayments or coinsurance. Ensure that the medicines you rely on are covered and the related expenses are reasonable for your budget.

Out-of-pocket Maximums

Out-of-pocket maximums are the amount you must pay for covered services in a calendar year. Once you reach this maximum, your insurance plan will cover 100% of the remaining expenses. When evaluating plans, take note of the out-of-pocket maximums and consider your potential healthcare costs. A plan with a higher out-of-pocket maximum may come with lower premiums, but it also means that you could be responsible for a higher proportion of your medical expenses.

Health Insurance Marketplaces

Overview

Health insurance marketplaces are platforms where individuals and families can compare and purchase health insurance plans in the United States. They provide a centralized location for exploring various coverage options based on specific needs and budget constraints.

The Affordable Care Act (ACA)

The Affordable Care Act, also known as Obamacare, established health insurance marketplaces to increase Americans’ access to affordable health insurance and emphasize the importance of health coverage in protecting individuals’ costs.

Subsidies And Tax Credits

Subsidies and tax credits offered through the Health Insurance Marketplaces help lower-income individuals and families afford health insurance. These financial assistance programs aim to make coverage more accessible and reduce the economic burden of premiums and out-of-pocket expenses.

Common Healthcare Terminology

Discover the most common healthcare terminology related to health insurance in the USA. From Medicaid and CHIP to health coverage options for low-income individuals and families, this comprehensive guide will help you navigate the complexities of the American healthcare system.

Copayment

A copayment, also known as a copay, is a fixed amount of money you pay out-of-pocket each time you receive a medical service or fill a prescription. This amount is usually specified in your health insurance plan. For example, if your plan has a copayment of $20 for doctor visits, you will pay $20 at your appointment.

Coinsurance

Coinsurance is the percentage of the cost of a covered service you must pay after meeting your deductible. For instance, if your coinsurance is 20% and the covered service costs $100, you will pay $20, and the insurance company will cover the remaining $80.

Out-of-network Coverage

Out-of-network coverage refers to how much your health insurance plan pays for healthcare services outside the network of providers it has contracted with. If you choose to receive care from a provider outside your plan’s network, you may have to pay more out-of-pocket, or your insurance may not cover the service.

Pre-existing Conditions

Pre-existing conditions are any health conditions or diseases you had before enrolling in a health insurance plan. In the past, insurance companies could deny coverage or charge higher premiums to individuals with pre-existing conditions. However, under the Affordable Care Act, insurance companies cannot deny coverage or charge more for pre-existing conditions.

Credit: www.amazon.com

The Impact Of Health Insurance On Healthcare Access

Health insurance is crucial in ensuring individuals have access to necessary healthcare services. Let’s delve into how health insurance impacts healthcare access:

Increase In Preventive Care Services Utilization

Health insurance encourages individuals to utilize preventive care services, such as regular check-ups and screenings, leading to early detection of health issues.

Reduction In Uninsured Rates

Health insurance significantly reduces the number of uninsured individuals, ensuring more people have access to essential medical care without financial barriers.

Challenges In The U.S. Health Insurance System

Healthcare in the United States faces several challenges impacting the effectiveness and accessibility of health insurance. Understanding these challenges is crucial to addressing shortcomings and improving the healthcare system.

Rising Healthcare Costs

The U.S. healthcare cost is escalating rapidly, outpacing inflation and U.S. economic growth. This has made it increasingly challenging for individuals and families to afford health insurance and necessary medical care. The rise in healthcare costs puts immense strain on patients and the healthcare system, demanding a comprehensive approach to mitigate its impact.

Health Disparities

Health disparities persist in the U.S., with specific demographics, such as racial and ethnic minorities, experiencing higher rates of diseases and inadequate access to healthcare. Reducing health disparities is imperative for achieving equitable health insurance coverage and improving overall population health.

Administrative Complexity

The administrative complexity of the U.S. health insurance system contributes to inefficiencies, administrative burdens, and increased costs for healthcare providers and patients. The administrative complexity and bureaucracy hinder accessibility and add unnecessary layers of complexity, warranting a streamlined and simplified approach.

Future Trends In Health Insurance

Telemedicine Services

Telemedicine services use technology to provide remote healthcare, including virtual consultations and monitoring. With the increasing reliance on digital platforms, telemedicine is experiencing exponential growth. Patients can now access healthcare professionals from the comfort of their homes, saving time and reducing healthcare costs.

Personalized Medicine

Personalized medicine, or precision medicine, is a healthcare approach that tailors medical treatment to each patient’s characteristics. Advances in genomics and data analytics have paved the way for personalized medicine, allowing healthcare providers to offer targeted treatments and preventive care strategies. This approach aims to improve patient outcomes and reduce unnecessary procedures.

Value-based Care Models

Value-based care models prioritize the quality and efficiency of healthcare services, moving away from the traditional fee-for-service approach. Healthcare providers are incentivized to deliver cost-effective, high-quality care by focusing on patient outcomes and population health. This model aims to enhance patient satisfaction and create a sustainable healthcare system.

Credit: google.com

Frequently Asked Questions Of Health Insurance USA

How Much Does Health Insurance Cost In The U.S.?

The cost of health insurance in the U.S. varies depending on factors like aU—factorization and coverage level.

What Is The Most Common Health Insurance In America?

Private companies like UnitedHealthcare, Anthem, and Aetna provide America’s most common health insurance. These companies offer a variety of plans and coverage options for individuals and families across the country.

Who Gets Free Health Insurance In the USA?

Medicaid and the Children’s Health Insurance Program (CHIP) provide free or low-cost health coverage to low-income individuals, families, children, pregnant women, the elderly, and people with disabilities in the USA.

Who Is The Number 1 Health Insurance In The U.S.?

UnitedHealthcare is the leading health insurance provU.S.erU.S.n U.S.e US, offering comprehensive coverage for individuals anU.S.famiU.S.es.

U.S.onclusion

In the ever-evolving world of healthcare, obtaining reliable health insurance coverage is crucial. With a wide range of options available in the USA, it’s essential to consider the cost, benefits, and accessibility of different plans. Whether you’re an individual or a family, programs like Medicaid and CHIP provide free or low-cost coverage to certain eligible groups.

The Health Insurance Marketplace and private insurance providers like Aetna, Blue Cross Blue Shield, and UnitedHealthcare offer a variety of plans to meet your specific needs. Understanding the available options, enrolling in the right plan, and staying informed about healthcare policies will ensure you receive the necessary coverage.

Take control of your health and protect yourself and your loved ones with the right health insurance plan in the USA.