Maine Health Insurance Marketplace: Your Path to Affordable Coverage

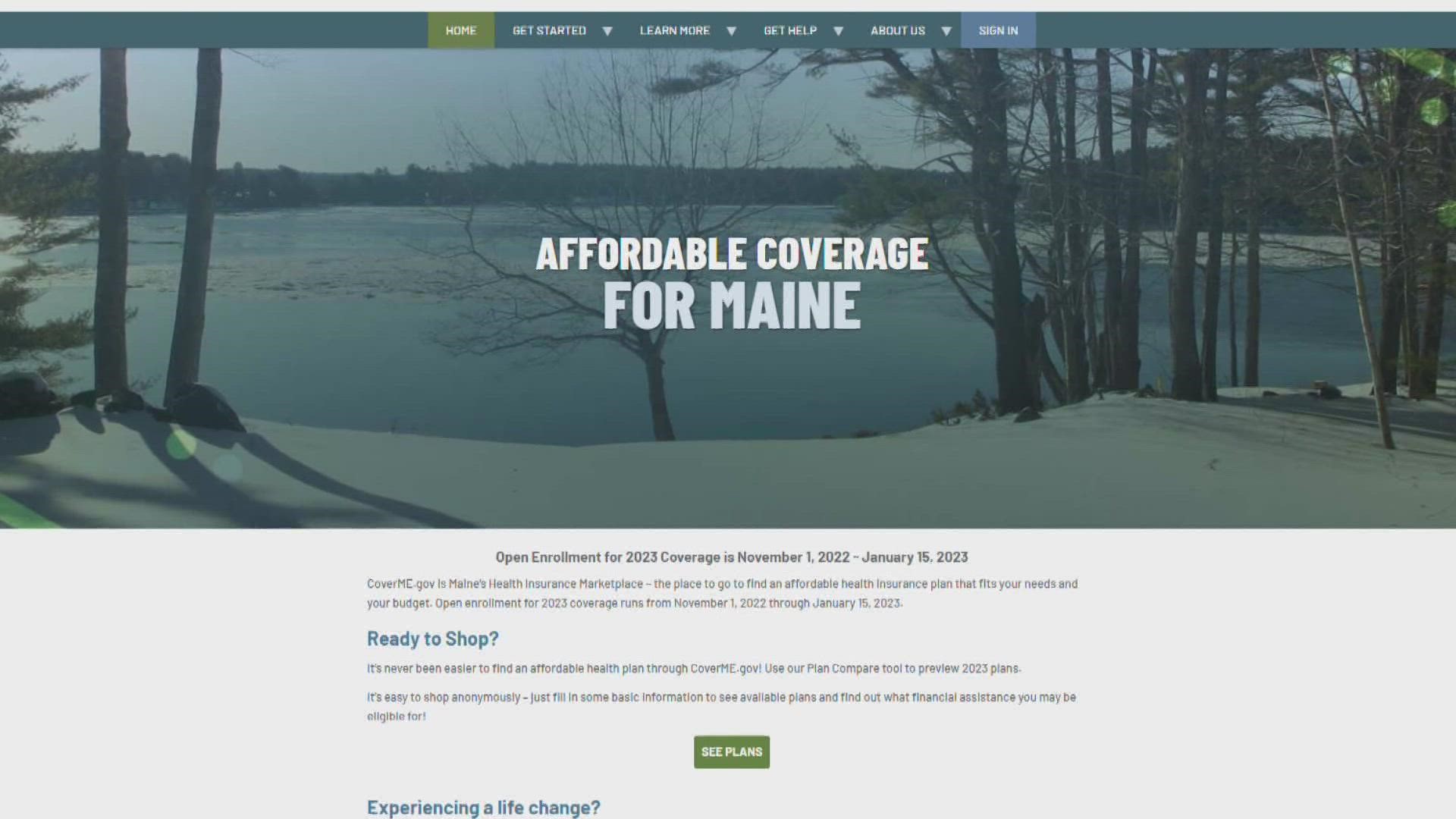

Maine operates the CoverME.gov state-based health insurance marketplace, offering affordable health insurance options. Individuals in Maine can access various health insurance plans through CoverME.gov.

The marketplace aims to provide Mainers with access to quality health coverage tailored to their needs and financial circumstances. CoverME. Gov is the official platform where residents can explore different health insurance options and find the most suitable plan for themselves and their families.

By utilizing the marketplace, individuals can compare plans, access financial assistance, and enroll in health insurance outside of the Open Enrollment period. This initiative by the Maine Department of Health facilitates access to essential healthcare services for all residents of the state.

Credit: www.penbaypilot.com

Understanding Maine’s Health Insurance Marketplace

“Explore Maine’s vibrant Health Insurance Marketplace on CoverME. gov, offering a diverse range of affordable health plans for individuals and families. Easily navigate and compare different options tailored to your specific health needs in just a few clicks. “

What Is The Maine Health Insurance Marketplace?

The Maine Health Insurance Marketplace is a state-based platform dedicated to helping individuals and families in Maine access affordable health insurance plans. It offers a range of health coverage options and provides resources for enrolling in insurance plans that suit individual needs.

Maine’s Marketplace Vs. Federal Marketplace

One key distinction between the Maine Health Insurance Marketplace and the Federal Marketplace is that Maine has its state-specific exchange, known as CoverME.gov. In contrast, the Federal Marketplace, HealthCare.gov, operates in other states. CoverME.gov provides tailored health insurance options specific to Maine residents, while HealthCare.gov caters to a broader national audience.

Benefits Of Choosing The Maine Health Insurance Marketplace

Introductory paragraph

Benefits of Choosing the Maine Health Insurance Marketplace

Access to Affordable Coverage

Access To Affordable Coverage

Maine Health Insurance Marketplace offers cost-effective healthcare options.

State-Specific Plans and Programs

State-specific Plans And Programs

Customized health plans tailored to the unique needs of Maine residents.

Enrollment Process And Eligibility

Enrolling in a health insurance marketplace is an essential step to ensure you have access to affordable and comprehensive coverage. In the state of Maine, the enrollment process is simple through CoverME.gov, the state’s official health insurance marketplace. Understanding the eligibility requirements and the steps involved in enrolling is crucial to making an informed decision about your healthcare needs.

Who Can Enroll?

Understanding who is eligible to enroll in the Maine Health Insurance Marketplace is the first step toward accessing affordable coverage. Generally, individuals and families who meet the following criteria are eligible:

- Resident of Maine

- U.S. citizen or qualified non-citizen

- Not incarcerated

- Not currently enrolled in Medicare

It’s important to note that eligibility requirements may vary, and it is recommended that you check the official website of CoverME.gov for the most up-to-date information on eligiInformation To Enroll In The Maine Health Insurance Marketplace

Enrolling in the Maine Health Insurance Marketplace is a simple process that can be completed online through CoverME.gov. Here are the steps to guide you through the enrollment process:

- Visit the official website of CoverME.gov.

- Create an account by providing the required personal Information.

- Submit Information documents to verify your eligibility.

- Explore the available insurance plans and compare them based on your needs and budget.

- Select the plan that best suits your requirements.

- Complete the application by providing the requested information about your household.

- Review the application and make sure all the information and any required supporting documents are accurate.

Once your application is submitted, you will receive notifications about the status of your enrollment. It is essential to keep track of any updates and respond promptly if any additional information is needed.

Enrolling in the Maine Health Insurance Marketplace through CoverME.gov provides you with access to a variety of health insurance plans, financial assistance options, and the peace of mind that comes with having comprehensive coverage for your healthcare needs. Take advantage of this opportunity and ensure you and your family are protected.

Financial Assistance And Subsidies

Understanding the financial assistance and subsidies available can significantly improve affordability when obtaining health insurance coverage in Maine. In this section, we will explore the various aspects of financial help and qualifying for subsidies.

Understanding Financial Help

Financial help in the form of subsidies can help lower the cost of health insurance premiums for individuals and families in Maine. These subsidies, also known as premium tax credits, are designed to make health insurance more affordable for those who qualify. The amount of financial assistance you may receive is based on your income and household size. By reducing your monthly premium costs, you can ensure that health insurance is within reach.

Qualifying For Subsidies

To qualify for subsidies in Maine, you must meet specific income requirements. Generally, individuals and families with an income between 100% and 400% of the federal poverty level (FPL) may be eligible for financial assistance. It’s important to note that the FPL guidelines vary depending on the household size. By calculating your income and comparing it to the FPL guidelines, you can determine if you qualify for subsidies.

To apply for subsidies, you will need to visit the official Maine Health Insurance Marketplace website, CoverME.gov. This website allows you to explore different health insurance plans and determine your eligibility for financial assistance. It is recommended that you gather all the necessary documentation, such as proof of income and identification, before starting the application process.

Once you apply, the Information provided through the marketplace will determine your eligibility for subsidies. If approved, you will receive a subsidy that can be used toward your monthly premium costs. It’s essential to review your options and choose the plan that best fits your healthcare needs and budget.

To summarize, understanding financial help and qualifying for subsidies is crucial when seeking health insurance coverage in Maine. By exploring the available assistance and applying through the official Maine Health Insurance Marketplace website, individuals and families can secure affordable coverage that meets their healthcare needs.

Comparing And Choosing Plans

When it comes to health insurance in Maine, it’s essential to explore your options and choose the plan that best suits your needs. Understanding the types of plans available and considering key factors can help you make an informed decision. In this article, we’ll discuss the different types of plans and guide you in selecting the right one for you.

Types Of Plans Available

When comparing health insurance plans, you’ll come across several options. Here are the common types of plans available in the Maine Health Insurance Marketplace:

- Health Maintenance Organization (HMO): With an HMO plan, you’ll have access to a network of healthcare providers. You’ll need to choose a primary care physician who will coordinate your care and make referrals to specialists.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers. You can see any provider, but you’ll generally get better coverage and lower out-of-pocket costs when using in-network providers.

- Exclusive Provider Organization (EPO): EPO plans are similar to PPO plans but have stricter network restrictions. You’ll need to use in-network providers for coverage, except in case of emergencies.

- Point of Service (POS): POS plans combine elements of HMO and PPO plans. You’ll have a primary care physician and referrals to specialists within the network, but you can still choose out-of-network providers at a higher cost.

Factors To Consider When Choosing A Plan

When comparing and choosing a health insurance plan, there are several factors to take into account:

- Monthly Premiums: Consider the monthly cost of the plan and whether it fits within your budget. Lower premiums may have higher deductibles and copayments.

- Deductibles and Out-of-Pocket Costs: Assess the deductible and out-of-pocket maximums to understand your financial responsibility. Higher deductibles may mean lower premiums but more expenses when accessing healthcare.

- Network Coverage: Look into the plan’s network of healthcare providers. Ensure that your preferred doctors and hospitals are in-network to maximize coverage and minimize costs.

- Prescription Drug Coverage: If you regularly take medications, check the plan’s formulary to ensure your prescriptions are covered. Consider the copayments or coinsurance for drugs.

- Additional Benefits: Some plans may offer additional benefits, such as dental or vision coverage. Evaluate these extras and determine if they align with your needs.

By comparing the types of plans available and considering these factors, you can make a well-informed decision when choosing a health insurance plan in Maine that provides the coverage you need and fits your budget.

Credit: www.mainepublic.org

Utilizing Coverme.gov

Welcome to CoverME.gov, the official health insurance marketplace for Maine residents. If you’re seeking quality healthcare coverage, this website offers comprehensive resources and support to help you navigate the complexities of health insurance in Maine.

Navigating The Website

When you visit CoverME.gov, you’ll find a user-friendly interface designed to simplify the process of exploring and selecting suitable health insurance plans. The website’s intuitive layout ensures that you can efficiently navigate through a range of options and access essential Information winformationrmation hsing Resources And Support

At CoverME.gov, you have access to a wealth of resources and support services specifically tailored to meet your health insurance needs. Whether you require guidance on plan enrollment, financial assistance, or general information about avInformationlthcare options, the website’s comprehensive resources can help you quickly find the necessary assistance.

Special Considerations For Small Businesses

If you own a small business in Maine, navigating the health insurance marketplace can seem daunting. However, with the proper guidance, you can find suitable options tailored to your business’s needs. As a small business owner, you have specific considerations and resources available to ensure you make informed decisions about healthcare coverage for your employees. Let’s explore the special considerations for small businesses in the Maine Health Insurance Marketplace.

Options For Small Businesses

When it comes to health insurance options for small businesses in Maine, there are several routes to consider. Small businesses with 1-50 full-time equivalent employees can explore the Small Business Health Options Program (SHOP) marketplace, which provides access to a range of health insurance plans and coverage options. Additionally, small businesses can also consider traditional group health insurance plans offered outside the SHOP marketplace. These options provide flexibility and choice for small business owners to select the most suitable coverage for their employees.

Guidance For Shop Owners

As a shop owner in Maine, it’s essential to seek guidance and explore the available resources to navigate the health insurance marketplace effectively. Whether you are considering enrolling in SHOP plans or traditional group health insurance options, accessing expert guidance can streamline the decision-making process. The Maine Health Insurance Marketplace offers resources and assistance to shop owners, ensuring they understand the available plans, coverage details, and eligibility requirements for small businesses.

Customer Support And Assistance

The Maine Health Insurance Marketplace provides customer support and assistance. It can help you find the best health insurance plans and understand the enrollment process. CoverME. Gov is the official website for Maine’s state-based health insurance marketplace, offering affordable options for individuals and families.

Customer Support and Assistance Customer support and assistance at the Maine Health Insurance Marketplace are available to help individuals navigate the enrollment process and understand their coverage options. Contact Information For assistance with information inquiries, you can reach out to the DHHS Office of the Health Insurance Marketplace (OHIM) at [Maine. gov/dhhs/ohim](http://www.maine.gov/dhhs/ohim) or directly call their hotline at [1-800-555-1234](tel:800-555-1234). They are finding Help and Counseling Services. When individuals need guidance, they can find help and counseling services through CoverME.gov or seek assistance from healthcare professionals for better understanding. Remember to reach out for help, as the Maine Health Insurance Marketplace is dedicated to providing support and assistance to make the process as smooth as possible.

Credit: www.newscentermaine.com

Frequently Asked Questions

Does Maine Have A Health Insurance Marketplace?

Yes, Maine has its own Health Insurance Marketplace, CoverME. Gov, for affordable health insurance options for its residents.

What Is The Best Health Insurance In Maine?

The best health insurance in Maine can be found at Maine’s health insurance marketplace, CoverME. Gov. It offers affordable options for individuals and families with various coverage choices.

Does Maine Have Its Marketplace?

Yes, Maine has its health insurance marketplace called CoverMe—gov, which allows residents to enroll in coverage.

What Is The Average Cost Of Health Insurance In Maine?

The average cost of health insurance in Maine varies depending on factors such as age, location, and coverage options. For specific quotes and plans, it is recommended to visit websites like eHealthInsurance or the Maine Health Insurance Marketplace.

Conclusion

When seeking health insurance in Maine, CoverME. Gov provides affordable options. Enroll for quality coverage at CoverMe. Discover Maine’s health insurance marketplace today. Make informed decisions on health insurance with CoverME. Gov. Secure your health with Maine’s marketplace options. Choose CoverME.

Gov for your health insurance needs.