Oklahoma Health Insurance Marketplace: Your Guide to Affordable Coverage

Oklahoma Health Insurance Marketplace: This is the platform where individuals can shop, compare, and purchase health insurance under the Affordable Care Act, commonly known as Obamacare. In Oklahoma, individuals can access the Health Insurance Marketplace through Healthcare.gov to shop, compare, and select the best health plans available.

As an Oklahoma resident, navigating the state’s health insurance marketplace is essential for finding the most suitable coverage with Healthcare. Individuals can conveniently browse various healthcare plans, compare their options, and choose the best plan to meet their needs.

Whether you are self-employed, seeking individual coverage, or exploring options for your family, the Oklahoma Health Insurance Marketplace provides an accessible platform for making informed decisions about your health insurance needs.

Credit: www.google.com

Understanding the Health Insurance Marketplace

Health Insurance Marketplace is a platform where individuals can explore various healthcare plans under the Affordable Care Act, commonly known as “Obamacare.” It allows users to compare these plans and purchase health insurance that suits their needs.

Key Features Of Marketplace

- Offers a range of health care plans

- Allows easy comparison of different plans

- Provides access to subsidies for eligible individuals

- Facilitates enrollment in health insurance

Eligibility Criteria

To be eligible for the Health Insurance Marketplace, individuals must meet specific criteria, including:

- Proof of citizenship or lawful presence

- Residency in the state where applying

- Not being incarcerated

- Not being enrolled in other government-sponsored health coverage

Types Of Coverage Available

Oklahoma offers a variety of health insurance coverage options through its health insurance marketplace. Whether you are an individual looking for coverage, part of a family needing a plan that suits everyone, or have specialized health needs, Oklahoma has you covered. Let’s explore the types of coverage available in more detail.

Individual Health Plans

Individual health plans in Oklahoma’s marketplace are designed to cater to individuals’ specific needs. These plans cover essential health benefits and preventive care services, ensuring individuals can access their needs.

Family Health Plans

Family health plans in Oklahoma cater to families’ needs, providing coverage for all family members under a single plan. These plans typically include pediatric services, maternity care, and other essential benefits families may need to maintain their health and well-being.

Specialized Plans

Specialized health plans are available for individuals with specific health needs or requirements. These plans can include coverage for mental health care, substance abuse treatment, and other specialized treatments that may not be covered under standard health plans. These specialized plans ensure that individuals with unique health needs can access the care they require.

Enrollment Process

The Oklahoma Health Insurance Marketplace provides a seamless enrollment process to ensure individuals and families can access the necessary health insurance coverage quickly. The enrollment process involves several steps, including creating an account, choosing the right plan, and submitting the application. Let’s take a closer look at each of these steps.

Creating An Account

Before enrolling, you must create an account on the Oklahoma Health Insurance Marketplace website. Creating an account is quick and easy. Visit the website and click the “Create an Account” button. You will be asked to provide basic information, such as your name, address, and contact details. Once your account is created, you will have access to your dashboard, where you can manage your health insurance plans.

Choosing The Right Plan

Once you have created an account, it’s time to choose the right health insurance plan for you and your family. The Oklahoma Health Insurance Marketplace offers a range of plans from various insurance providers, each with its coverage options and premiums. To help you make an informed decision, the website provides detailed information about each plan, including the benefits, costs, and network of healthcare providers. Take your time to compare the plans and choose the one that best fits your healthcare needs and budget.

Application Submission

After you have selected the right plan, the final step in the enrollment process is submitting your application. This can be done directly through the Oklahoma Health Insurance Marketplace website. The application will ask for your personal information, such as your income, household size, and preferred coverage start date. It is essential to provide accurate and complete information to ensure the swift processing of your application.

Once your application is submitted, the Oklahoma Health Insurance Marketplace will review it. You will be contacted promptly if any additional information or documentation is required. Once your application is approved, you will receive a confirmation, and your health insurance coverage will begin according to the selected start date.

Enrolling in health insurance through the Oklahoma Health Insurance Marketplace is straightforward and user-friendly. By creating an account, choosing the right plan, and submitting your application, you can protect yourself and your family with the necessary health insurance coverage.

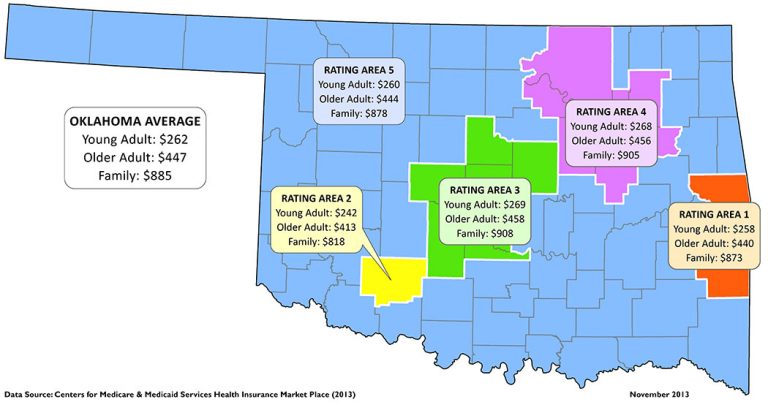

Credit: www.kff.org

Cost Considerations

When exploring the Oklahoma Health Insurance Marketplace, it’s crucial to consider various cost factors that can impact your overall healthcare expenses. Understanding the Premiums, Deductibles, and Out-of-Pocket Costs involved can help you make informed decisions.

Premiums

Health insurance premiums in Oklahoma vary depending on factors like age, location, and the level of coverage. Before selecting a plan, compare the monthly premiums to ensure affordability.

Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles typically result in lower monthly premiums, but assessing your financial situation is essential to determine the best balance.

Out-of-pocket Costs

Out-of-pocket costs include copayments, coinsurance, and any expenses not covered by insurance. Understanding these costs is essential to effectively budgeting for healthcare needs.

Benefits Of Oklahoma Health Insurance Marketplace

Oklahoma Health Insurance Marketplace benefits individuals and families, ensuring access to essential healthcare services and coverage. From preventive care to mental health services, the marketplace provides comprehensive options for managing and improving overall health.

Preventive Care Services

Oklahoma Health Insurance Marketplace covers preventive care services such as routine check-ups, vaccinations, and screenings. These services focus on early detection and prevention of illnesses, promoting overall wellness and reducing long-term healthcare costs.

Prescription Drug Coverage

Individuals enrolled in the marketplace have access to prescription drug coverage, which ensures the affordability and availability of necessary medications. This coverage alleviates the financial burdens associated with prescription costs, allowing individuals to manage their health conditions effectively.

Mental Health Services

The Oklahoma Health Insurance Marketplace provides comprehensive mental health services, encompassing counseling, therapy, and treatment for mental health conditions. Access to mental health services is crucial for holistic well-being and addresses the importance of mental health in overall Healthcare.

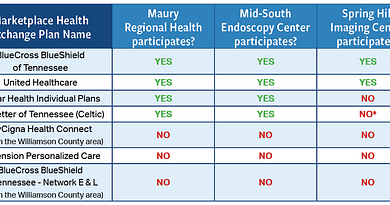

Comparing Health Insurance Plans

When choosing health insurance in Oklahoma, comparing different plans is crucial. You can find a plan that best suits your needs by evaluating various factors and utilizing the right tools for comparison.

Factors To Consider

Before selecting a health insurance plan, consider the following key factors:

- Coverage: Ensure the plan covers essential healthcare services.

- Cost: Compare premiums, deductibles, and out-of-pocket expenses.

- Network: Check if your preferred doctors and hospitals are included in the plan’s network.

- Benefits: Consider additional benefits like preventive care, prescription drugs, and mental health services.

- Customer Service: Evaluate the insurer’s reputation for customer support.

Tools For Comparison

When comparing health insurance plans, utilize the following tools:

- Health Insurance Marketplace: Visit the official Health Insurance Marketplace website to browse and compare different plans.

- Online Calculators: Use tools to estimate costs based on your healthcare needs.

- Insurance Brokers: Consult with licensed agents who can provide personalized guidance.

- Customer Reviews: Consider feedback from current policyholders to gauge satisfaction levels.

Credit: extension.okstate.edu

Frequently Asked Questions

Does Oklahoma Have A Healthcare Marketplace?

Oklahoma has a healthcare marketplace where individuals can browse and purchase health insurance plans under the Affordable Care Act, also known as Obamacare.

What Is The Best Health Insurance In Oklahoma?

Oklahoma’s best health insurance is on the Health Insurance Marketplace. Visit Healthcare. You can shop, compare, and choose the plan that suits your needs.

How Much Is Health Insurance Per Month In Oklahoma?

Health insurance in Oklahoma can cost varying amounts per month depending on factors such as age, coverage, and insurance provider. It is recommended that quotes from different providers be compared to find the best rate.

Is Marketplace Insurance The Same As Obamacare?

Marketplace insurance is the same as Obamacare, and it is available on the Health Insurance Marketplace to purchase healthcare plans under the Affordable Care Act.

Conclusion

Finding the right health insurance plan can be challenging in our fast-changing world. Understanding the Oklahoma Health Insurance Marketplace is crucial. With many options available, comparing and choosing the best plan for your needs is essential. Take control of your health and ensure appropriate coverage today.