Tennessee Health Insurance Marketplace: Everything You Need to Know

Tennessee Health Insurance Marketplace, Tennessee Health Insurance Marketplace, provides an online platform for shopping, comparing, and selecting the best health insurance plan for individuals and families. It is accessible through HealthCare.gov for coverage options and plan enrollment.

Whether looking for the cheapest health insurance plan in Tennessee or exploring free health insurance options, the SHOP Health Insurance Marketplace offers a range of ACA-compliant plans to meet your needs. To apply for Medicaid in Tennessee, contact the state Medicaid agency or utilize the SHOP Health Insurance Marketplace to explore coverage options.

GetCoveredTenn, a non-profit program, provides free health insurance enrollment and advice to all Tennesseans needing healthcare coverage. HealthMarkets can help you find the right health insurance plan in Tennessee that fits your specific coverage and budget requirements.

History

——- Start of Blog Post Section ——-

Significant developments and changes over time have marked the history of the Tennessee Health Insurance Marketplace. Understanding the marketplace’s evolution can provide insights into its current state.

——- Development of Tennessee Health Insurance Marketplace ——-

Development Of Tennessee Health Insurance Marketplace

- Tennessee Health Insurance Marketplace was established to provide residents with affordable health insurance options.

- The marketplace evolved in response to changes in healthcare legislation and policies.

- Its development reflects the state’s commitment to improving healthcare access for all Tennessee residents.

——- Key Milestones and Changes Over Time ——-

Key Milestones And Changes Over Time

- Initial Launch: The Tennessee Health Insurance Marketplace was introduced to facilitate the purchase of health insurance.

- Expansion of Coverage: Over time, the marketplace expanded its coverage options to cater to diverse healthcare needs.

- Policy Adjustments: The marketplace underwent various adjustments to align with federal healthcare regulations.

- Technology Integration: Embracing technological advancements, the marketplace improved online accessibility for users.

——- End of Blog Post Section ——-

Credit: www.kff.org

Coverage Options

Tennessee Health Insurance Marketplace offers a range of coverage options to cater to the diverse needs of its residents. Understanding the types of health insurance plans available and comparing coverage levels and costs is crucial for individuals and families to make informed decisions about their health insurance needs.

Types Of Health Insurance Plans Available

When exploring health insurance plans, Tennessee residents have access to several types of insurance options, including:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

- Health Savings Account (HSA)

Comparison Of Coverage Levels And Costs

Understanding and comparing coverage levels and costs is essential for choosing the most suitable health insurance plan. The marketplace provides an overview of coverage levels, such as:

| Plan Category | Coverage Level | Cost Range |

|---|---|---|

| Bronze | Lowest | $ |

| Silver | Moderate | $$ |

| Gold | High | $$$ |

| Platinum | Highest | $$$$ |

Enrollment

To enroll in the Tennessee Health Insurance Marketplace, visit HealthCare. Gov. Here, you can access an online platform to shop for and compare different health insurance options available in Tennessee. Get the coverage that suits your needs and budget.

Process Of Enrolling In Tennessee Health Insurance Marketplace

Enrolling in the Tennessee Health Insurance Marketplace is simple. Whether you live in Nashville, Memphis, or another city in the state, you can access the marketplace online through HealthCare.gov. Here, you will find an online platform that allows you to explore and compare various health insurance options.

Eligibility Criteria And Requirements

You should meet specific criteria and requirements to be eligible for Tennessee Health Insurance Marketplace enrollment. These include:

- Being a resident of Tennessee

- Being a U.S. citizen or a legal immigrant

- Not having access to affordable employer-sponsored health insurance

- Not being eligible for other government health programs like Medicaid or Medicare

Additionally, the open enrollment period for the Tennessee Health Insurance Marketplace usually takes place from November to December. You can sign up for a health insurance plan or change your coverage during this period.

Enrolling in the marketplace requires specific documentation, including proof of residency, citizenship or immigration status, and income information. This documentation is essential to determine your eligibility for subsidies or financial assistance programs that can help you lower the cost of your health insurance premiums.

Once you have gathered all the necessary documents, visit HealthCare.gov and follow the step-by-step enrollment process. You will be asked to provide information about yourself and your household, including your income, family size, and preferred coverage options.

If you need assistance with enrollment, you can also contact certified enrollment counselors or insurance agents who can guide and help you navigate the system. They can answer any questions and ensure you understand the options available.

Enrolling in the Tennessee Health Insurance Marketplace is crucial to securing affordable and comprehensive health coverage. By understanding the enrollment process and meeting the eligibility criteria, you can take control of your healthcare and ensure access to the best possible insurance options available in the state.

Credit: www.tn.gov

Financial Assistance

In Tennessee, the Health Insurance Marketplace is a valuable resource for individuals and families seeking financial assistance for their healthcare needs. The availability of subsidies and discounts and the process for applying for financial aid can make a significant difference in accessing affordable coverage.

Availability Of Subsidies And Discounts

Through the Tennessee Health Insurance Marketplace, individuals may be eligible for subsidies and discounts to help lower their health insurance premiums. These financial assistance options are designed to make coverage more affordable for those who qualify. Depending on income and other factors, individuals may receive premium tax credits or cost-sharing reductions, which can result in substantial savings.

How To Apply For Financial Aid

Applying for financial aid through the Tennessee Health Insurance Marketplace is straightforward. Individuals can visit the official website or seek assistance from trained enrollment specialists who can provide guidance and support throughout the application process. By supplying relevant financial information and completing the necessary forms, individuals can determine their eligibility for subsidies and discounts.

Benefits

Tennessee Health Insurance Marketplace offers a range of benefits to individuals and families, ensuring access to quality healthcare services. Let’s explore the key advantages of Tennessee health insurance plans.

Services Covered By Tennessee Health Insurance Plans

- Medical Services

- Prescription Drug Coverage

- Emergency Care

- Mental Health Services

- Maternity and Newborn Care

- Preventive and Wellness Services

| Covered Services | Details |

|---|---|

| Medical Services | Includes doctor visits, hospital stays, and outpatient care. |

| Prescription Drug Coverage | Access to a wide range of medications at affordable prices. |

| Emergency Care | Urgent medical attention in case of accidents or sudden illnesses. |

| Mental Health Services | Coverage for counseling and therapy sessions. |

| Maternity and Newborn Care | Prenatal care, delivery, and postnatal support for expectant mothers. |

| Preventive and Wellness Services | Regular check-ups, screenings, and vaccinations to promote well-being. |

Additional Benefits And Wellness Programs

- Health Management Programs

- Telemedicine Services

- Nutritional Counseling

- Smoking Cessation Support

- Fitness and Weight Management Programs

Empowering individuals to lead healthier lives, Tennessee Health Insurance Marketplace goes beyond basic coverage to offer wellness initiatives.

Credit: www.google.com

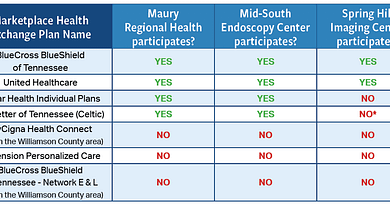

Provider Network

The Tennessee Health Insurance Marketplace provider network determines which healthcare professionals you can consult for medical services. Your choice of network can impact both the quality of care you receive and the associated costs.

Overview Of Healthcare Providers In Tennessee

When considering healthcare providers in Tennessee, it’s essential to understand the types of networks available. These networks consist of doctors, hospitals, specialists, and other healthcare facilities that have agreements with insurance companies to provide services at specific rates.

Choosing In-network Vs. Out-of-network Providers

Opting for in-network healthcare providers typically results in lower out-of-pocket costs, as insurance plans negotiate discounted rates with these providers. On the other hand, visiting out-of-network providers may incur higher expenses, as they do not have contracted rates with your insurance.

When deciding between in-network and out-of-network providers, consider cost, convenience, and quality of care. Reviewing your insurance policy to understand the coverage and costs associated with each provider option is essential.

Frequently Asked Questions

Does TN have A Healthcare Marketplace?

Yes, Tennessee has a HealthCare marketplace. To enroll in an ACA Marketplace plan in Tennessee, you can visit HealthCare. Gov. This is Tennessee’s health insurance marketplace where you can shop, compare, and choose the best health insurance plan.

What Is The Best Health Insurance In Tennessee For Individuals?

For individuals in Tennessee, the best health insurance providers include BlueCross BlueShield, Cigna, and United Healthcare. These insurers offer a range of plans, allowing individuals to find the best fit for their healthcare needs. Consider comparing details like premiums, deductibles, and coverage options.

How Much Is Health Insurance In Tn Per Month?

Health insurance costs in TN vary, ranging from around $200 to $600 per month.

Does Tennessee Have Free Health Insurance?

Tennessee does not offer free health insurance. Residents can access the Health Insurance Marketplace for coverage options.

Conclusion

In Tennessee’s Health Insurance Marketplace, accessing quality coverage just got easier. With diverse options and affordable plans, you can finally find the perfect fit for your health needs. Navigate through the platform, compare, and select your ideal insurance plan hassle-free.

Take control of your health and secure your future now.