Maryland Group Health Insurance: Secure Your Employees’ Health

Maryland Group Health Insurance BlueCross Blue Shield (BCBS) is the largest provider of group health insurance in Maryland. It offers plans through HMO and PPO networks that provide access to a wide array of healthcare providers. Maryland Health Connection provides options for small businesses to offer health and dental insurance.

These programs enable employers and employees to compare and shop for private health plans. Additionally, Medicaid through Maryland Health Connection provides free or low-cost healthcare options for those who qualify. Overall, BCBS, combined with Maryland Health Connection options, ensures that individuals and small businesses in Maryland have access to comprehensive and affordable group health insurance coverage.

Understanding Maryland Group Health Insurance

Group health insurance in Maryland is an essential benefit that employers offer to their employees. It provides healthcare coverage to a group of people, typically employees of a company or members of an organization. Understanding the key providers and coverage options is crucial for businesses to make informed decisions when selecting a group health insurance plan for their employees.

Key Providers In Maryland

When it comes to group health insurance in Maryland, one of the critical providers is BlueCross Blue Shield (BCBS). BCBS is the largest healthcare services provider in the state, offering plans through both Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) networks. These networks provide access to a vast network of physicians and hospitals, ensuring comprehensive healthcare coverage for employees. Additionally, BCBS also includes vision and dental coverage as part of its package, enhancing the overall benefits for employees.

Coverage Options For Employees

Employers in Maryland have a range of coverage options to consider when selecting group health insurance for their employees. These options include comprehensive medical coverage, vision and dental benefits, and additional wellness programs. Employers can customize their group health insurance plans to meet the specific needs of their workforce, ensuring that employees receive the necessary healthcare benefits.

Credit: wetzelandlanzi.com

Maryland Health Connection

Maryland Health Connection plays a crucial role in providing individuals and businesses in Maryland with access to affordable health insurance options. One key aspect of Maryland Health Connection is the availability of group health insurance plans tailored for small businesses.

Enrollment And Eligibility

Eligibility for group health insurance through Maryland Health Connection depends on various factors, such as the size of the business and the number of employees. Enrollment can be done online through the Maryland Health Connection portal, making it convenient for small businesses to explore their options and choose the best plan for their workforce.

Benefits For Small Businesses

Small businesses utilizing Maryland Health Connection for group health insurance can enjoy a range of benefits, including cost-effective plans, access to a diverse network of healthcare providers, and the opportunity to provide comprehensive health coverage to their employees.

Choosing The Right Plan

In Maryland, choosing the right group health insurance plan is crucial for businesses and individuals. With options like BlueCross Blue Shield, you can access a vast network of healthcare providers and additional benefits like vision and dental coverage. Compare and select the best plan for your needs and ensure comprehensive healthcare coverage.

When it comes to Maryland Group Health Insurance, choosing the right plan is crucial to ensuring that you and your employees have access to the healthcare services you need. With various options available, it can be overwhelming to make a decision.

Factors To Consider

When selecting a group health insurance plan, you should take into account several factors that will impact the coverage and benefits provided. These factors include:

- Cost: Consider the premium costs, deductibles, copayments, and coinsurance. It’s essential to find a plan that fits within your budget while still providing adequate coverage.

- Coverage: Evaluate what services and treatments are included in the plan, such as preventive care, emergency services, prescription drugs, and mental health services. Ensure that the plan covers your employees’ specific health needs.

- Network: Check if the plan has a network of healthcare providers and hospitals that are easily accessible to your employees. Having a vast network ensures that your employees can receive care from their preferred doctors or hospitals.

- Flexibility: Consider the plan’s flexibility in terms of adding or removing members and the ability to change it as your business grows or needs change.

- Additional Benefits: Some group health insurance plans may offer additional benefits such as vision and dental coverage, wellness programs, and maternity care. Evaluate these extra benefits and determine if they align with your employees’ needs.

Consulting With Insurance Providers

Once you have identified the factors that are important to you, it’s time to consult with insurance providers to gather information and get quotes. Reach out to multiple providers and ask detailed questions about their plans, cost structures, and coverage options, clarifying any doubts you may have.

Discuss your specific business needs and the demographics of your employee population to get tailored recommendations from the insurance providers. This will help you make an informed decision that best meets your employees’ healthcare needs.

Remember, choosing the right group health insurance plan is an investment in the well-being of your employees and the success of your business. Take the time to evaluate your options and consult with insurance providers to find the plan that offers the coverage and benefits you and your employees deserve.

Credit: www.carefirst.com

Benefits For Employees

Maryland Group Health Insurance offers substantial benefits for employees. It provides access to healthcare services and offers vision and dental coverage, ensuring comprehensive medical benefits.

Access To Healthcare Services

Maryland Group Health Insurance ensures that employees have access to a wide range of healthcare services. With both HMO and PPO networks, employees can choose from an extensive network of physicians and hospitals across the state. This comprehensive access to healthcare services allows employees to receive the care they need without unnecessary barriers.

Vision And Dental Coverage

Maryland Group Health Insurance provides vision and dental coverage in addition to essential healthcare services. This plan ensures that employees can maintain their overall health and well-being by allowing them to receive regular vision check-ups and necessary dental treatments without incurring significant out-of-pocket expenses.

Legal Framework

Legal Framework: Understanding the legal regulations and laws governing group health insurance is crucial for businesses in Maryland.

Regulations For Group Health Insurance

Group health insurance in Maryland is subject to specific regulations that ensure fair treatment and coverage for employees.

Small Business Health Insurance Laws

Small businesses in Maryland must adhere to state laws that govern the provision of health insurance for their employees.

Comparing Providers

Choosing the right group health insurance provider is essential for the well-being of your employees. Let’s compare leading providers in Maryland.

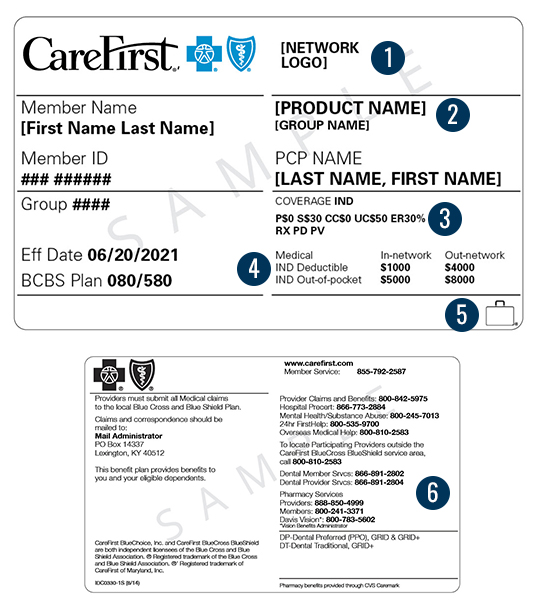

Carefirst Bluecross Blueshield

CareFirst BlueCross BlueShield is the largest health insurance company in Maryland. They offer comprehensive plans through HMO and PPO networks, ensuring a wide range of healthcare options for employees. Additionally, CareFirst BlueCross BlueShield provides vision and dental coverage as part of their package, further enhancing the benefits for your employees.

Other Major Insurance Carriers

Aside from CareFirst BlueCross BlueShield, several other major insurance carriers in Maryland offer group health insurance plans for small businesses. These include Maryland Health Connection, Maryland Insurance Administration, and eHealthInsurance. Each of these carriers provides different features and benefits, so it’s crucial to compare their offerings to find the most suitable coverage for your employees.

Credit: www.taylorbenefitsinsurance.com

Frequently Asked Questions

What Is The Largest Health Insurance Company In Maryland?

BlueCross Blue Shield (BCBS) is the largest health insurance company in Maryland. It offers plans through HMO and PPO networks with access to a wide range of healthcare providers. BCBS also provides vision and dental coverage.

What Type Of Insurance Is Group Health Insurance?

Group health insurance is a type of health insurance offered by an employer or an organization to its members.

Which Group Health Insurance Is Best?

The best group health insurance depends on your company’s needs and budget. Compare plans to find the most suitable option for your employees’ healthcare coverage.

Is Maryland Health Connection The Same As Medicaid?

Yes, Maryland Health Connection is a platform to enroll in Medicaid for free or low-cost healthcare.

Conclusion

Maryland Group Health Insurance offers comprehensive coverage through BCBS with HMO and PPO options. For low-cost healthcare, sign up for Medicaid through Maryland Health Connection. Small businesses can utilize Maryland Health Connection to provide health and dental insurance for employees.

Explore your insurance options today.