Best Insurance in Florida Health: Find Affordable Coverage Today!

Best Insurance in Florida Health, consider Kaiser Permanente, Aetna, Blue Cross Blue Shield, or UnitedHealthcare, known for their excellent coverage options and provider networks. Finding the right health insurance in Florida can be crucial to ensure you and your family can access quality healthcare when needed.

With various options from reputable providers like Florida Blue, it’s essential to compare plans and choose the one that fits your needs and budget. Understanding your coverage options and selecting a reliable health insurance provider can give you peace of mind, knowing you’re adequately protected in any medical emergencies or healthcare needs.

Take the time to research and select the best health insurance plan in Florida that meets your requirements and offers comprehensive coverage.

Types Of Health Insurance

Health insurance in Florida offers various options to suit different needs and circumstances. Understanding the types of health insurance available can help you make an informed decision about choosing your best plan.

Individual Health Insurance

Individual health insurance is suitable for self-employed people not covered by employer-based insurance or seeking coverage for themselves and their families. This type of insurance is tailored to the needs of an individual or a family.

Group Health Insurance

Employers typically offer group health insurance to provide coverage for their employees. It allows a group of people to be covered under a single policy, often resulting in lower premiums and better benefits than individual plans.

Medicare

Medicare is a federal health insurance program primarily for individuals aged 65 and older and certain younger people with disabilities. It comprises different parts that cover various healthcare services, including hospital stays, medical expenses, and prescription drugs.

Medicaid

Medicaid is a joint federal and state program that offers free or low-cost health coverage to people with limited income. Eligibility for Medicaid is determined based on household size, income, and other factors.

Credit: www.google.com

Factors To Consider

When choosing the best health insurance in Florida, consider the premiums, coverage, provider network, and customer reviews. Compare plans from top companies like Kaiser Permanente, Aetna, Blue Cross Blue Shield, and UnitedHealthcare for comprehensive coverage that fits your needs.

Health insurance is a significant investment, especially in Florida, where quality healthcare is essential. When considering the best insurance in Florida, several factors should be considered to ensure you make an informed decision that meets your needs. These factors include coverage options, premiums, deductibles, and network providers.

Coverage Options

One of the primary factors to consider when choosing the best health insurance in Florida is the coverage options available. Ensure the policy covers essential services such as doctor visits, hospitalization, prescription drugs, and preventive care.

Premiums

Premiums play a vital role in choosing the best insurance in Florida. The amount you pay for your health insurance each month should be manageable and within your budget. Consider the monthly premium costs and how they fit into your overall financial plan when comparing plans.

Deductibles

Deductibles represent the money you must pay out of pocket before your insurance kicks in. Choosing a health insurance plan with a deductible that aligns with your financial capabilities is crucial. Consider opting for a lower deductible plan if you anticipate needing costly medical services.

Network Providers

The network of healthcare providers and facilities included in your health insurance plan is a significant consideration. Ensure that your preferred doctors, specialists, and hospitals are in-network to maximize your coverage and minimize out-of-pocket costs. Consider these factors carefully when evaluating the best insurance in Florida to secure a health insurance plan that meets your individual needs and provides comprehensive coverage at an affordable cost.

Top Health Insurance Providers In Florida

Florida residents have a variety of health insurance providers to choose from for their healthcare needs. Here, we highlight some of the top health insurance providers in the state:

Provider A

- Provider A offers comprehensive health insurance plans for individuals and families.

- They have a vast network of healthcare providers and hospitals across Florida.

- Provider A prioritizes affordability and quality healthcare services for their members.

Provider B

- Provider B is known for its specialized health insurance plans tailored to different demographics.

- They offer innovative healthcare solutions and wellness programs to promote a healthy lifestyle.

- Provider B provides excellent customer service and support to assist members with their insurance needs.

Provider C

- Provider C stands out for its flexible health insurance options and customizable coverage.

- They have a reputation for quick claims processing and efficient healthcare management.

- Provider C’s plans are designed to meet the diverse needs of individuals and businesses in Florida.

Credit: www.google.com

Benefits Of Choosing The Best Insurance

Regarding health insurance in Florida, choosing the best policy can offer comprehensive coverage for your medical needs. The best insurance plan provides access to top-notch healthcare providers and ensures financial protection during unexpected medical emergencies, offering peace of mind for you and your family.

Additionally, the best insurance plan offers affordable premiums, giving you the best value for your investment.

Comprehensive Coverage

Regarding your health, you want to ensure that you have the best insurance coverage possible. Choosing the best insurance in Florida can provide you with comprehensive coverage that takes care of your healthcare needs. With extensive coverage, you can have peace of mind knowing you are covered for a wide range of medical expenses. Whether routine check-ups, hospital stays, or specialized treatments, you can rest easy knowing that your insurance covers you.

Access To Quality Healthcare

One of the key benefits of choosing the best insurance in Florida is access to quality healthcare. With the right insurance plan, you can access a network of reputable healthcare providers, including doctors, specialists, and hospitals. This means you can receive the best medical care possible, ensuring you get the treatment you need when you need it. Whether you’re dealing with a minor ailment or a chronic condition, having access to quality healthcare can make all the difference in your overall health and well-being.

Peace Of Mind

Another significant benefit of choosing the best insurance in Florida is the peace of mind it brings. Knowing that a reliable insurance provider covers you can alleviate financial worries arising from unexpected medical expenses. With the right insurance plan, you can focus on your health and recovery without the added stress of medical bills. When you have peace of mind, you can confidently seek medical attention when needed and prioritize your well-being, knowing that your insurance will take care of the costs.

Steps To Choose The Best Insurance

When choosing the best health insurance in Florida, consider coverage, cost, provider network, and additional benefits like dental coverage. Compare quotes from different insurance companies to find the most suitable plan for your needs and budget. Research and reviews can also help you make an informed decision.

Assess Your Needs

Assess your healthcare needs first to determine what coverage you require.

- Consider your medical history

- Evaluate your family’s health requirements

- Calculate your budget for premiums

Research Providers

Research various insurance providers in Florida to find reputable options.

- Check the reputation and credibility of each company

- Review their network of healthcare providers

- Look into their customer service ratings

Compare Plans

Compare different insurance plans to find the most suitable one for your needs.

- Compare coverage options and limits

- Evaluate deductibles and copayments

- Consider additional benefits like vision or dental coverage

Read Reviews

Read reviews from current and past customers to gauge their satisfaction levels.

- Look for feedback on claim processing

- Check for reviews on the ease of communication with the insurer

- Consider any negative feedback regarding coverage issues

Tips For Maximizing Insurance Benefits

Understanding your policy and making the most of your benefits is vital regarding your health insurance in Florida. By utilizing preventive care, taking advantage of wellness programs, and proactively managing your healthcare, you can optimize your insurance coverage and ensure you get the most out of your plan.

Understand Your Policy

One of the first steps to maximizing your insurance benefits is understanding your policy in detail. Read the terms and conditions, coverage limits, and applicable exclusions or restrictions. Familiarize yourself with the different types of coverage your policy offers, such as medical, dental, and vision, and know what services are covered under each. By clearly understanding your policy, you can better navigate the healthcare system and avoid surprises when using your insurance.

Utilize Preventive Care

Prevention is vital to maintaining your health and saving on healthcare costs. Many health insurance plans in Florida offer preventive care services at no additional cost to the policyholder. These services include annual check-ups, screenings, immunizations, and preventive tests. By taking advantage of these services, you can catch potential health issues early on and receive the necessary treatment before they become more severe and costly. Regular preventive care can also help you maintain optimal health and well-being, leading to a higher quality of life.

Take Advantage Of Wellness Programs

In addition to preventive care, many health insurance providers in Florida offer wellness programs designed to support and incentivize healthy behaviors. These programs may include discounts or reimbursements for gym memberships, weight loss programs, smoking cessation programs, and other wellness initiatives. By actively participating in these programs, you improve your health and reduce healthcare costs in the long run. Check with your insurance provider to see if they offer any wellness programs and take full advantage of the benefits they provide.

In conclusion, by understanding your policy, utilizing preventive care, and taking advantage of wellness programs, you can maximize your health insurance benefits in Florida. By being proactive and prioritizing your health, you save on healthcare costs and ensure you get the most out of your insurance coverage.

Common Mistakes To Avoid

When searching for the best health insurance in Florida, it’s crucial to be mindful of potential pitfalls. By avoiding these common mistakes, you can make informed decisions that protect your well-being and finances.

Ignoring The Fine Print

One of the most common errors is ignoring the fine print in insurance policies. It’s essential to review all terms, conditions, and exclusions carefully. Failure to do so may result in unexpected limitations and denied claims, leaving you vulnerable to unforeseen expenses.

Not Considering Out-of-network Costs

Overlooking out-of-network costs can be costly. Ensure that the insurance plan provides adequate coverage for out-of-network services, as ignoring this can lead to hefty out-of-pocket expenses when seeking care from non-network providers.

Focusing Solely On Price

Solely focusing on price might lead to compromising essential coverage. While affordability is crucial, it’s equally important to evaluate the comprehensiveness of the plan, ensuring it meets your specific healthcare needs without sacrificing necessary benefits.

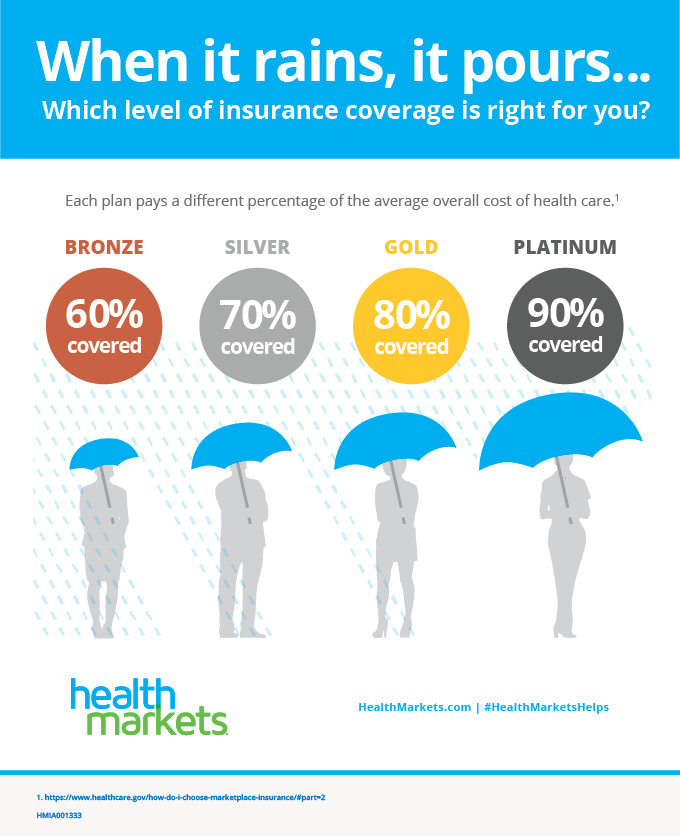

Credit: www.healthmarkets.com

Resources For Finding The Best Insurance

When finding the best insurance in Florida for your health, having the right resources at your disposal is essential. To ensure you make the best decision for your health insurance needs, consider utilizing the following resources to help guide your choice.

Health Insurance Marketplaces

Health insurance marketplaces are a valuable resource for individuals and families seeking comprehensive health coverage in Florida. These marketplaces offer various health insurance plans from multiple providers, allowing you to compare the options available and choose the one that best suits your needs and budget.

Insurance Brokers

Insurance brokers can provide personalized assistance in navigating the complex world of health insurance. They have in-depth knowledge of the insurance market and can offer expert advice, helping you find the best insurance coverage tailored to your specific requirements. Whether you’re looking for individual or family coverage, insurance brokers can guide you through the process and ensure you make an informed decision.

Online Comparison Tools

Online comparison tools are a convenient way to evaluate different health insurance plans and their benefits. These tools allow you to input your specific criteria and receive detailed comparisons of various plans, making it easier to identify the best option for your health insurance needs. By analyzing and comparing plans side by side, online comparison tools empower you to make a well-informed choice that aligns with your health and financial goals.

Frequently Asked Questions Of Best Insurance In Florida Health

Which Florida Health Insurance Is Best?

The best Florida health insurance includes Kaiser Permanente, Aetna for young adults, and Blue Cross Blue Shield for the self-employed. UnitedHealthcare offers the best provider network. Additional options are available through various insurers in the market.

What Are The Top 3 Health Insurances?

The top 3 health insurance are Kaiser Permanente, Aetna, and United Healthcare.

How Much Does Health Insurance Cost Per Month In Fl?

In FL, the cost of health insurance per month varies depending on factors such as age, coverage level, and the insurance provider you choose. Getting a quote from different insurance companies to find the most affordable option for you and your family is best.

Which Is The Best Company For Health Insurance?

Kaiser Permanente, Aetna, Blue Cross Blue Shield, and UnitedHealthcare are some of Florida’s best health insurance companies.

Conclusion

When finding the best health insurance in Florida, options like Kaiser Permanente and Blue Cross Blue Shield stand out. Affordable plans tailored for individuals and families can quickly meet your health needs. Choose wisely and protect your well-being.