Small Business Health Insurance Wisconsin: Secure and Affordable Coverage

Small Business Health Insurance Wisconsin provides options for small employers to offer health benefits to attract and retain good employees. Numerous insurers and managed care plans offer small employer health insurance in Wisconsin, providing Coverage to eligible employees.

Small business owners in Wisconsin can access resources and FAQs about group health insurance, guiding them to purchase the right Coverage and care for their employees’ health. Additionally, the Wisconsin Office of the Commissioner of Insurance provides detailed information and plans for small-group health insurance to help small employers and their employees in Wisconsin secure comprehensive health coverage.

:max_bytes(150000):strip_icc()/BUSINESS-INSURANCE-FINAL-8f618ad694714d22a24dda5e9cc5a23c.jpg)

Credit: www.investopedia.com

Importance Of Small Business Health Insurance

The Importance of Small Business Health Insurance:

Benefits Of Providing Health Insurance

Health insurance for small businesses can enhance the overall well-being of employees.

It helps alleviate financial burdens related to medical expenses, ensuring employees stay healthy and productive.

Small businesses demonstrate care and support for their employees’ health by offering health insurance.

Impact On Employee Retention

Providing health insurance can significantly improve employee retention rates.

Employees are likelier to stay loyal to a company that values their health and provides essential benefits.

Health insurance coverage can be a factor for employees when choosing an employer.

Options For Small Businesses In Wisconsin

Several avenues exist regarding health insurance options for small businesses in Wisconsin. From Wisconsin’s Health Insurance Marketplace to private health insurance providers, small businesses have choices tailored to their needs.

Wisconsin’s Health Insurance Marketplace

Wisconsin’s Health Insurance Marketplace, also known as the Exchange, offers small businesses a platform to explore affordable health insurance options for their employees. It provides access to various plans and subsidies, making it easier for small businesses to find suitable Coverage.

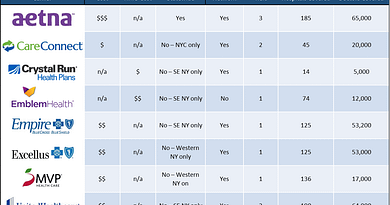

Private Health Insurance Providers

Private health insurance providers in Wisconsin cater to small businesses seeking customized health insurance solutions. These providers offer a range of plans, including group health insurance, to ensure that small business owners can provide comprehensive Coverage for their employees.

“` In the blog post section provided above, the focus is on presenting options for small businesses in Wisconsin regarding health insurance. The content is in an HTML format suitable for WordPress, with clear headings and concise paragraphs to enhance readability and SEO optimization.

Cost Considerations

Are you looking for affordable small business health insurance in Wisconsin? Explore cost-saving coverage options that prioritize the health and happiness of your employees with Anthem. Find the right plan that meets your needs and budget.

Cost Considerations Small businesses in Wisconsin must carefully consider their employees’ health insurance costs. Making the right decisions about premiums and Coverage and navigating tax credits and deductions can significantly impact the bottom line. Understanding these cost considerations is crucial for small business owners to provide valuable employee benefits while managing expenses effectively. Premiums vs. Coverage When evaluating small business health insurance in Wisconsin, it’s essential to assess the balance between premiums and Coverage. While it may be tempting to opt for the lowest premium available, business owners must also consider the level of Coverage provided. A comprehensive plan may offer higher initial premiums but can provide better protection and cost savings in the long run, ensuring employees have access to the care they need. Tax Credits and Deductions Exploring tax credits and deductions can significantly impact the overall cost of health insurance for small businesses in Wisconsin. Understanding the available tax benefits can help business owners make informed decisions and potentially reduce expenses. Leveraging these incentives can make health insurance coverage more affordable and attractive for employers and employees.

In conclusion, small business health insurance in Wisconsin requires carefully examining cost considerations. Balancing premiums and Coverage and taking advantage of tax credits and deductions can help businesses offer valuable benefits while maintaining financial stability. By understanding the economic implications and maximizing available resources, small businesses can navigate the complex landscape of health insurance with confidence and efficiency.

Credit: www.tdi.texas.gov

Legal Requirements And Regulations

Navigating the legal requirements and regulations for Small Business Health Insurance in Wisconsin can be complex. While small employers don’t need to offer health benefits in the state, many choose to do so to attract and retain talent.

Understanding the available options and compliance with state guidelines is essential for small businesses in Wisconsin.

Affordable Care Act Compliance

The Affordable Care Act (ACA) is a federal law that requires certain small businesses to provide health insurance to their employees. Under the ACA, small businesses with 50 or more full-time equivalent employees are considered Applicable Large Employers (ALEs). They must offer affordable health insurance coverage that meets minimum essential coverage requirements.

For small businesses in Wisconsin, ensuring ACA compliance is essential to avoid potential penalties. This means providing affordable health insurance for employees, with premiums not exceeding a certain percentage of their income. Additionally, the Coverage must meet specific minimum value standards.

State-specific Laws In Wisconsin

In addition to federal requirements under the ACA, Wisconsin has state-specific laws and regulations regarding health insurance regarding health insurance that small businesses must adhere to. These laws may vary depending on the size of the company and the number of employees.

One important state-specific law in Wisconsin is the requirement for small employers to offer continuation coverage, also known as COBRA coverage, to eligible employees who experience a qualifying event such as termination of employment or reduction in work hours.

Furthermore, Wisconsin has established its health insurance exchange, the Wisconsin Health Insurance Marketplace. This marketplace allows small businesses and individuals to shop for and compare different state health insurance plans offered by private insurers.

Small business owners in Wisconsin must familiarize themselves with these state-specific laws and regulations to ensure compliance and provide their employees with the required health insurance coverage.

Choosing The Right Plan

Assessing Business Needs

When choosing the right health insurance plan for your small business in Wisconsin, it’s crucial to assess your company’s specific needs. Factors such as the number of employees, their ages, and any particular health requirements must be considered. Moreover, foresight in anticipated growth and future healthcare needs is essential in making an informed decision.

Consulting With A Broker

Consulting with a qualified insurance broker can simplify finding the most suitable health insurance plan for your small business in Wisconsin. A professional broker possesses the expertise and knowledge to navigate the complexities of the insurance market. They can assist in comparing various plans, costs, and coverage options, ultimately ensuring that you make an informed decision that aligns with your business’s requirements.

Employee Involvement And Satisfaction

Regarding small business health insurance in Wisconsin, employee involvement and satisfaction play a vital role in creating a positive and productive work environment. Educating employees on benefits and implementing health and wellness programs are critical factors in achieving this goal.

Educating Employees On Benefits

Properly educating employees on their health insurance coverage benefits is essential for their understanding and satisfaction. Employees can make informed decisions regarding their healthcare needs by explaining the coverage options clearly and simply. This can be done through:

- Detailed presentations

- One-on-one consultations

- Online resources and FAQs

Health And Wellness Programs

Implementing health and wellness programs can significantly impact the employee’s satisfaction and well-being. By promoting a healthy lifestyle and providing resources to support it, businesses can encourage employees to take an active role in their health. Some effective programs include:

- Regular health screenings and check-ups

- Fitness challenges and incentives

- Stress management workshops

- Healthy eating initiatives

Small businesses can create a positive work culture that enhances employee satisfaction and productivity by involving employees in the decision-making process and offering opportunities for growth and improvement. Employee involvement and satisfaction go hand in hand, benefiting the employees and the business.

Managing Enrollment And Renewals

When managing enrollment and renewals for small business health insurance in Wisconsin, staying organized and informed throughout the process is essential. From open enrollment periods to evaluating plan satisfaction, each step is crucial in ensuring your employees have access to the best healthcare coverage.

Open Enrollment Periods

Open enrollment periods are when small business employees can enroll in or change their health insurance coverage. Employers must communicate these dates clearly and ensure all eligible employees understand the enrollment process.

Evaluating Plan Satisfaction

Evaluating plan satisfaction entails gathering employee feedback about their current health insurance coverage. Consider conducting surveys or holding discussions to understand what aspects of the plan work well and where improvements can be made.

Credit: www.securityhealth.org

Future Trends In Small Business Health Insurance

The Future Trends in Small Business Health Insurance

In the ever-evolving healthcare landscape, small businesses in Wisconsin are adapting to emerging trends in health insurance to meet the needs of their employees. Understanding these trends is crucial for companies to provide comprehensive healthcare coverage.

Telemedicine Services

With the rise of technology, telemedicine services are becoming more prevalent in small business health insurance plans. This innovative approach allows employees to access medical consultations and services remotely, ensuring convenient and timely healthcare.

Flexible Benefits Packages

Offering flexible benefits packages is another trend that is gaining momentum. Small businesses customize healthcare options to suit individual employee needs, promoting employee satisfaction and retention.

Frequently Asked Questions On Small Business Health Insurance Wisconsin

How Much Is Health Insurance In Wisconsin Per Month?

Health insurance in Wisconsin can cost around $400-$600 per month, based on factors like age and Coverage.

Do Employers In Wisconsin Have To Provide Health Insurance?

State law does not require employers in Wisconsin to provide health insurance. However, many choose to offer health benefits to attract and retain employees. Various insurers and managed care plans provide tri-Wisconsin m employer health insurance options.

How Much Does Health Insurance Cost For A Small Business Per Employee Usa?

The cost of health insurance for small businesses in the USA varies depending on factors like location and Coverage. It can range from $6,000 to $16,000 per employee per year.

Does Wisconsin Have Free Health Insurance?

Medicaid provides free or low-cost health coverage to eligible needy persons in Wisconsin. Although small employers are not required by state law to offer health insurance, many do so to attract and retain employees. Small employer health insurance is available from multiple insurers and managed care plans in Wisconsin.

Conclusion

In Wisconsin, finding the right health insurance plan is essential for the success of your small business. Explore all the options and choose the Coverage that best suits your employees and your budget. With the help of reputable insurers like Anthem and eHealth, you can provide your team with the care they need to thrive.