Domestic Partner Affidavit for Health Insurance: A Comprehensive Guide

Domestic Partner Affidavit for Health Insurance is a legal document affirming a domestic partnership for insurance purposes. This affidavit serves as proof of the relationship to qualify for coverage under the partner’s healthcare benefits.

Including a domestic partner in a health insurance plan is an essential document. Securing this affidavit ensures that your partner is eligible for vital health insurance coverage, providing both parties peace of mind and security. Additionally, it helps demonstrate commitment and financial responsibility in the eyes of insurance providers, facilitating access to crucial health benefits for the domestic partner.

Without this document, your partner may not be eligible for insurance coverage under your plan, potentially risking their health and well-being.

Eligibility

To be eligible for domestic partner health insurance, couples must meet specific criteria and provide necessary documentation.

Determining Eligibility For Domestic Partner Health Insurance

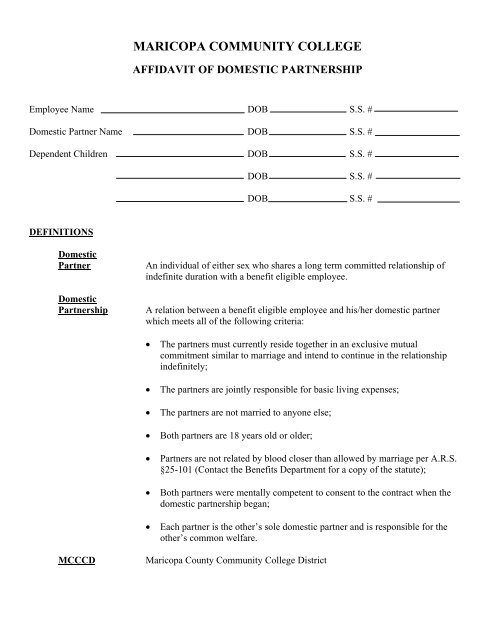

An affidavit of domestic partnership is required to prove eligibility for domestic partner health insurance.

Requirements For Being Considered Domestic Partners

- Both partners must be at least 18 years old.

- Partners must be in a committed relationship and share a typical residence.

- Proof of financial interdependence may be required.

- Partners must not be legally married to anyone else.

Documentation such as a partnership affidavit or official registration may be needed to establish a domestic partnership.

Credit: www.yumpu.com

Benefits

Benefits of Domestic Partner Affidavit for Health Insurance

Health Insurance Coverage For Domestic Partners

Employers and health insurance providers often offer coverage options for domestic partners, ensuring that both individuals in a relationship have access to necessary healthcare services. By submitting a domestic partner affidavit, individuals can extend health insurance coverage to their partners, providing peace of mind and security in times of illness or injury.

Additional Benefits Of Domestic Partner Affidavit

- Legal Recognition: A domestic partner affidavit validates the relationship between unmarried partners, granting legal recognition and rights similar to those of married couples.

- Financial Protection: Access to health insurance coverage through a domestic partner affidavit safeguards partners from the economic burden of medical expenses.

- Emotional Support: Knowing that their partner has access to healthcare can alleviate stress and provide emotional support during challenging times.

- Equality and Inclusivity: Offering health insurance coverage for domestic partners promotes inclusivity and equality and supports diverse family structures.

Proving Partnership

The process of proving a partnership for domestic health insurance can vary depending on the state in which you reside. It is essential to provide the appropriate documentation to your employer or insurer to ensure your domestic partner is eligible for coverage. This blog post will explore the types of documentation accepted for domestic partnerships and the specifics of documentation in different states.

Types Of Documentation Accepted For Domestic Partnership

When it comes to proving your domestic partnership for health insurance, there are various types of documentation accepted by employers and insurers. These documents help establish the legitimacy and commitment of your collaboration. Some common types of documentation include:

- Affidavit of domestic partnership

- Domestic partnership registration (municipal or state)

- Civil union license (state)

- Marriage license (state or issued in other countries)

By providing these documents, you can demonstrate that you are in a committed domestic partnership, making your partner eligible for health insurance coverage.

Specifics Of Documentation In Different States

Specific requirements for documentation may vary depending on the state in which you reside. Below are some examples of the specifics of documentation in different states:

| State | Accepted Documentation |

|---|---|

| Texas | Affidavit of Domestic Partnership |

| Pennsylvania | Domestic partnership registration (municipal or state) |

| California | Civil union license (state) |

| New York | Marriage license (state or issued in other countries) |

Understanding your state’s requirements is crucial to providing the correct documentation for your domestic partner’s health insurance coverage.

Credit: declaration-domestic-partnership.pdffiller.com

Adding A Domestic Partner

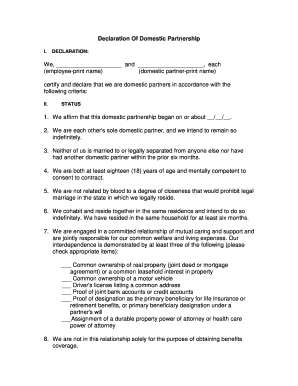

Adding a domestic partner to your health insurance is an important decision that can provide valuable coverage for your loved one. Understanding the process and qualifying life events for adding a domestic partner is crucial to ensure a smooth transition to a joint health insurance plan. Whether in a domestic partnership or planning to add one, familiarizing yourself with the necessary steps and requirements will help you navigate this process effectively.

Process Of Adding A Domestic Partner To Health Insurance

When considering adding a domestic partner to your health insurance, the process typically involves submitting a Domestic Partner Affidavit to your insurance provider. This document verifies the domestic partnership and may require specific details such as shared residence and financial arrangements. It’s essential to review the requirements outlined by your insurer and ensure all necessary information is accurately provided in the affidavit.

Qualifying Life Events For Adding A Domestic Partner

Eligibility for adding a domestic partner to health insurance often hinges on qualifying life events, such as marriage, the birth of a child, or a significant change in partnership status. These events may allow for a particular enrollment period outside the standard open enrollment window. It’s essential to be aware of the specific qualifying criteria set forth by your insurance provider and to promptly inform them of any relevant life changes to initiate the addition of your domestic partner to the policy.

Legal Considerations

Understanding the legal aspects of domestic partner affidavits for health insurance is essential. Below, we delve into domestic partners’ legal rights and responsibilities and compare them to marriage regarding legal protection.

Legal Rights And Responsibilities Of Domestic Partners

Domestic partners have legal rights and responsibilities that may vary depending on the state. These can include inheritance rights, medical decision-making, and shared property ownership. To protect themselves, domestic partners must clearly understand their legal rights.

Comparison To Marriage In Terms Of Legal Protection

While domestic partnerships may offer some legal protections similar to marriage, they do not provide the same recognition and benefits in all states. Domestic partners may encounter limitations such as taxation, immigration, and healthcare benefits.

Credit: google.com

Employer Requirements

- Employees must accurately fill out the Domestic Partner Affidavit provided by the employer.

- The affidavit typically requires personal and relationship details to establish the domestic partnership.

Importance Of Employer Recognition For Health Insurance

- Employers play a crucial role in acknowledging and accepting domestic partnerships for health insurance coverage.

- Recognition by the employer ensures that domestic partners are eligible for benefits like health insurance.

Benefits Of Employer Recognition

Employer recognition facilitates access to vital benefits for domestic partners, such as:

- Health insurance coverage.

- Medical benefits for partners.

- Ability to add partners to company-sponsored plans.

Remember, employer recognition is essential for domestic partners to access health insurance benefits and ensure their well-being.

Frequently Asked Questions

Can I Add My Girlfriend To My Health Insurance If We Live Together?

If you live together, you can add your girlfriend to your health insurance. You will need to provide your employer with a document recognizing your domestic partnership, such as an affidavit of domestic partnership.

Does A Girlfriend Count As A Domestic Partner Affidavit for Health Insurance?

A girlfriend can be a domestic partner if you have established a shared life. You may need to provide documentation, such as an affidavit of domestic partnership, to add them to your health insurance.

How To Prove Domestic Partnership For Insurance In Texas?

To prove a domestic partnership for insurance in Texas, provide a partnership affidavit or domestic partnership registration document. This can be a municipal or state registration, a civil union license, or a marriage license from another country. Additionally, you may also need to provide an Affidavit of domestic partnership.

Can I Add My Domestic Partner To My Health Insurance In Pa?

You can add your domestic partner to your health insurance in PA. Apply for family coverage during Open Enrollment or after a qualifying life event.

Conclusion

The domestic partner affidavit is a crucial document for obtaining health insurance coverage for your partner. To validate your partnership, you must provide proof of your relationship, such as a municipal or state registration.

By understanding and fulfilling the requirements, you can secure health insurance benefits for your domestic partner.