Large Group Health Insurance: Get Comprehensive Coverage Today!

Large group health insurance provides coverage for a large number of employees. It is typically offered by employers to provide affordable medical benefits for their staff and their families. This type of insurance offers comprehensive medical coverage for a wide range of healthcare needs and is usually more cost-effective than individual plans.

Large group health insurance is essential for businesses to attract and retain talented employees. It demonstrates an organization’s commitment to the well-being of its workforce and provides a sense of security and support for employees and their families, ensuring that they have access to quality healthcare when needed.

Choosing the right large-group health insurance plan is crucial for both employers and employees to ensure adequate coverage and financial protection in times of illness or injury.

Large Group Health Insurance Vs. Small Group Health Insurance

Large Group Health Insurance vs. Small Group Health Insurance

Key Differences

Large group health insurance is typically offered to companies with 50 or more employees, while small group health insurance caters to businesses with fewer than 50 employees.

Premiums And Benefits Comparison

| Category | Large Group Health Insurance | Small Group Health Insurance |

|---|---|---|

| Premiums | Lower due to risk spread over a larger pool. | Higher due to risks concentrated in a smaller group. |

| Benefits | Comprehensive coverage with more options. | Basic coverage with limited choices. |

Large group health insurance plans provide affordable medical coverage for employees, their family members, and dependents. These plans offer quality coverage solutions across medical, pharmacy, dental, vision, and more. On the other hand, small-group health insurance is more limited in scope and may have higher premiums due to the smaller risk pool.

- Large group plans cater to companies with 50+ employees.

- Small group plans are designed for businesses with under 50 employees.

- Large group plans offer extensive benefits.

- Small group plans may have fewer coverage options.

Conclusion

In summary, the size of the group plays a significant role in determining the premiums, benefits, and overall coverage quality of health insurance plans. Understanding these key differences can help businesses make informed decisions when selecting the most suitable plan for their employees.

Top Providers Of Large Group Health Insurance

Large group health insurance is an essential consideration for businesses and organizations to ensure the well-being of their employees. Choosing a leading provider for large group health insurance is crucial for accessing comprehensive coverage and impactful benefits. Let’s explore the top providers and understand the benefits of opting for their services.

Overview

When it comes to large-group health insurance, selecting a reputable provider is paramount. Several industry leaders offer extensive coverage and tailored solutions for organizations with a large number of employees. These providers stand out for their commitment to delivering top-notch health insurance options for businesses, ensuring the well-being of their workforce.

Benefits Of Choosing A Leading Provider

Opting for a leading provider of large-group health insurance comes with numerous advantages for businesses. Here are the compelling benefits of selecting a top provider:

- Comprehensive Coverage: Top providers offer robust health insurance plans that encompass a wide range of medical services, ensuring that employees have access to quality healthcare.

- Customized Solutions: Leading providers often tailor their plans to meet organizations’ specific needs, offering flexibility and personalized coverage options.

- Exceptional Network: By choosing a renowned provider, businesses can tap into an extensive network of healthcare providers and facilities, giving employees access to a diverse range of medical professionals and services.

- Wellness Programs: Many top providers offer wellness initiatives and programs aimed at promoting employee health and overall well-being, contributing to a healthier and more productive workforce.

Understanding Group Health Insurance Plans

Understanding group health insurance plans is crucial for businesses that fall under the category of large groups. These plans offer affordable coverage for employees, their families, and dependents, providing a range of benefits, including medical, pharmacy, dental, and vision. Explore the options available to ensure comprehensive healthcare for your workforce.

Affordability And Coverage

A large group health insurance plan offers an array of benefits, including affordability and extensive coverage. Employers who provide this type of insurance can offer their employees and their dependents access to quality medical care without breaking the bank.

One critical advantage of large-group health insurance is its affordability. By pooling the risk among a large number of individuals, these plans can negotiate lower premiums and overall costs. This ensures that employees can receive comprehensive coverage at a fraction of the cost compared to individual plans.

Moreover, large-group health insurance plans typically come with extensive coverage options. From preventive care and routine check-ups to specialized treatments and hospital stays, employees and their dependents can gain access to a wide range of medical services. This comprehensive coverage provides peace of mind and ensures that everyone can receive the care they need when they need it.

Available Options For Employees And Dependents

Large group health insurance plans also offer a variety of options for both employees and their dependents. These plans understand that different individuals have unique healthcare needs and, therefore, provide flexibility in coverage.

Employees can typically choose from a range of health plan options, including different levels of coverage and various networks of healthcare providers. This allows them to select a plan that best suits their specific healthcare needs and preferences. From preferred provider organizations (PPOs) to health maintenance organizations (HMOs), employees have the freedom to choose the option that aligns with their priorities.

Additionally, large group health insurance plans often extend coverage to dependents. This means that not only employees but also their spouses, domestic partners, and children can enjoy the benefits of the insurance plan. This inclusion ensures that the entire family is protected and can receive necessary medical care without facing financial burdens.

Factors Affecting Large Group Health Insurance

Several essential factors can affect the coverage and cost of large-group health insurance. Understanding these factors is crucial for businesses looking to provide comprehensive health benefits to their employees while optimizing costs.

Requirements For Large Group Coverage

Large group health insurance comes with specific requirements that businesses must meet to qualify for coverage. These requirements vary by state and insurer but typically include factors such as the number of employees in the group, the percentage of employee participation, and contribution requirements from the employer. Businesses need to familiarize themselves with these requirements to ensure that they are eligible for ample group coverage.

Cost Considerations And Savings Opportunities

Cost is a significant consideration when it comes to large-group health insurance. While the premiums for large group coverage may be higher compared to small group or individual plans, businesses can explore potential savings opportunities. These may include wellness programs, preventative care initiatives, and negotiating with insurers for competitive rates. Businesses should carefully evaluate these options to maximize the value of their large group health insurance while managing costs effectively.

Choosing The Right Large Group Health Insurance

Choosing the right large-group health insurance is crucial for businesses. It provides extensive coverage for employees and their families at a lower premium than individual plans. With various options available, finding the right plan for your company’s needs is essential for employee well-being and satisfaction.

Considerations For Decision-making

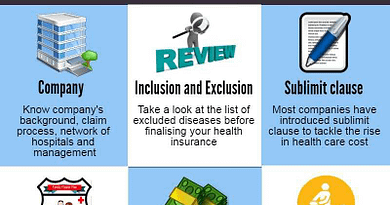

When it comes to choosing the right large-group health insurance for your company, there are several important considerations to keep in mind. Making an informed decision is crucial in ensuring that your employees have access to the healthcare coverage they need. Here are some key factors to consider: 1. Budget: Determine your budget and stick to it. Assessing your financial resources will help you determine the level of coverage you can afford without compromising quality. 2. Employee needs: Consider the healthcare needs of your employees. Are there specific medical conditions or needs that should be addressed? Tailoring the plan to meet the unique needs of your workforce can enhance employee satisfaction and retention. 3. Network: Evaluate the network of doctors, hospitals, and specialists that are included in the plan. Ensure that there is a wide range of healthcare providers available so that your employees have ample options for care. 4. Benefits: Carefully review the benefits offered by each plan. Look for coverage in areas that are important to your employees, such as preventive care, mental health services, or maternity care. 5. Prescription coverage: Assess the plan’s prescription coverage options. Determine if the medications commonly used by your employees are covered and if there are any restrictions or limitations that could impact their access to necessary medicines. 6. Flexibility: Consider the flexibility of the plan. Is it easy to add or remove employees? Can you make changes to the coverage options as your company grows or evolves?

Customizing Plans To Fit Company Needs

One of the advantages of large group health insurance is the ability to customize plans to fit the specific needs of your company. By tailoring the coverage to meet the unique requirements of your employees, you can provide them with the best possible healthcare options. Here are some ways you can customize your plan: 1. Cost-sharing options: Determine how much of the premium cost will be shared between the employer and the employee. You can choose to cover a more significant portion of the premium to make healthcare more affordable for your employees. 2. Additional benefits: Consider adding additional benefits to the plan that are not typically covered, such as gym memberships, wellness programs, or alternative therapies. These extra perks can enhance employee satisfaction and overall well-being. 3. Flexible contribution strategies: Explore different contribution strategies, such as a defined contribution approach, where employees are given a fixed amount of money to spend on healthcare coverage. This allows them to choose the plan that best suits their individual needs. 4. Wellness incentives: Implement wellness incentives to encourage your employees to take care of their health. This could include rewards for participating in health screenings, quitting smoking, or reaching specific health goals. In conclusion, choosing the right large-group health insurance requires careful consideration of various factors, including budget, employee needs, network, benefits, prescription coverage, and flexibility. By customizing the plan to fit your company’s unique needs, you can provide your employees with comprehensive healthcare coverage that promotes their well-being and satisfaction.

Credit: ghcscw.com

Group Health Insurance For Small Businesses

Group Health Insurance for Small Businesses can be a valuable asset for owners and employees alike. It provides affordable medical coverage for employees, their families, and dependents.

Benefits For Small Business Owners

- Lower premium costs compared to individual plans

- Enhances employee satisfaction and retention

- Access to a broader network of healthcare providers

- May attract top talent during recruitment

Comparison With Individual Health Plans

A group health insurance plan typically offers coverage at a reduced cost compared to individual plans. Moreover, it is tailored to meet the needs of a collective group, providing a comprehensive range of benefits that individual plans may lack.

Employee Health Insurance In Small Businesses

In small businesses, owners face challenges when providing health insurance to their employees.

Small businesses have various options to offer affordable health insurance coverage to their employees:

- Group health insurance plans

- Health reimbursement arrangements (HRAs)

- Health savings accounts (HSAs)

Credit: www.plumhq.com

Credit: www.loophealth.com

Frequently Asked Questions

What Is A Large Group Health Insurance?

A large group health insurance plan covers medical costs for employees and their families. It offers affordable coverage compared to individual plans.

What Is Considered A Large Group?

A large group typically consists of 50 or more individuals for health insurance coverage.

What Is The Difference Between Small Groups and Large Groups?

The main difference lies in the number of employees—small group typically has fewer than 50, while large group has 50 or more. Premiums and benefits may vary based on group size.

What Is The Largest Provider Of Health Insurance?

Kaiser Permanente is the largest health insurance provider.

Conclusion

Choosing a large group health insurance plan offers numerous benefits, including affordable premiums and comprehensive coverage for employees and their families. Understanding the differences between small and large group plans is crucial for making the right decision for your business.

With the variety of options available, employers can find a plan that suits their specific needs.